This post was originally published on this site.

Truist was formed through the merger of BB&T and SunTrust in 2019.

In 2019, two strong regional banks, BB&T and SunTrust, announced one of the largest bank mergers of equals in many years, at least at the time. Eventually, the pro forma institution also adopted a new name, Truist (TFC 0.26%), to establish a new brand that better represented the new entity. The pitch for the massive merger was simple in theory: deliver best-in-class efficiency and returns.

More than six years later, that has yet to be accomplished and investors have shown their displeasure, with the stock up just about 7% over the past five years. You can do way better than Truist. Buy and hold this stock forever, instead.

Why mergers and acquisitions are difficult

When a merger or an acquisition is announced, it often sounds very enticing. Management promises that bigger will be better and that scale is necessary to better compete, which is certainly true in the banking sector. However, the devil is always in the details.

Bank investors, in particular, often dislike mergers and acquisitions because they typically require destroying tangible book value (TBV), or a bank’s net worth, and what bank stocks often trade relative to, in order to purchase the bank being acquired. Then the bank must earn that TBV back over time through higher earnings accretion.

Image source: Getty Images.

Meanwhile, mergers have regulatory and execution risk, and it’s often easier said than done to merge the cultures of two large banks. Additionally, revenue synergies don’t always materialize, and numerous technical hurdles must be overcome when merging the complex back- and front-end systems of two banks, which may have been operating on legacy technology stacks.

Advertisement

Interestingly, in the initial merger presentation from February 2019, BB&T and SunTrust, each of which had about $200 billion to $230 billion in assets upon announcement, said the deal would be immediately accretive to BB&T’s TBV per share by 6%. BB&T was the technical buyer in the deal. This is a great start for any bank deal.

However, Truist also promised an efficiency ratio, expenses expressed as a percentage of revenue, of 51% (lower is better), and a return on tangible common equity (ROTCE) of 22%. In Truist’s most recent quarter, the bank delivered an adjusted efficiency ratio of 55.7% and an ROTCE of 13.6%. Part of the issue was due to higher-than-expected tech integration costs and other technical issues that resulted in backlash from customers.

Now, hopefully, for Truist, those issues are behind the bank. However, after such a long merger process and disappointing stock performance, it will need to recoup lost shareholder value, and there’s no guarantee of success.

An easier and safer bet

If you are in the market for a bank stock, a sector expected to do well next year, then look no further than Bank of America (BAC 0.14%). It’s the second-largest bank in the U.S. and has one of the strongest retail deposit bases in the country. Bank of America also offers a range of banking services at scale, all under one umbrella, including commercial lending, credit card lending, investment banking, payments, and wealth management.

Bank of America

Today’s Change

(-0.14%) $-0.08

Current Price

$56.17

Key Data Points

Market Cap

$410B

Day’s Range

$56.02 – $56.55

52wk Range

$33.06 – $56.55

Volume

15M

Avg Vol

36M

Dividend Yield

1.92%

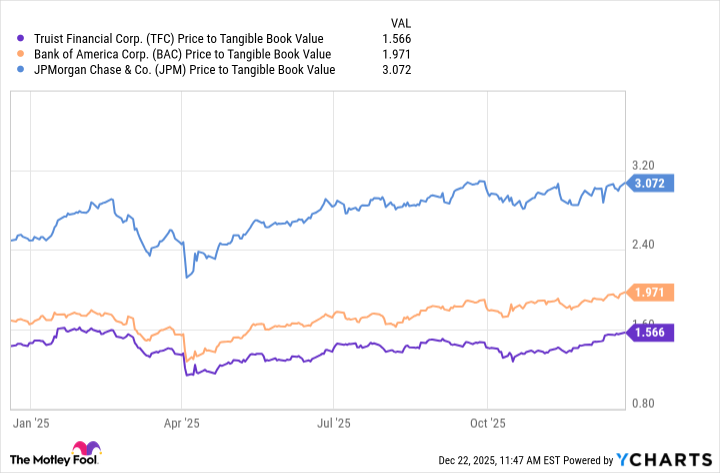

On a price-to-tangible book basis, it’s more expensive than Truist, but for a good reason. In the bank’s most recent quarter, Bank of America generated a ROTCE of over 15.4%. Meanwhile, it still trades at a notable discount to JPMorgan Chase, also for good reason, but I think there’s an opportunity to close the gap.

TFC Price to Tangible Book Value data by YCharts.

Bank of America made a significant mistake when it purchased too many low-yielding, long-dated bonds at the beginning of the pandemic, when interest rates were low. Management lacked the foresight to anticipate that inflation would not be transitory and that the Federal Reserve would have to raise interest rates substantially. Those bonds fell deeply underwater, resulting in significant paper losses.

As the bonds mature, Bank of America should be able to recoup its TBV and deploy deposits into higher-yielding assets, which should boost earnings over time. The bank also offers a solid 2% dividend yield and will benefit from deregulation, which will likely come in the form of lower capital and liquidity requirements. That leaves more capital for lending and capital distributions to shareholders.