This post was originally published on this site.

Never miss an important update on your stock portfolio and cut through the noise. Over 7 million investors trust Simply Wall St to stay informed where it matters for FREE.

Nova’s new US$450 price target comes against a backdrop where the core fair value model is essentially unchanged at US$393.75, with key inputs like the discount rate and revenue growth assumptions staying effectively steady. The higher target is being linked by bullish analysts to clearer demand trends, a broader customer mix, and the potential for stronger free cash flow over the next cycle, rather than any wholesale shift in the underlying valuation model. Stay with this article to see how you can keep on top of these narrative shifts as they emerge.

Stay updated as the Fair Value for Nova shifts by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Nova.

🐂 Bullish Takeaways

-

BofA analyst Michael Mani lifted Nova’s price target to US$450 from US$380, which is a sizeable reset in expectations around what the shares could be worth over time.

-

BofA links its higher target to what it sees as a stronger multi year demand outlook across the semiconductor capital equipment space, suggesting a more supportive backdrop for Nova’s growth prospects.

-

The firm also highlights increasing visibility and greater customer diversification, which it views as positives for Nova’s execution quality and potential resilience across different end markets.

-

Potential for higher free cash flow generation in an industry upturn is another key point for BofA, feeding into its higher valuation framework for the stock.

🐻 Bearish Takeaways

-

BofA’s report keeps a positive stance and does not outline specific bearish arguments. However, the focus on a multi year outlook and an upturn signals that some of the thesis rests on conditions that may not play out in a straight line.

Do your thoughts align with the Bull or Bear Analysts? Perhaps you think there’s more to the story. Head to the Simply Wall St Community to discover more perspectives or begin writing your own Narrative!

-

Nova reported that its Nova Metrion platform has been adopted by leading global customers in both Memory and Logic production, with a focus on Gate All Around and advanced DRAM device manufacturing.

-

The company highlighted that Nova Metrion is the first fully automated Secondary Ion Mass Spectrometry system validated for inline production process control, designed to shorten time to feedback and support near real time process adjustments inside the fab.

-

Nova stated that Nova Metrion enables full wafer mapping and repetitive in fab measurements, which is intended to support Statistical Process Control and reduce reliance on lab based measurements, with an emphasis on achieving faster ROI through prevention of scrap and rework.

-

The platform is built to provide high precision materials metrology for complex film stacks in both logic and memory, measuring chemical species concentration by depth to generate profiles for monitoring dopant levels, implant uniformity, and potential contamination.

-

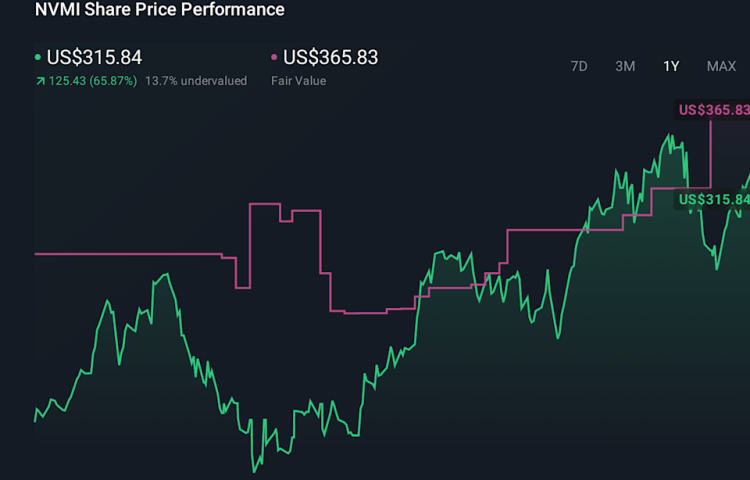

Fair Value: Model fair value remains unchanged at US$393.75, so the core valuation output is holding steady for now.

-

Discount Rate: The discount rate is effectively stable, moving fractionally from 13.948221% to 13.948809%. This keeps the overall risk assumption broadly consistent.

-

Revenue Growth: The revenue growth assumption is unchanged at 14.263139%, using the same outlook that underpinned the prior model run.

-

Net Profit Margin: The net profit margin input is effectively flat at 31.632612%, so profitability expectations in the model are essentially the same as before.

-

Future P/E: The future P/E is effectively stable, moving marginally from 44.879237x to 44.879932x, with no material change in the multiple the model applies.

Narratives on Simply Wall St let you connect Nova’s story to the numbers by setting out your view on future revenue, earnings, margins, and fair value in one place. Each Narrative links a thesis about the business to a forecast and a fair value, then compares that to the current share price to help you think about buy or sell decisions. Narratives sit inside the Community page, update as new news or earnings arrive, and are designed to be an easy tool used by millions of investors.

If Nova is on your radar, the existing Narrative is a useful way to track how the story and valuation thesis evolve over time.

-

Follow how demand for advanced metrology tools, AI driven complexity, and new fab investments feed into expectations for Nova’s long term revenue and earnings profile.

-

Keep tabs on the balance between recurring, higher margin services, rising R&D spend, and competitive or geopolitical risks that could affect future free cash flow.

-

See how the Narrative connects these drivers to a fair value and P/E assumption, so you can compare that to Nova’s current price and sense check your own view.

To see all of this brought together in one place, read the full Nova Narrative on Simply Wall St here: NVMI: Stronger Demand Visibility And Diversified Customers Will Support Future Free Cash Flow.

Once you have read the Narrative, it is easy to stay close to the story and react when new information arrives, just use Stay updated on the most important news stories for Nova by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Nova..

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NVMI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com