This post was originally published on this site.

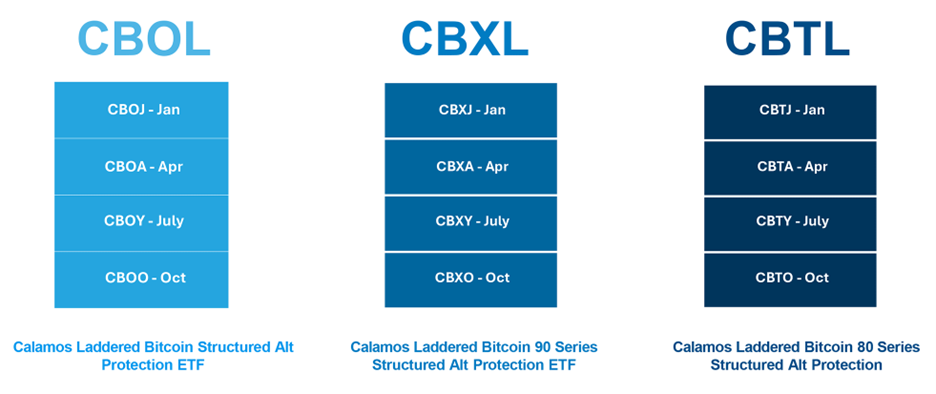

In October, Calamos Investments released three Laddered Protected Bitcoin ETFs, each providing laddered exposure to three different underlying portfolios of Calamos Protected Bitcoin ETFs.

With three different options on the table, advisors and investors may wonder which one can potentially best meet their needs. All three allocate across four quarterly Calamos Bitcoin Structured Alt Protection ETFs®, each starting in a different quarter for continuous laddered exposure. The underlying funds are designed to match the positive price returns of indexes that track the spot price of bitcoin, although the funds are subject to defined caps in order to provide specific levels of downside protection. Despite these similarities, their appropriate portfolio applications certainly differ. Here’s a quick rundown.

CBOL: Bitcoin with a Level of Safety for Retirees

Let’s start with the Calamos Laddered Bitcoin Structured Alt Protection ETF (CBOL), which offers complete downside protection across its underlying funds’ individual outcome periods, after fees and expenses. While this robust protection requires limiting the upside initial caps of the underlying funds, CBOL still delivers an attractive weighted average starting cap rate, currently at 10.25%.*

In terms of portfolio applications, CBOL has several particularly potent use cases. Some may look to the fund as a potential fixed-income alternative, given its lower downside risk. However, the fund could also serve as a means for retirees to access bitcoin in a risk-averse manner. Retirees are understandably focused on limiting risk while remaining engaged in the market, which aligns with what CBOL seeks to bring to the table.

CBTL: A Potent Equity Alternative

On the other end of the spectrum is the Calamos Laddered Bitcoin 80 Series Structured Alt Protection ETF (CBTL). Unlike CBOL, CBTL’s laddered portfolio does not offer complete downside protection. Instead, the fund’s underlying ETFs limit the maximum loss to -20% per outcome period, after expenses and fees.

The higher upside caps of CBTL’s underlying ETFs significantly influence how it might be utilized in portfolio applications. All the underlying ETFs in this fund’s portfolio launched with initial caps well above 40%, with two above 50%. Currently, CBTL delivers an attractive weighted average starting cap rate of 46.34%.* This allows the fund to operate as an equity alternative, pursuing equity-like returns based on the price of bitcoin while still limiting some of the impact from a significant drawdown. Given the uncertain equity outlook for 2026, equity alternatives may be a serious consideration for many investors.

CBXL: Inflation Hedge and Diversifier

Last but not least is the Calamos Laddered Bitcoin 90 Series Structured Alt Protection ETF (CBXL). Its laddered selection of Calamos ETFs seeks to provide a middle ground of downside protection. Each underlying fund limits total loss, after fees and expenses, to no more than -10% during its outcome period. Meanwhile, the underlying funds’ upside caps sit between CBOL and CBTL’s percentages, offering a good runway for capturing bitcoin opportunity. Currently, CBTL delivers an attractive weighted average starting cap rate of 26.61%.*

CBXL’s middle-ground approach could help the fund tap into bitcoin’s innate strengths as a potential inflation hedge or portfolio diversifier.

Overall, these Calamos ETFs may seem similar at face value. However, their underlying ETFs can align with various portfolio applications. As such, advisors and investors may want to evaluate what they’re looking to gain from their bitcoin exposure before they choose where to invest.

*Source: Calamos Autocallable Dashboard as of 12/12/25.

For more news, information, and strategy, visit the Crypto Content Hub

Before investing, carefully consider the Fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund is subject to risks, and you could lose money on your investment in the Fund. There can be no assurance that the Fund will achieve its investment objective. Your investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund can increase during times of significant market volatility. The Fund also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Investing involves risks. Loss of principal is possible. The Fund(s) face numerous market trading risks, including authorized participation concentration risk, cap change risk, capital protection risk, capped upside risk, cash holdings risk, clearing member default risk, correlation risk, derivatives risk, equity securities risk, investment timing risk, large-capitalization investing risk, liquidity risk, market maker risk, market risk, non- diversification risk, options risk, premium-discount risk, secondary market trading risk, sector risk, tax risk, trading issues risk, underlying ETF risk and valuation risk. For a detailed list of fund risks see the prospectus.

FUND-OF-FUNDS RISK. Shareholders of the Fund will experience investment returns that are different than the investment returns provided by an Underlying ETF. The Fund does not itself pursue a defined outcome strategy, nor does the Fund itself provide downside protection against SPY losses. Because the Fund will typically not purchase an Underlying ETF on the first day of a Target Outcome Period, it is not likely that the stated outcome of the Underlying ETF will be realized by the Fund. The Fund will be continuously exposed to the investment profiles of each of the Underlying ETFs during their respective Target Outcome Periods. The Fund, with its aggregate exposure to each of the Underlying ETFs, may have investment returns that are inferior to that of any single Underlying ETF or group of Underlying ETFs over any given time period. In between the semi-annual rebalance period of the Index, because the Fund is not equally weighted on a continuous basis, the Fund may be exposed to one or more Underlying ETFs disproportionately when compared to other Underlying ETFs. In such circumstances, the Fund will be subject to the over-weighted performance of such Underlying ETF. As a shareholder in other ETFs, the Fund bears its proportionate share of each ETF’s expenses, subjecting Fund shareholders to duplicative expenses.

There are no assurances the Underlying ETFs will be successful in providing the sought-after protection. The outcomes that the Underlying ETFs seek to provide may only be realized if you are holding shares on the first day of the outcome period and continue to hold them on the last day of the outcome period, approximately one year. There is no guarantee that the outcomes for an outcome period will be realized or that the Underlying ETFs will achieve their investment objective. If the outcome period has begun and the underlying ETF has increased in value, any appreciation of the Fund(s) by virtue of increases in the underlying ETF since the commencement of the outcome period will not be protected by the sought-after protection, and an investor could experience losses until the underlying ETF returns to the original price at the commencement of the outcome period. The Underlying ETFs are subject to an upside return cap (the “Cap”) that represents the maximum percentage return an investor can achieve from an investment in the fund(s) for the outcome period, before fees and expenses. If the outcome period has begun and the Underlying ETFs have increased in value to a level near to their individual Cap, an investor purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks. Additionally, the Cap may rise or fall from one outcome period to the next. Unlike the Underlying ETFs, the Fund itself does not pursue a target outcome strategy. The protection is only provided by the Underlying ETFs and the Fund itself does not provide any stated downside protection against losses. The Fund will likely not receive the full benefit of the Underlying ETF downside protections and could have limited upside potential. The Fund’s returns are limited by the caps of the Underlying ETFs. The Cap, and the Fund(s) position relative to it, should be considered before investing in the Fund(s) website, www.calamos.com, provides important Fund information as well as information relating to the potential outcomes of an investment in the Fund(s) on a daily basis.

Cap Rate – Maximum percentage return an investor can achieve from an investment in the Fund if held over the Outcome Period.

Protection Level – Amount of protection the Fund is designed to achieve over the Days Remaining. Outcome Period – The defined length of time over which the outcomes are sought.

Calamos Financial Services LLC, Distributor

2020 Calamos Court | Naperville, IL 60563-2787

866.363.9219 | www.calamos.com | [email protected]

© 2025 Calamos Investments LLC. All Rights Reserved.

Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC