This post was originally published on this site.

Many advisors and investors remain concerned about how market and geopolitical uncertainty will affect their equity and fixed income strategies, but those aren’t the only assets at risk.

The crypto industry got nearly everything it wanted last year yet the selloff that began in the second half of 2025 continues. The price of Bitcoin has struggled to return to its former glory.

With Bitcoin trading well below its previous high of roughly $126K and hovering near its 52‑week low around $74K, some investors may be questioning whether the long‑held “buy‑and‑hold” strategy is starting to lose its appeal.

Shaky conditions for the cryptocurrency are likely to continue in the coming weeks as well. Tumultuous foreign policy maneuvers from the U.S. government are causing some to shy away from riskier assets. Furthermore, the Federal Reserve seems to be keen to slow down interest rate cuts for the time being.

Protected Bitcoin ETFs: Built for the Long-Term

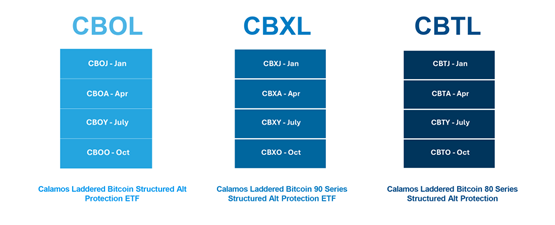

As such, it may be time to look at an alternative route for maintaining Bitcoin exposure over the long term. One way to do so is through funds like the Calamos Laddered Protected Bitcoin ETFs: CBOL, CBXL, and CBTL.

Each Calamos Laddered Protected Bitcoin ETF (at 100%, 90% & 80% protection levels from underlying ETFs) allocates equally across the four quarterly Calamos Protected Bitcoin ETFs creating a continuous outcome period without timing risk considerations.

Protected Bitcoin ETFs | Calamos Investments

CBOL, CBXL, and CBTL risk-on AND risk-off approach to Bitcoin exposure could prove to be an advantageous way of looking at the asset class in 2026. If the cryptocurrency’s price goes up, investors get to remain exposed to a rally. Inversely, if Bitcoin continues to perform poorly throughout the year, the funds’ focus on risk management can help preserve the kind of principal that pure-play or spot Bitcoin investors may be at risk of losing.

For more news, information, and strategy, visit the Alternatives Content Hub.

Before investing, carefully consider the Fund’s investment objectives, risks, charges and expenses.

Please see the prospectus and summary prospectus containing this and other information which can

be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund is subject to risks, and you could lose money on your investment in the

Fund. There can be no assurance that the Fund will achieve its investment objective. Your investment in

the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance

Corporation (FDIC) or any other government agency. The risks associated with an investment in the

Fund can increase during times of significant market volatility. The Fund also has specific principal risks,

which are described below. More detailed information regarding these risks can be found in the Fund’s

prospectus.

Investing involves risks. Loss of principal is possible. The Fund(s) face numerous market trading risks,

including authorized participation concentration risk, cap change risk, capital protection risk, capped

upside risk, cash holdings risk, clearing member default risk, correlation risk, derivatives risk, equity

securities risk, investment timing risk, large-capitalization investing risk, liquidity risk, market maker risk, market risk, non- diversification risk, options risk, premium-discount risk, secondary market trading risk, sector risk, tax risk, trading issues risk, underlying ETF risk and valuation risk. For a detailed list of fund risks see the prospectus.

FUND-OF-FUNDS RISK. Shareholders of the Fund will experience investment returns that are different

than the investment returns provided by an Underlying ETF. The Fund does not itself pursue a defined

outcome strategy, nor does the Fund itself provide downside protection against SPY losses. Because the

Fund will typically not purchase an Underlying ETF on the first day of a Target Outcome Period, it is not

likely that the stated outcome of the Underlying ETF will be realized by the Fund. The Fund will be

continuously exposed to the investment profiles of each of the Underlying ETFs during their respective

Target Outcome Periods. The Fund, with its aggregate exposure to each of the Underlying ETFs, may

have investment returns that are inferior to that of any single Underlying ETF or group of Underlying

ETFs over any given time period. In between the semi-annual rebalance period of the Index, because the

Fund is not equally weighted on a continuous basis, the Fund may be exposed to one or more

Underlying ETFs disproportionately when compared to other Underlying ETFs. In such circumstances,

the Fund will be subject to the over-weighted performance of such Underlying ETF. As a shareholder in

other ETFs, the Fund bears its proportionate share of each ETF’s expenses, subjecting Fund shareholders

to duplicative expenses.

There are no assurances the Underlying ETFs will be successful in providing the sought-after protection.

The outcomes that the Underlying ETFs seek to provide may only be realized if you are holding shares on

the first day of the outcome period and continue to hold them on the last day of the outcome period,

approximately one year. There is no guarantee that the outcomes for an outcome period will be realized

or that the Underlying ETFs will achieve their investment objective. If the outcome period has begun and

the underlying ETF has increased in value, any appreciation of the Fund(s) by virtue of increases in the

underlying ETF since the commencement of the outcome period will not be protected by the sought-

after protection, and an investor could experience losses until the underlying ETF returns to the original

price at the commencement of the outcome period. The Underlying ETFs are subject to an upside return

cap (the “Cap”) that represents the maximum percentage return an investor can achieve from an

investment in the fund(s) for the outcome period, before fees and expenses. If the outcome period has

begun and the Underlying ETFs have increased in value to a level near to their individual Cap, an investor

purchasing at that price has little or no ability to achieve gains but remains vulnerable to downside risks.

Additionally, the Cap may rise or fall from one outcome period to the next. Unlike the Underlying ETFs,

the Fund itself does not pursue a target outcome strategy. The protection is only provided by the

Underlying ETFs and the Fund itself does not provide any stated downside protection against losses. The

Fund will likely not receive the full benefit of the Underlying ETF downside protections and could have

limited upside potential. The Fund’s returns are limited by the caps of the Underlying ETFs. The Cap, and

the Fund(s) position relative to it, should be considered before investing in the Fund(s) website,

www.calamos.com, provides important Fund information as well as information relating to the potential

outcomes of an investment in the Fund(s) on a daily basis.

Cap Rate – Maximum percentage return an investor can achieve from an investment in the Fund if held

over the Outcome Period.

Protection Level – Amount of protection the Fund is designed to achieve over the Days Remaining.

Outcome Period – The defined length of time over which the outcomes are sought.

Calamos Financial Services LLC, Distributor

2020 Calamos Court | Naperville, IL 60563-2787

866.363.9219 | www.calamos.com | [email protected]

© 2025 Calamos Investments LLC. All Rights Reserved.

Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC