This post was originally published on this site.

U.S. spot bitcoin exchange-traded funds recorded their largest net withdrawals since Nov. 20 on Monday as bitcoin slid to as low as $85,100.

Outflows hit two-week high

Spot bitcoin ETFs posted $357.6 million in net outflows, the biggest daily redemption total in nearly two weeks.

The move came as broader market weakness weighed on bitcoin.

Monday weakness shows up again

Velo data cited in the report shows Monday has been the third-worst performing weekday for bitcoin over the past 12 months, behind Thursday and Friday.

Cost basis near $83,000 in focus

A key level highlighted for potential support was the U.S. spot ETF cost basis, described as the average entry price of bitcoin held by spot ETFs.

Glassnode data put the aggregate U.S. bitcoin ETF cost basis near $83,000, a level bitcoin rebounded from during prior lows on Nov. 21 and Dec. 1.

Fund-by-fund breakdown

Fidelity’s Wise Origin Bitcoin Fund (FBTC) led bitcoin ETF redemptions with $230.1 million.

Bitwise’s BITB and ARK 21Shares’ ARKB saw outflows of $44.3 million and $34.3 million.

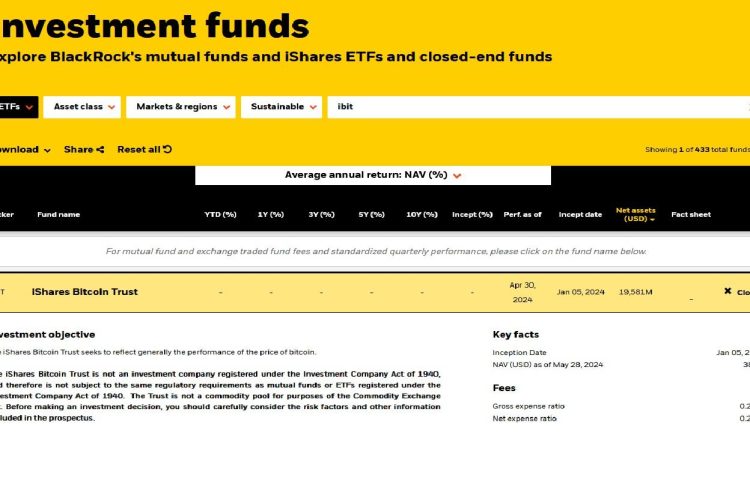

BlackRock’s iShares Bitcoin Trust (IBIT) reported no net flows.