This post was originally published on this site.

Great links, images, and reading from Chartbook Newsletter by Adam Tooze

Thank you for opening your Chartbook email.

Ekaterina Zernova On the mast of the research vessel 1956

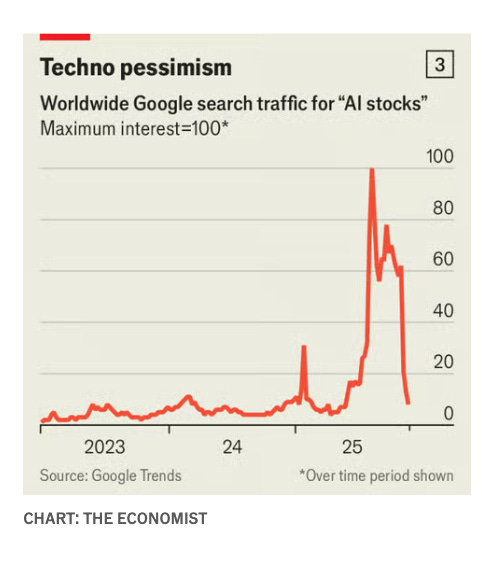

When Google searches for investing fads spiked.

The logic is that a bubble is most likely to draw interest from lots of retail traders just as it reaches bursting-point. Chart 2 shows the results for a range of manias. They encompass cryptocurrencies (bitcoin and Dogecoin), baskets of once-trendy “thematic” stocks (cannabis, wearable tech and space) and the crazes, in 2021, for special-purpose acquisition companies (SPACs) and Cathie Wood’s “ARKK” investment fund. Surges in Googling do a much better job than valuations at forecasting an imminent fall, as the third column of the chart shows. In each case the price of the stock, basket, fund or cryptocurrency dropped considerably over the 12 months following the peak in internet searches. Moreover, for the ARKK fund, bitcoin, GameStop and SPACs, prices spiked at almost exactly the same time as Googling did. Naturally, such observations do not constitute a rigorous study. There will have been many instances of internet traffic concerning popular investments spiking with no subsequent fall in prices. In fact, searches for “AI stocks” hit their zenith in mid-August, and their prices continued to rise serenely for weeks.

Source: The Economist

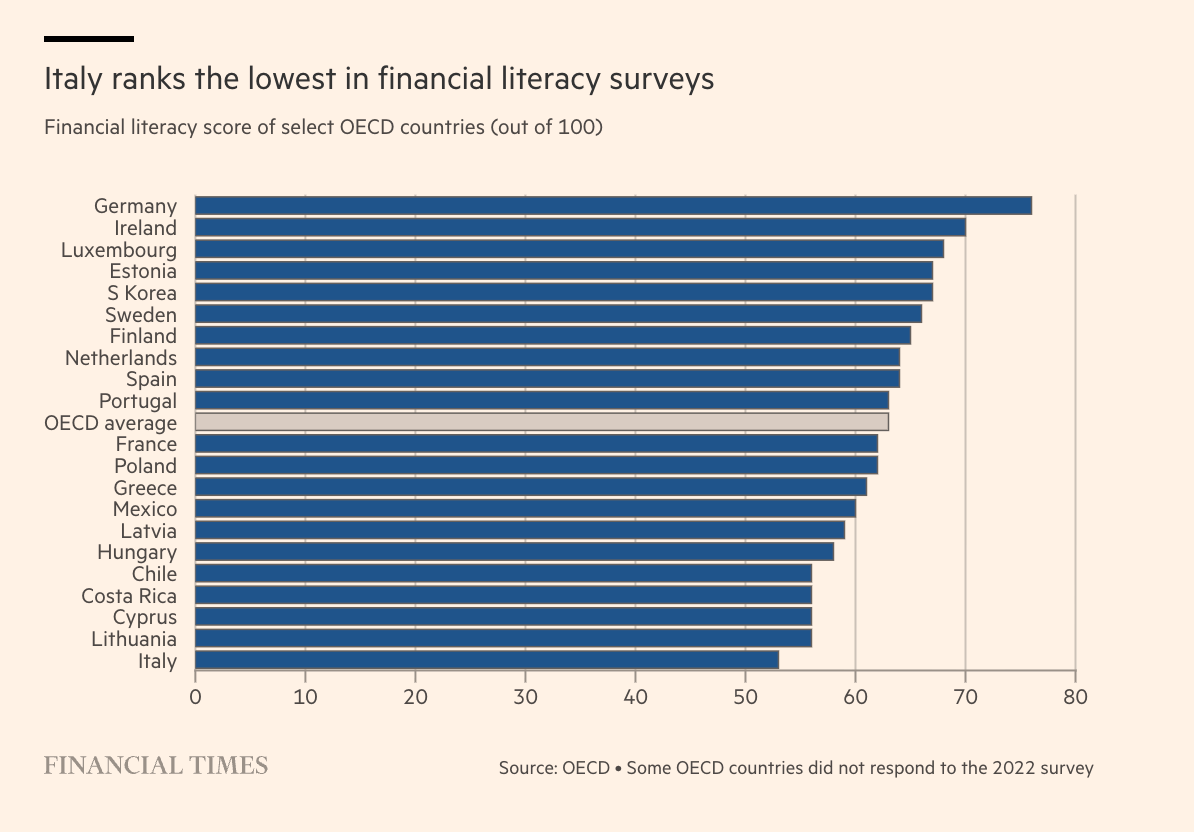

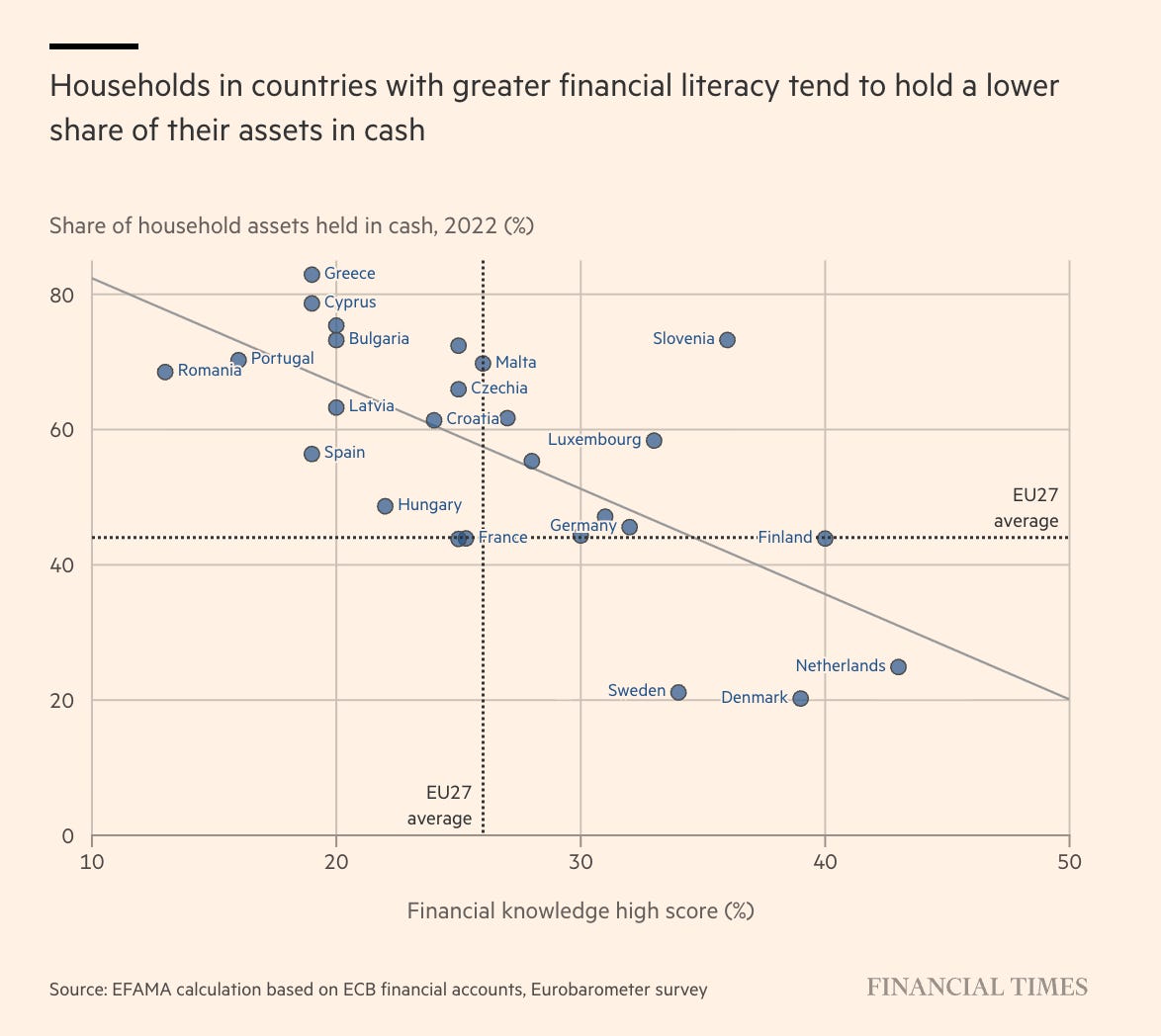

Making Europeans love finance is the new EU agenda

Italy has the least financially literate population among developed nations surveyed by the OECD. Fewer than four in 10 Italians can correctly answer questions about basic concepts like inflation, compound interest and risk diversification, compared with an OECD average of almost six in 10 people. We come from a Catholic and Latin culture where money has a negative connotation, it’s associated with greed and avarice In Brussels, financial literacy has moved up the policy agenda as legislators try to counter Europe’s sluggish growth rates and mounting fiscal pressures from an ageing population. The European Commission recently unveiled a bloc-wide strategy to tackle low financial literacy, aiming to boost consumer confidence, deepen retail participation in capital markets, and reduce financial vulnerability. A more investment-savvy European public would help mobilise some of the €11tn in private savings that largely sit idle in bank accounts, the thinking goes.

Source: Financial Times

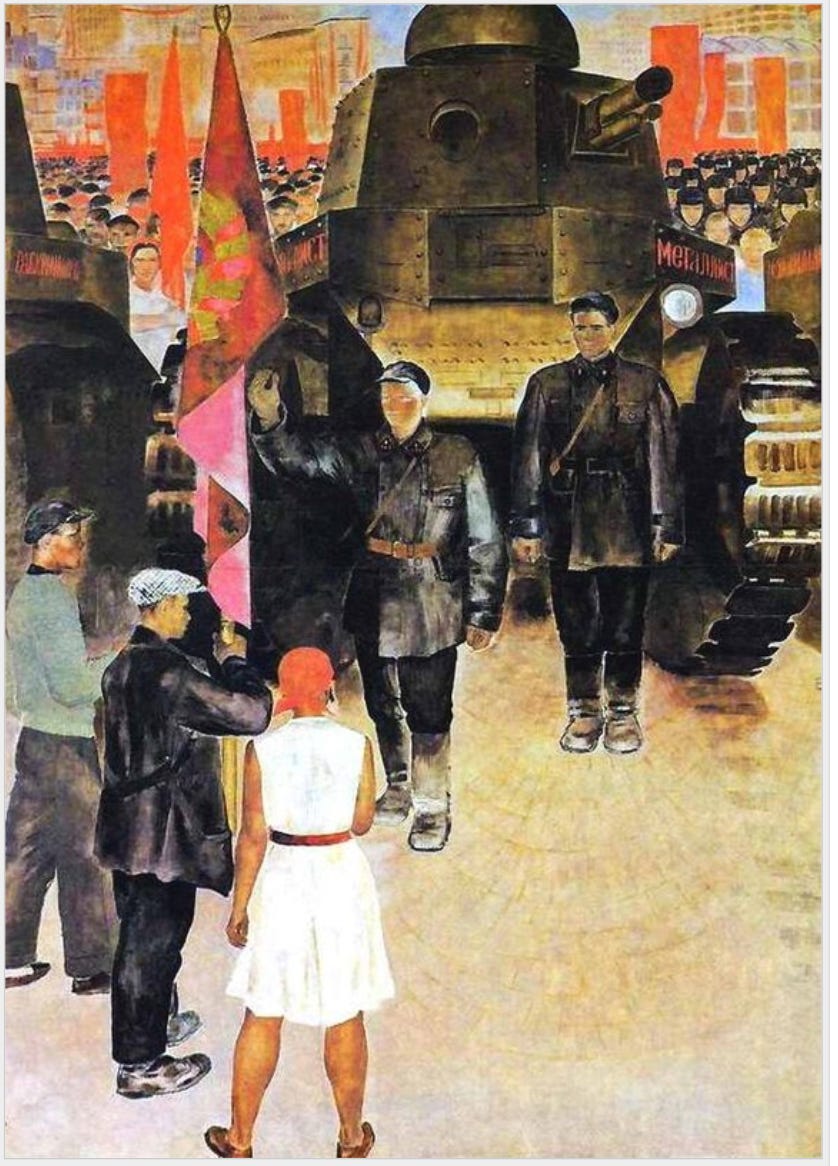

The transfer of tanks 1931

Source: Soviet Art

Zernova was born in April of 1900, daughter of a natural history museum curator. Her family moved to Moscow when she was 14 and she began to study in the private studio of F. Rerberg for three years. After she studied at the State Free Art Studios until 1924. In addition to her artistic education she studied at the Physics and Mathematics Faculty of Moscow University. She was a Member of the Moscow Union of Soviet Artists (1932), book illustrator, poster and monumental artist. During the Great War she was sent to the front lines and made sketches in hospitals, medical battalions, and operating rooms. After the war she taught at the Moscow Institute of Applied and Decorative Arts, and at the Moscow Textile Institute from 1953 to ‘71. She died in 1995 in Moscow.

Source: Web Kiosk

HEY READERS,

THANK YOU for opening the Chartbook email. I hope it brightens your day.

I enjoy putting out the newsletter, but tbh, what keeps this flow going is the generosity of those readers who clicked the subscription button.

If you are persuaded to click, please consider the annual subscription of $50. It is both better value for you and a much better deal for me, as it involves only one credit card charge. Why feed the payments companies if we don’t have to.

Accommodations

For contributing subscribers only.

Attacking tanks 1933

If you’ve scrolled this far, you know you want to click: