This post was originally published on this site.

Track your investments for FREE with Simply Wall St, the portfolio command center trusted by over 7 million individual investors worldwide.

-

Thomson Reuters (TSX:TRI) has agreed to acquire Noetica, Inc., an AI native analytics platform focused on deal professionals.

-

The transaction is aimed at deepening AI capabilities across Thomson Reuters legal and financial data products.

-

The move aligns with the company’s broader push into professional grade AI tools for legal and financial clients.

Thomson Reuters, trading at CA$120.93, is pushing further into AI as it works to refine its tools for legal and financial professionals. The acquisition of Noetica, Inc. comes after a period of weaker share price performance, with TSX:TRI down 5.4% over the past week and 32.4% over the past month. Over 1 year, the stock is down 51.2%, while the 5 year return stands at 25.1%.

For investors, the deal highlights how Thomson Reuters is leaning into specialized AI to deepen its product offering for deal makers and information heavy workflows. The key question from here is how effectively Noetica’s analytics platform is integrated into core products and whether customers see enough value in these AI driven tools to influence adoption and long term revenue mix.

Stay updated on the most important news stories for Thomson Reuters by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Thomson Reuters.

We’ve flagged 3 risks for Thomson Reuters. See which could impact your investment.

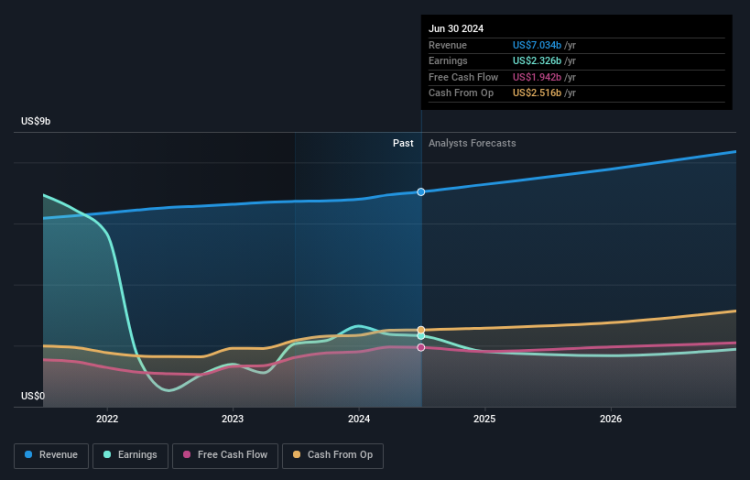

The Noetica deal slots into Thomson Reuters’ push to make its legal and financial platforms more AI centric, especially for complex deal workflows. You have already seen the company invest in AI-powered products like CoCounsel, and this acquisition adds a specialist engine that turns unstructured transaction data into structured intelligence. That sits squarely in the same territory where competitors such as RELX, Bloomberg and Wolters Kluwer are also building AI workflow tools. For investors, this comes on the back of 2025 results where sales reached US$7,476m but net income was US$1,502m, lower than the prior year, and margin pressure was visible in earnings per share. At the same time, the board approved a 10% dividend increase to US$2.62 a share, extending a 33 year streak of annual rises. The combination of rising AI investment, ongoing acquisitions and a higher dividend means you may want to pay close attention to how effectively Thomson Reuters converts AI-related spend into product uptake and whether earnings quality keeps pace with its payout commitments.

-

The acquisition of Noetica supports the narrative that AI-driven workflow tools and proprietary content can deepen Thomson Reuters’ role in legal and accounting processes, especially for deal professionals.

-

Integration risk around Noetica and other AI-focused deals could challenge expectations for margin uplift and earnings growth that the narrative ties to successful execution of acquisitions.

-

The emphasis on AI for deal data and transaction intelligence adds a specific use case that is not fully detailed in the existing narrative, which has mostly focused on research, advisory and tax workflows.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Thomson Reuters to help decide what it’s worth to you.

-

⚠️ Profit margins of 19.8% are lower than the 30.2% reported last year, which points to pressure on earnings even as the company increases AI investment and continues acquisitions.

-

⚠️ Analysts have flagged 3 important risks, including an unstable dividend track record assessment, recent insider selling and weaker net profit margin trends, which may temper confidence in near term earnings resilience.

-

🎁 Thomson Reuters is trading at 50.4% below one estimate of fair value, which some investors may view as a potential cushion if the AI strategy and acquisitions like Noetica prove effective.

-

🎁 Earnings are forecast to grow 12.44% per year in analyst models, and the company continues to approve regular dividend increases, which supports the view that management is focused on long term cash generation for shareholders.

From here, it makes sense to watch how quickly Noetica’s AI analytics are embedded into CoCounsel and other Thomson Reuters platforms, and whether clients adopt these tools for high value deal work. You might also track how AI-native competitors, including tools such as Anthropic’s Claude plug ins and offerings from RELX or Bloomberg, influence pricing power and contract renewals. On the financial side, the key signals will be any shift in net income and profit margins relative to growing AI spend, as well as management’s stance on future dividend increases if earnings do not keep pace.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for Thomson Reuters, head to the community page for Thomson Reuters to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TRI.TO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com