This post was originally published on this site.

COVID was a massively negative shock to brick and mortar retail in the US

Before the pandemic, there was a time when there was intense interest in the “retail apocalypse,” the shift to online buying that was driving many brick and mortar retailers out of business. It’s ironic that interest in this topic has faded, because COVID was an absolute body blow to brick and mortar retail. The pandemic forced many households, which had previously resisted the shift to online buying, to switch to the internet and they’ve never gone back. Department stores like Macy’s, Nordstrom or Kohl’s have ceased being economically meaningful entities in US retail.

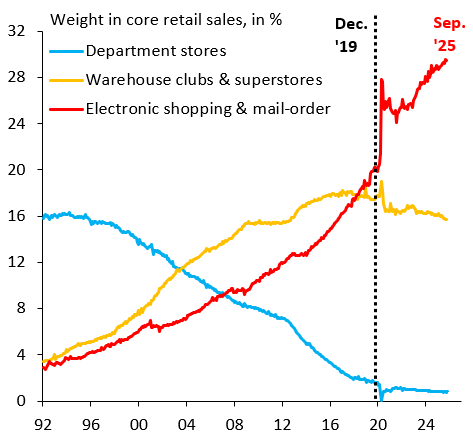

The chart above shows the changing importance of brick and mortar retail versus e-commerce in core retail sales, which exclude volatile categories like autos, gasoline, building materials and food. The blue line is the share of department store sales in core retail sales. The orange line is warehouse clubs and superstores, which is things like Costco, Sam’s Club and Walmart. The red line is electronic shopping and mail-order, which is primarily e-commerce. Three conclusions stand out: (i) the pandemic was a massively positive shift for e-commerce, which prior to COVID accounted for around 20 percent of core retail sales but now stands at 30 percent; (ii) big box stores like Walmart did well during the initial stages of the pandemic, but are now ceding ground to e-commerce; and (iii) department stores were already getting obliterated ahead of the pandemic and have basically ceased to be economically meaningful.

I’m endlessly amazed how many empty storefronts there are in prime retail locations around the US. My read of these data is that there’s still a lot of room for e-commerce to take market share away from brick and mortar retail. The retail apocalypse is far from over.