This post was originally published on this site.

© jittawit21 / Shutterstock.com

No matter where you are in your investment journey, dividends can become the backbone of your income. Dividend stocks are an ideal way to generate money from your investment; they can help cover monthly expenses and provide stability in the form of steady income. However, they may not always outperform the market and could bring worry when the market is down. This is where exchange-traded funds (ETFs) come into play.

If you’re building a retirement portfolio and looking to generate passive income, consider dividend ETFs. These ETFs are focused on dividend stocks and provide exposure to various industries. They can protect your portfolio in any circumstances and ensure you have a smooth retirement. Here are three dividend ETFs worth adding to your portfolio.

Schwab U.S. Dividend Equity ETF

Dividend yield: 3.76%

A passive index fund, the Schwab US Dividend Equity ETF (NYSEARCA:SCHD) tracks the Dow Jones U.S. Dividend 100 index and owns 102 stocks. Known for a high yield, SCHD has a yield of 3.76% and an expense ratio of 0.06%. It offers fair diversification across industries, including industrials, healthcare, and financials. The fund screens for financial stability and dividend sustainability to build a portfolio that focuses on the traditional dividend stocks instead of growth stocks.

SCHD doesn’t invest in high-growth stocks and hasn’t managed to beat the market. However, it invests in dividend-paying stocks with a strong history and solid fundamentals. The sector holdings bring an opportunity for 2025.

It invests 19% in energy, 18% in consumer staples, 16% in healthcare, and 9% in financials. It holds major positions in the biggest companies in each sector, such as Chevron and ConocoPhillips. Its top 10 holdings include Bristol-Myers Squibb, Lockheed Martin, Chevron, Merck, and ConocoPhillips. These are industry giants known for reliable dividend growth.

The ETF holds a strong position across sectors, and it can see an upside through 2026. SCHD also provides protection in difficult market situations, ideal for retirement when you value security.

Up 2% in the past year, SCHD is exchanging hands for $27.90. It has generated an annualized 3-year return of 5.46% and a 5-year return of 9.48%.

Vanguard High Dividend Yield Index Fund ETF

Dividend yield: 2.45%

The Vanguard High Dividend Yield Index Fund ETF (NYSEARCA:VYM) is another dividend ETF worth adding to your portfolio. It has a yield of 2.45% and tracks the performance of the FTSE High Dividend Yield index and measures the return on stocks of companies known for high dividend yields. The ETF has an expense ratio of 0.06%. Since its inception in 2006, VYM has delivered an average annual return of 9%.

The fund has generated a cumulative 3-year return of 44.62% and a 5-year return of 81.66%. VYM holds over 500 stocks, offering ultimate diversification. It has the highest allocation in the financial sector at 21%, followed by technology at 14.30% and industrials at 12.90%.

Its top 10 holdings include some of the renowned dividend stocks, such as Walmart, Johnson & Johnson, Bank of America, Cisco, Exxon Mobil, and AbbVie. These companies have historically paid steady dividends and have the potential to sustain them.

VYM has $84.5 billion in assets under management and has a large set of holdings, which protect investors from a downturn in any given sector. It also has limited exposure to the technology sector, which sets it apart from other tech-heavy stocks. If you do not want to take risks during your retirement years, VYM can be a great choice.

The ETF has gained 13.39% in the past year and is exchanging hands for $145.10.

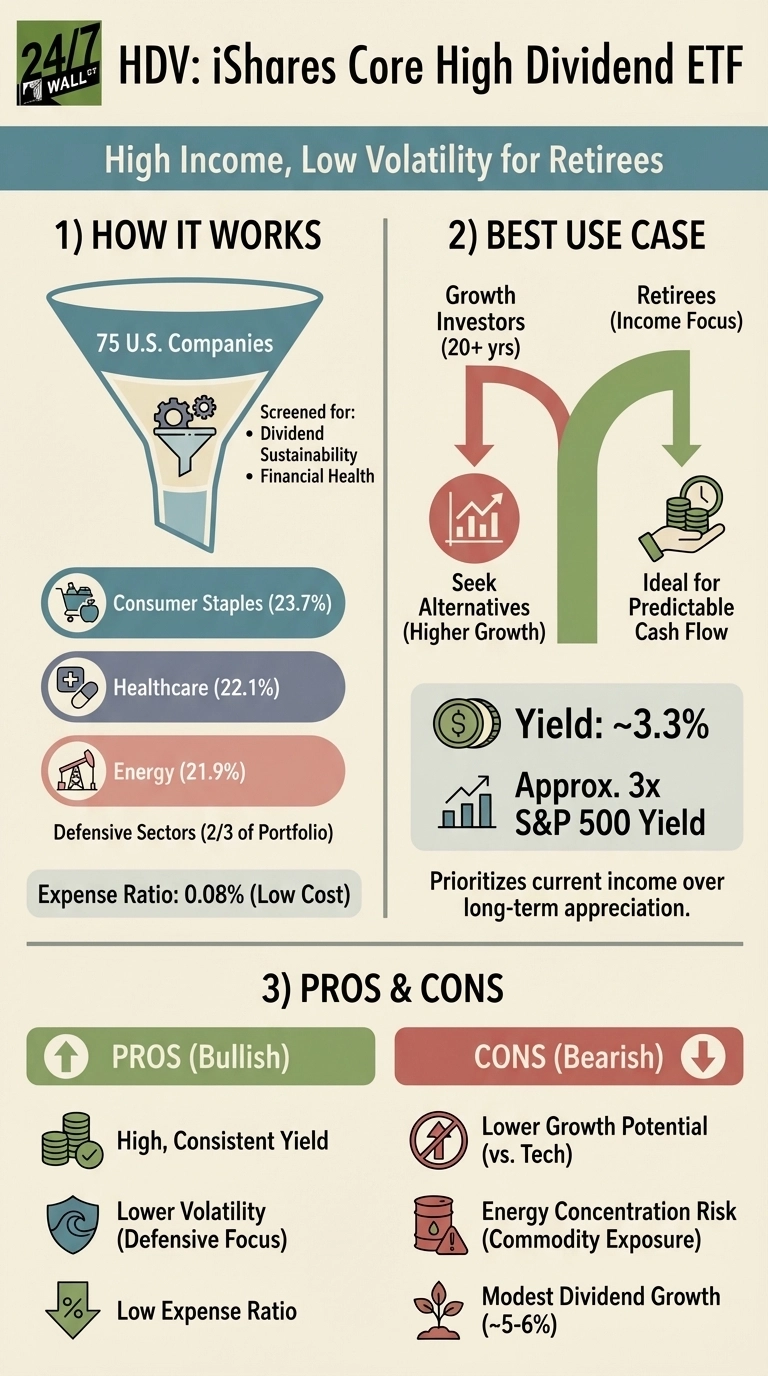

iShares Core High Dividend ETF

Dividend yield: 3.30%

Next on the list is the iShares Core High Dividend ETF (NYSEARCA:HDV). It tracks the results of an index composed of high dividend-paying U.S. stocks. The fund holds 75 stocks that have been thoroughly screened for financial health, and it has a yield of 3.30%.

HDV has generated a total return of 29.98% in 3 years and 66.12% in 5 years. The fund has an expense ratio of 0.08% and pays quarterly dividends. It has the highest exposure to the consumer staples sector at 26.82%, followed by energy at 23.84% and healthcare at 17.41%. The top 10 holdings in the ETF include solid dividend stocks such as Chevron Corporation, Exxon Mobil, Johnson & Johnson, Coca-Cola, PepsiCo., Procter & Gamble, and AbbVie. Some of these are dividend aristocrats with the potential to increase dividends this year.

The fund has $12 billion in assets under management, and it remains more concentrated in the traditional energy and defensive sectors. It manages to deliver by focusing on the less volatile sectors and will offer a high dividend at the lowest volatility.

In 2025, HDV paid total dividends of $3.9, delivering on its steady income promise. The fund gained 7.9% in the past year and is exchanging hands for $121 today.