This post was originally published on this site.

The Trade Desk was the darling of adtech. A profitable, founder-led adtech software company that grew at epic rates year after year, built the leading independent demand-side platform, and positioned itself as the Switzerland of programmatic advertising.

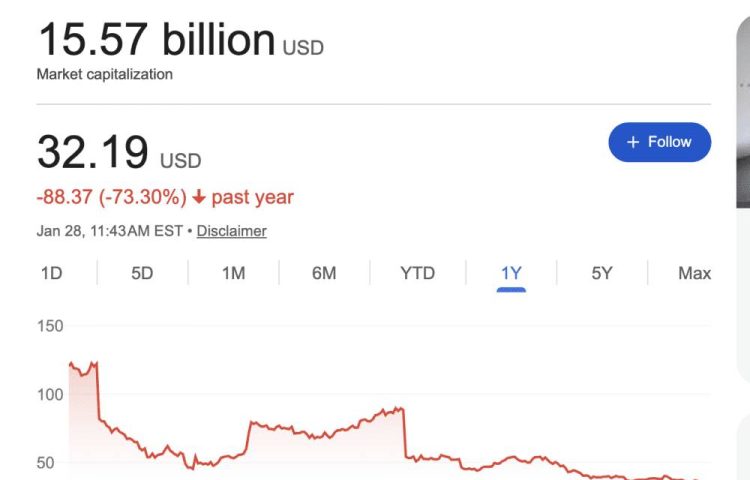

And then it became the worst performing stock in the entire S&P 500 in past 12 months. Down 73%. Market cap cratered from $70B to under $15B.

What happened? The same thing that happens to every B2B company that’s priced for perfection: growth decelerated, and the market repriced the business accordingly. It fell from the hypergrowth category to mature growth (<20% year-over-year). And was brutally punished for it.

The same will happen to your start-up if you decelerate.

Here’s what founders scaling toward $100M+ ARR (and beyond) can learn from it.

The Deceleration Death Spiral

Trade Desk grew revenue 26% in 2024. Still solid. But in 2025, that slipped to ~20% for the first nine months. Q3 came in at 18%.

For many mature companies, 18% growth might be OK. Not great but OK perhaps.

But Trade Desk was trading at 90x+ earnings. At that multiple, you’re not paying for what the business is — you’re paying for what it’s becoming. When growth decelerates, the market doesn’t just adjust the multiple down linearly. It re-rates the entire story.

The stock didn’t drop 10% because growth dropped a few points. It dropped 73% because investors started asking: “Wait, is this a 15% grower now? A 12% grower? What’s the terminal growth rate?”

As Rosenblatt analyst Barton Crockett noted after the recent CFO departure, there’s been a “contraction of peer multiples” across the sector — but Trade Desk has been hit hardest because it had the furthest to fall.

The Rule of 40 (And Profitability) Doesn’t Save You at Scale

Trade Desk still has great margins. They did over $1B in adjusted EBITDA in 2024. They’re profitable. They generate real free cash flow.

Didn’t matter.

At a $70B market cap, the market wasn’t paying for profitability. They were paying for growth. When you’re valued like a hyper-growth company, you need to deliver hyper-growth. Profitability is table stakes at that valuation, not a differentiator.

This is the trap a lot of founders don’t see coming. You optimize for Rule of 40, you hit your EBITDA targets, and you think you’re executing well. But if you’re priced for 25% growth and you deliver 18%, you’re going to get crushed — regardless of how profitable you are.

Evercore ISI cut their price target on the stock, noting that “a linear path to a premium growth rate isn’t guaranteed.” That’s Wall Street speak for: the days of assuming Trade Desk would just keep compounding at 25%+ are over.

Competition Showed Up

Trade Desk’s core pitch is that they’re the independent, objective alternative to the walled gardens. They don’t own media. They don’t compete with their customers. They’re aligned with the buy side.

It’s a great positioning. Until Amazon decides to build the same thing.

Amazon now has its own DSP. They signed Netflix for inventory. They have better retail data than anyone. And they’re going after the same connected TV budgets that have been Trade Desk’s fastest-growing segment.

As Motley Fool analyst Brett Schafer put it: “The Trade Desk is a small minnow competing with the sharks in Alphabet, Meta Platforms, and Amazon.”

When you’re competing with those three, being “independent” only matters if you’re also meaningfully better. If the giants close the gap on targeting and measurement, your neutrality becomes a nice-to-have, not a must-have.

For founders: your positioning is only as strong as the moat behind it. “We’re not them” works until “them” decides to copy you with 100x your resources.

The C-Suite Chaos Factor

As if the fundamentals weren’t enough, Trade Desk just fired their CFO — five months after hiring him. This was the second CFO departure in under six months.

No explanation given. The CFO stays on the board through the annual meeting, which is weird. And management is conducting an “external search” for a replacement while their stock is in freefall.

Truist analyst Youssef Squali lowered his price target from $85 to $60, citing “greater uncertainty” following the CFO transition. Wells Fargo noted the announcement signals “continued fundamental and narrative volatility” and suggested Trade Desk should seek a candidate with actual public company CFO experience — since neither of their last two CFOs had it.

Rosenblatt’s Crockett was more blunt: the “surprising personnel volatility in this key post for now eviscerates the argument for a valuation premium to growth.”

Here’s the thing: at $70B, you can survive some executive turnover. At $20B after a 68% drawdown, every signal matters. The market is already nervous about the growth story. Unexplained C-suite chaos just confirms that something is off.

For founders: leadership stability matters more when things are hard. When you’re growing 50%, people forgive a lot. When growth is decelerating and the stock is getting crushed, every management misstep gets amplified.

What This Means for B2B Founders

If you’re building a B2B company and thinking about what your public market story might look like someday, Trade Desk is a case study in what happens when growth expectations diverge from reality.

The lessons are pretty clear.

- Growth rate determines your multiple, not your profitability. At scale, investors are paying for what you’re becoming. If you’re priced as a 25% grower and you deliver 18%, you will get re-rated violently.

- Deceleration is the enemy. It’s not about the absolute growth rate. It’s about the trajectory. Going from 26% to 23% to 18% tells a story of a company that’s maturing faster than expected. The market hates that story.

- Your competitive moat has to hold. Trade Desk’s “independent and objective” positioning is under pressure because Amazon is building a credible alternative with better data. If your differentiation can be replicated by a megacap with unlimited resources, you don’t have a moat — you have a head start.

- Management stability matters most when times are hard. Two CFOs in six months, no explanation, during a 68% stock decline? That’s how you turn a growth slowdown into a full-blown crisis of confidence.

The Bigger Picture

Trade Desk isn’t a bad company. It’s still a great one, in fact. It’s still worth $15B+ and they have $2.4B in revenue, strong margins, real technology differentiation, and a great founder-CEO who’s been there since 2009. They reach 90M+ households in CTV. They have meaningful partnerships with every major retailer for shopper marketing data.

But they were priced for perfection, and they stopped being perfect.

At around 16x forward earnings today (per Motley Fool estimates), the stock is actually at its cheapest valuation in years. The bull case is that CTV and retail media are still massive tailwinds, that international expansion (only 12% of revenue today vs. 60% of global ad spend) is a huge opportunity, and that the growth deceleration is temporary.

Maybe. But the market is making them prove it now. Benchmark upgraded the stock to Buy after Q3 results, arguing that “perceived industry growth hurdles were generally in the rearview” and that Trade Desk’s forward-chain innovations would be “critical differentiators driving significant AI efficiency gains.”

For founders still scaling: understand that the rules change at different stages. At $10M ARR, growth covers all sins. At $100M ARR, efficiency starts to matter. At $1B+ ARR with a public market valuation, you’re running on a treadmill that speeds up every quarter.

Trade Desk’s last 12 months is a reminder that even the best companies can go from darling to disaster when growth expectations reset. The stock market doesn’t grade on a curve — it prices in the future, and when that future changes, so does everything else.