This post was originally published on this site.

In a Substack post, Burry said another 10% drop in Bitcoin’s price could leave Strategy billions underwater and restrict its access to capital markets.

- ‘The Big Short’ investor blamed Bitcoin’s slide for the fall in precious metals this week.

- If Bitcoin were to slide toward $50,000, he said mining firms would struggle to remain solvent.

- Burry also questioned Bitcoin’s ability to find support without any “organic use case.”

Michael Burry, known for calling the US housing market crisis ahead of the 2018 financial crash, warned that if Bitcoin’s (BTC) price fell any further, it could trigger a “death spiral” for companies like Strategy (MSTR) with crypto on their balance sheets.

“Sickening scenarios have now come within reach,” Burry wrote in a Substack post cited by Bloomberg, stating that if Bitcoin’s price fell another 10%, Michael Saylor’s Strategy would be billions in the red and “find capital markets essentially closed.” Any drop bigger than 10% would push Bitcoin miners like MARA Holdings (MARA) and Riot Platforms (RIOT) towards bankruptcy.

MSTR Stock Plummets Ahead Of Earnings Amid Bitcoin’s Slide

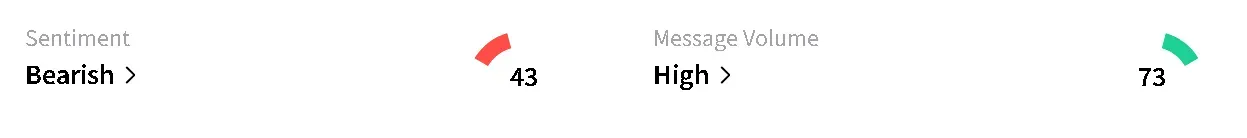

Burry’s comments come as MSTR’s stock fell 1.47% in overnight trade following a decline of 4.56% in the regular session. The shares has fallen lows not seen since September 2024 amid Bitcoin’s downtrend this year, shedding 18% of their value this month alone. Retail sentiment around the Bitcoin proxy fell to ‘bearish’ from ‘neutral’ over the past day, while chatter remained at ‘high’ levels.

Strategy is scheduled to report its fourth quarter (Q4) earnings after the bell on Thursday, with Wall Street expecting a loss of $0.08 per share on revenue of $119.12 million, as per platform data.

Meanwhile, Bitcoin’s price fell 3.2% in the last 24 hours to around $76,300, recovering from an intra-day low of $73,100. According to Burry’s hypothesis, MSTR will be trouble once Bitcoin’s price falls under $70,000.

The cryptocurrency has been struggling to break above the $80,000 mark after the weekend flash crash and is currently almost 40% below its record high of over $126,000 seen in October last year. On Stocktwits, retail sentiment around BTC fell to ‘extremely bearish’ from ‘bearish’ territory over the past day, accompanied by ‘extremely high’ levels of chatter.

There’s Nothing To Stop Bitcoin’s Drop

Adding to his bearish commentary, Burry said that there is no “organic use case” to help cushion Bitcoin’s fall. He noted that the apex cryptocurrency has not responded to its usual catalysts like weakness in the dollar or heightened geopolitical risks, which saw gold and silver rally while Bitcoin plunged alongside the stock market.

The cryptocurrency may be on corporate balance sheets and seen a boost from the influx of exchange traded funds (ETFs), but Burry contends those moves won’t be enough to uplift Bitcoin’s price – or prevent the losses that follow from it dipping lower. “There’s nothing permanent about treasury assets,” he wrote. He even blamed ETFs for adding fuel to the fire and making Bitcoin more speculative than before.

Miners, ETFs And Spillover Risks

Burry warned that continued weakness could spill into broader markets. “It looks like up to $1 billion in precious metals were liquidated at month’s very end as a result of falling crypto prices,” Burry wrote.

If Bitcoin were to slide toward $50,000, he said mining firms would struggle to remain solvent, while “tokenized metals futures would collapse into a black hole with no buyer.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.