This post was originally published on this site.

We help online sellers pick the best ecommerce accounting software. It automates reconciliations, makes compliance easy, and increases profits on platforms like Amazon, Shopify, and Etsy. Did you know 82% of small businesses fail due to cash flow problems? Online sellers often face hidden fees, delayed payouts, and inventory mistakes in spreadsheets.

If you’re selling on Shopify, Amazon, Etsy, or a mix, you need a tool that syncs your sales, handles GST/HST correctly, tracks inventory costs, and makes tax season bearable. SAL Accounting team specializes in bookkeeping for ecommerce stores in Toronto, and we’ve tested these tools with hundreds of clients. This in-depth guide breaks down what actually works in 2025—no fluff, just real insights from the front lines.

Why “Regular” Accounting Software Falls Short for Canadian Ecommerce

Most generic accounting tools are built for service businesses or U.S. retailers. They stumble on Canadian ecommerce realities like:

- GST/HST (and Quebec’s QST)

- Place of supply rules across provinces

- Multi-currency sales (CAD to USD is everyday)

- Complex payout reconciliations (Shopify fees, refunds, chargebacks)

- Inventory and cost of goods sold (COGS) for margin tracking

The right software saves you 10–20 hours a month and prevents costly CRA mistakes. The wrong one leaves you manually fixing errors at 2 a.m.

The Top 6 Ecommerce Accounting Software Options for Canadian Sellers in 2025

1. QuickBooks Online + A2X: The Powerhouse Combo

QuickBooks Online (Canadian version) is the most robust choice, and when paired with A2X, it’s unbeatable for multi-channel sellers.

What makes it stand out:

- Native GST/HST tracking with one-click reports

- A2X automatically reconciles Shopify/Amazon/Etsy payouts—fees, refunds, everything

- Advanced inventory and COGS tracking

- Multi-currency with Bank of Canada exchange rates

- Seamless CRA filings and audit trails

Real client win: A Toronto clothing brand went from 25 hours/month on books to 4 hours after switching to this combo. They also caught $8,000 in unclaimed input tax credits.

Cost: QuickBooks $20–$90/month + A2X $39–$149/month

Best for: Stores over $200k/year, especially multi-platform.

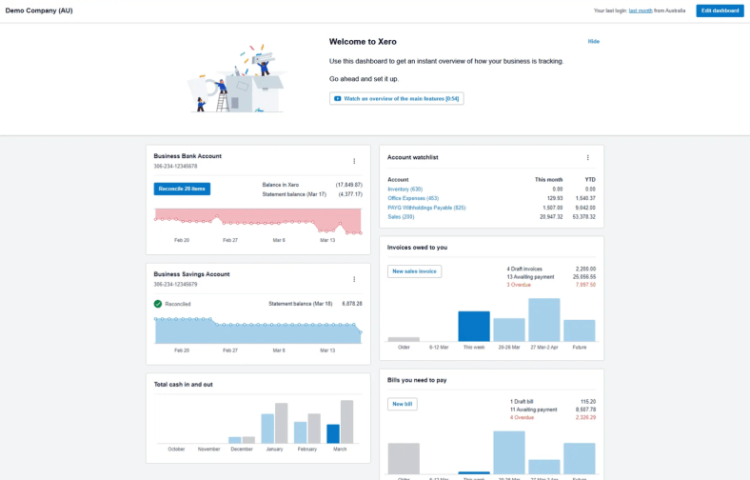

2. Xero + A2X or Link My Books: Clean and Modern

Xero’s interface feels fresh, and it’s a favorite for sellers who want simplicity without sacrificing power.

Standout features:

- Beautiful, easy-to-read dashboards

- Excellent bank feeds and reconciliation

- Built-in GST/HST reports ready for CRA

- Strong multi-currency handling

- Great mobile app for on-the-go receipt snapping

Client story: A Vancouver skincare brand switched from QuickBooks because they found Xero “less intimidating.” With Link My Books, their Amazon FBA sales synced perfectly.

Cost: Xero $13–$65/month + integration $20–$80/month

Best for: Growing stores ($100k–$500k) that value usability.

3. Wave: The Best Free Option That’s Actually Canadian

Wave is built in Canada, free for core accounting, and surprisingly capable for smaller stores.

Why it works:

- No monthly fee for accounting/invoicing

- Automatic GST/HST calculation

- Decent receipt scanning

- Simple profit & loss reports

Limitations: Weaker multi-channel automation and inventory tracking. Payroll and payments are paid add-ons.

Client example: A small Etsy seller making $80k/year uses Wave and our quarterly review service. Zero software cost, full compliance.

Cost: Free (add-ons extra)

Best for: Stores under $150k/year starting out.

4. FreshBooks: Perfect for Creators and Service + Product Sellers

FreshBooks started as invoicing software but has solid double-entry accounting now.

Highlights:

- Gorgeous, client-friendly invoices

- Time tracking (great if you consult + sell products)

- Basic Shopify integration

- Canadian GST/HST built in

Client story: A Calgary photographer selling prints uses FreshBooks for invoicing clients and tracking product sales in one place.

Cost: $19–$60/month

Best for: Creative sellers with mixed income streams.

5. Zoho Books: Powerful and Affordable Multi-Channel Choice

Zoho is often overlooked but packs serious features at a low price.

Key advantages:

- Direct Shopify and Amazon integrations

- Strong inventory management

- Excellent multi-currency

- Client portals for wholesale buyers

Cost: $20–$50/month

Best for: Budget-conscious sellers with complex inventory.

6. Bench + Manual Integrations: Hands-Off Bookkeeping (Not Software)

Bench pairs human bookkeepers with basic software. It’s not “software-only,” but worth mentioning for sellers who want done-for-you books.

Pros: Dedicated bookkeeper, tax-ready reports.

Cons: Less control, higher cost long-term.

Cost: $300–$600/month

Best for: Sellers who hate bookkeeping entirely.

| Tool | Starting Price | Standout Features | Main Integrations | Inventory | Best For |

| QuickBooks Online | ~$38/month | Fee breakdowns, channel profits | Amazon, Shopify, A2X | Strong | Growing stores ($100K–$5M) |

| Xero | ~$20/month | VAT/GST, clean reports | A2X, platforms | Solid | Cross-border sellers |

| Zoho Books | Free (<$50K)/~$20/mo | Product profits, taxes | Shopify, Zoho | Lot tracking | Budget growth |

| Wave | Free | Simple bookkeeping | CSV | Basic | Startups (<$50K) |

| FreshBooks | ~$19–20/month | Easy invoicing | Shopify, Woo | Light | Solo/service sellers |

| A2X | ~$29/month | Payout reconciliation | QBO, Xero | Via tool | Multi-platform |

| Sage 50cloud | ~$50–60/month | Landed costs, stock detail | Third-party | Advanced | Complex inventory |

How to Choose the Right Software for Your Canadian Ecommerce Store

Ask yourself these questions:

- What platforms do you sell on?

Single Shopify → any tool works. Multi-channel (Amazon + Etsy + own site) → prioritize A2X or Link My Books. - How much inventory do you carry?

Dropshipping → basic COGS is fine. Stocked inventory → need advanced tracking (QuickBooks or Zoho). - Do you sell to the U.S.?

Multi-currency and potential nexus tracking matter. - How much time can you spend on books?

Love DIY → Xero or Wave. Hate it → consider outsourced help. - What’s your revenue?

Under $150k → Wave or FreshBooks.

$150k–$500k → Xero.

Over $500k → QuickBooks + A2X.

Common (and Expensive) Mistakes Canadian Sellers Make

- Using U.S.-centric software that botches GST/HST.

- Relying on Shopify reports alone for tax filings (they don’t include expenses or COGS).

- Manual CSV imports every month (error-prone and soul-crushing).

- Ignoring inventory until year-end (missed deductions and margin insights).

The Hidden Cost of “Free” Software

Free tools like Wave save money upfront but cost time—and time is money. One client spent 15 hours/month fixing Wave’s limitations. Switching to Xero + automation dropped it to 3 hours, freeing her to grow sales by 30%.

Final Thoughts: Pick the Tool, Then Get It Set Up Right

The best ecommerce accounting software is the one that fits your store today and scales tomorrow. For most Canadian sellers, that’s QuickBooks + A2X or Xero + a solid integration. But great software is only half the battle. Proper setup—chart of accounts, tax mappings, payout reconciliations—makes or breaks it.

That’s where Shopify store accountants come in. They configure your software, clean historical data, and handle ongoing compliance so you can focus on selling. Ready to stop guessing and start growing with confidence? Book a free consultation at https://salaccounting.ca/

📧 Email: [email protected]

📍 Location: 330 Bay St. Unit 1401, Toronto, ON M5J 0B6 | 55 Village Centre Pl, Suit 734, Mississauga, ON L4Z 1V9, Canada