This post was originally published on this site.

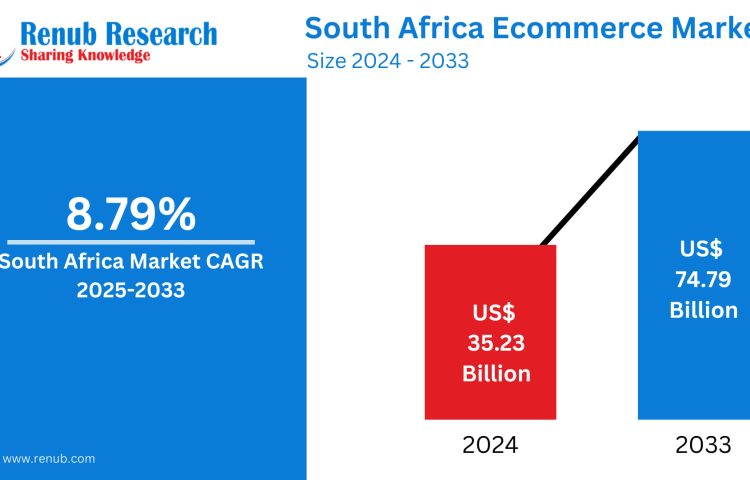

The South African e-commerce market is entering a transformative decade, one that will be defined by rapid digitization, expanding connectivity, and unprecedented consumer adoption of online retail. According to Renub Research, the market is projected to reach US$ 74.79 billion by 2033, nearly double its estimated US$ 35.23 billion valuation in 2024, growing at a compound annual growth rate (CAGR) of 8.79% from 2025 to 2033.

Driven by increased smartphone penetration, maturing digital payment solutions, logistics advancements, and shifting consumer lifestyles, South Africa is fast becoming one of Africa’s most dynamic online retail markets. From fashion and electronics to groceries and health products, the digital marketplace is reshaping how millions of South Africans shop.

The South Africa Ecommerce Market & Forecast report (2025–2033) covers a wide range of categories—Apparel & Accessories, Beauty & Personal Care, Consumer Electronics, Office Supplies, Toys and Hobby, Furniture, Books & Media, and Others. It also evaluates payment modes including Digital Wallets, Credit/Debit Cards, Account-to-Account (A2A), Buy Now Pay Later (BNPL), Cash on Delivery (COD), and even Cryptocurrency.

Below is a detailed news-style market overview written for clarity, insight, and reader engagement.

South Africa E-commerce Market Overview

E-commerce—defined as the digital buying and selling of goods and services—has expanded dramatically across South Africa over the past decade. Consumers now rely on online platforms to compare prices, shop for essentials, pay for services, and receive home deliveries with increasing convenience.

The market’s momentum stems from a potent mix of factors:

Widespread internet access

High smartphone usage

Growth in digital and mobile payment solutions

A cultural shift toward convenience-driven consumption

South Africa’s e-commerce ecosystem is anchored by leading platforms such as Takealot, Zando, Superbalist, Amazon (recently launched in 2024), and various specialized online retailers. These companies have leveraged consumer behavior shifts—particularly after the COVID-19 pandemic—to expand product selection, offer smoother delivery options, and provide personalized online shopping experiences.

The rise of e-commerce has also empowered small and medium-sized enterprises (SMEs), enabling them to reach national audiences without heavily investing in physical stores. Enhanced security protocols and the expansion of mobile banking further contribute to rising consumer trust in online transactions.

What was once a convenience-driven luxury for urban residents has now become a necessity-driven digital lifestyle across the country.

Key Drivers of the South Africa E-commerce Market

1. High Internet Penetration and Mobile Usage

South Africa’s digital infrastructure has improved significantly, allowing millions to access online shopping platforms seamlessly. As of January 2024, 74.7% of the population had internet access, with more than 118.6 million active internet connections reported—a number exceeding the total population due to multi-device usage.

Smartphones have become the primary gateway to digital commerce, particularly with:

Affordable data packages

Competitive mobile brands

Improved mobile broadband speeds

This widespread connectivity has brought online shopping to both urban centers and remote regions, expanding the national consumer base. With mobile phones serving as the primary shopping tool, retailers are now optimizing their apps, mobile interfaces, and one-click checkout features to keep pace with rising demand.

2. Growth of Digital Payment Solutions

Digital payment adoption is accelerating across South Africa, creating a safer, more efficient environment for online commerce. Consumers increasingly rely on mobile wallets, credit cards, debit cards, and localized fintech apps to complete purchases digitally.

Platforms like PayFast, Ozow, SnapScan, and Zapper have enhanced payment convenience and security. Additionally, the South African Reserve Bank’s Digital Payments Roadmap, aligned with Vision 2025, aims to:

Promote innovation

Enhance interoperability

Improve competition

Strengthen financial inclusion

These initiatives reduce consumer friction and increase trust in online shopping, further fueling e-commerce growth. As more South Africans adopt cashless lifestyles, digital wallets and A2A payments will continue to outpace traditional methods.

3. Changing Consumer Shopping Behavior

Over the past few years, South African consumers have increasingly prioritized convenience, value, and time-saving solutions. Online shopping allows them to:

Browse products anytime

Compare prices instantly

Read verified customer reviews

Receive orders at their doorstep

Post-pandemic habits have reinforced this shift. Consumers now prefer home delivery, curbside pickup, and quick-buy features, while companies tailor personalized shopping journeys using:

AI-driven product recommendations

Influencer-led marketing

Loyalty and rewards programs

As living costs rise, consumers also pursue better deals online, contributing to strong e-commerce penetration across categories like electronics, apparel, groceries, and beauty products.

Challenges Facing the South African E-commerce Market

Despite strong growth, the market faces several obstacles that companies must continue to address.

1. Delivery and Logistics Inefficiencies

Logistics remains one of the biggest barriers to seamless e-commerce expansion. While delivery networks in major urban hubs—Johannesburg, Cape Town, and Durban—are robust, rural areas often face:

Longer delivery times

Higher shipping costs

Infrastructure limitations

Road maintenance issues

These hurdles directly affect customer satisfaction. As the market grows, e-commerce companies must invest in:

Micro-fulfillment centers

Advanced last-mile delivery technologies

Partnerships with private courier networks

Innovations such as drone delivery and gig-economy logistics could play significant roles in the next decade.

2. Online Payment Security Concerns

Although digital payments are growing, many consumers still hesitate due to fears of:

Fraudulent transactions

Data breaches

Phishing scams

Identity theft

Building trust remains critical. Companies must prioritize:

Multi-factor authentication

Encrypted payment gateways

Consumer education campaigns

Transparent security policies

Stronger cybersecurity frameworks will encourage hesitant users to shop online with confidence.

Category Insights

South Africa E-commerce Apparel and Accessories Market

This segment is one of the fastest-growing categories in the digital retail landscape. As disposable incomes rise and consumers seek wider fashion choices, online platforms such as Zando, Superbalist, Takealot, and international brands continue to gain traction.

Key growth drivers include:

Mobile-first shopping trends

Personalized style recommendations

Flexible return policies

Competitive pricing

Social media-driven fashion inspiration

In May 2024, Amazon’s entry into South Africa intensified competition within the apparel and fast-fashion sector. The market is expected to flourish as consumers increasingly use smartphones to explore new styles, compare brands, and purchase clothing online.

South Africa Digital Wallet Market

The digital wallet market is expanding rapidly due to:

Rising smartphone ownership

Improved financial inclusion

Growth in mobile banking

Consumer preference for touchless payments

Apple Pay, Google Pay, SnapScan, and Zapper dominate both online and in-store transactions. As e-commerce and fintech ecosystems mature, digital wallets will continue to shape South Africa’s evolving payment landscape—especially among Gen Z and urban millennials.

South Africa E-commerce Market Segmentation

By Product Categories

Apparel & Accessories

Health, Personal Care & Beauty

Computer & Consumer Electronics

Office Equipment & Supplies

Toys & Hobby

Furniture & Home Furnishing

Books / Music / Video

Other Categories

By Payment Mode

Digital Wallet

Credit Card

Debit Card

Account-to-Account (A2A)

Buy Now Pay Later (BNPL)

Cash on Delivery

Prepay

Other (including Cryptocurrency)

Competitive Landscape

Each major company is evaluated across five key viewpoints:

Overview, Key Persons, Recent Developments, Product Portfolio, and Revenue.

Key Players

Takealot Online (Pty) Ltd.

Evetech (Pty) Ltd.

Jumia

Walmart Inc. (via Massmart)

Zando

SoFresh

Decathlon

UCook

These companies are investing in logistics hubs, AI-driven retail solutions, on-demand delivery, subscription-based shopping, and omnichannel strategies to stay ahead of intensifying competition.

Final Thoughts

South Africa’s e-commerce market is poised for a decade of strong, technology-driven evolution. With its value set to rise from US$ 35.23 billion in 2024 to US$ 74.79 billion by 2033, the sector reflects a broader shift toward digital-first consumption.

Improved internet access, a thriving mobile economy, innovative payment solutions, and the changing expectations of modern consumers all contribute to this impressive momentum. However, addressing challenges in logistics infrastructure and cybersecurity will be crucial to unlocking the market’s full potential.

As global and local players expand their footprints, South Africa is well-positioned to emerge as a leading e-commerce powerhouse—not just in Africa, but across the global digital economy.