This post was originally published on this site.

-

Principal Financial Group recently reported full-year 2025 results showing revenue of US$15,625.5 million and net income of US$1,185.1 million, alongside fourth-quarter adjusted earnings per share of US$2.19 on revenue of US$4.46 billion.

-

In tandem with these results, the company boosted its first-quarter 2026 dividend to US$0.80 per share and returned over US$1.5 billion to shareholders in 2025 through dividends and share repurchases.

-

We’ll now examine how Principal Financial Group’s higher dividend and sizable 2025 capital returns reshape the company’s broader investment narrative for investors.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

To own Principal Financial Group, you have to believe in its ability to keep turning a diversified retirement, asset management, and insurance franchise into consistent cash returns, even as markets stay choppy and fee-based revenue feels pressure. The latest results and higher dividend do not remove the key short term risk around net cash outflows from institutional clients, but they do reinforce the near term catalyst of disciplined capital returns as a core part of the story.

The most relevant announcement here is the 7% year over year dividend increase to US$0.80 per share for the first quarter of 2026, alongside over US$1.5 billion returned in 2025 via dividends and buybacks. For investors focused on income and capital return, this links directly to the main catalyst of cost control and capital deployment, while still sitting against the backdrop of market driven revenue and margin pressures in retirement and asset management.

Yet even with rising dividends and buybacks, the risk that ongoing institutional outflows could pressure fee revenue is something investors should be aware of and…

Read the full narrative on Principal Financial Group (it’s free!)

Principal Financial Group’s narrative projects $18.8 billion revenue and $2.2 billion earnings by 2028. This requires 7.5% yearly revenue growth and a $1.1 billion earnings increase from $1.1 billion today.

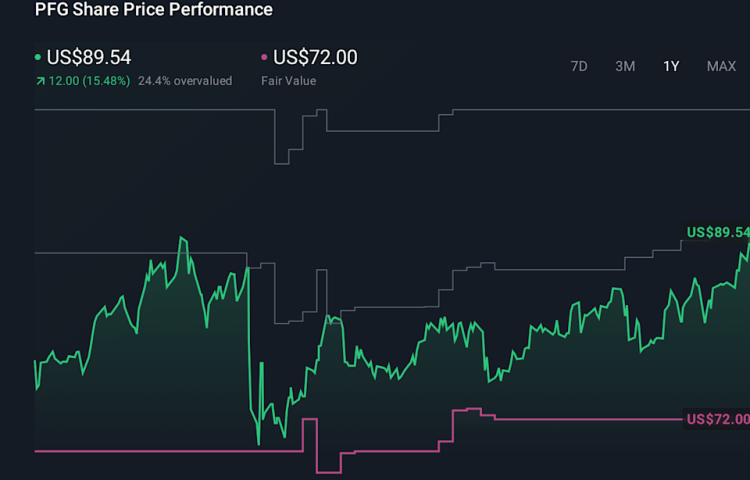

Uncover how Principal Financial Group’s forecasts yield a $92.91 fair value, in line with its current price.

Before this news, the most pessimistic analysts were assuming only about 1.5 percent annual revenue growth to roughly US$16.5 billion and a much lower future valuation multiple, which is a very different story to the cost control and earnings resilience you might focus on today; it is worth comparing these cooler expectations with the latest results to see whether your own view sits closer to that cautious camp or somewhere more optimistic.

Explore 3 other fair value estimates on Principal Financial Group – why the stock might be a potential multi-bagger!

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your Principal Financial Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

-

Our free Principal Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Principal Financial Group’s overall financial health at a glance.

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include PFG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com