This post was originally published on this site.

Saudi Arabia E-Commerce Market Overview

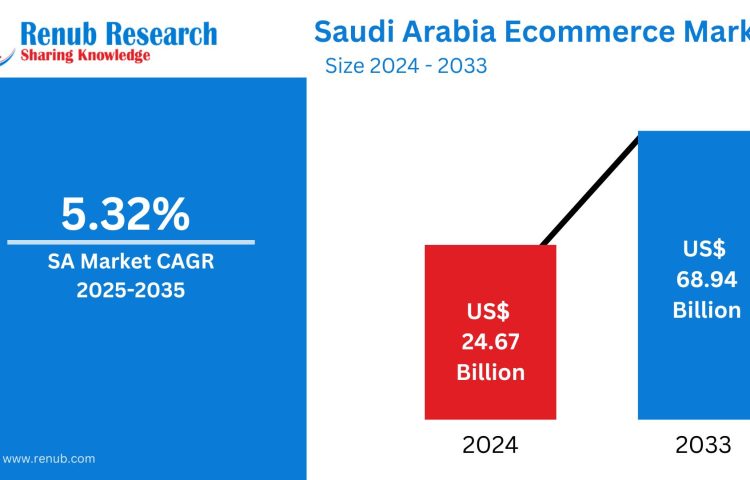

The Saudi Arabia eCommerce market has emerged as one of the fastest-growing digital retail ecosystems in the Middle East. Valued at US$ 24.67 billion in 2024, the market is projected to expand at a compound annual growth rate (CAGR) of 12.10% between 2025 and 2033, reaching an estimated US$ 68.94 billion by 2033, according to Renub Research.

This rapid growth reflects a fundamental shift in how Saudi consumers and businesses purchase goods and services. Rising internet penetration, near-universal smartphone adoption, expanding logistics infrastructure, and strong government backing under Vision 2030 have transformed eCommerce from a convenience into a mainstream retail channel.

From global giants like Amazon and Alibaba to regional platforms such as Noon and Namshi, the Saudi digital marketplace now offers everything from electronics and fashion to groceries, digital services, and B2B procurement solutions. As consumer trust improves and payment ecosystems mature, eCommerce is set to play a defining role in the Kingdom’s non-oil economic diversification.

What Is E-Commerce and Why It Matters in Saudi Arabia

E-commerce refers to the buying and selling of goods and services through online platforms, including retail websites, mobile apps, digital marketplaces, and business-to-business (B2B) portals. Transactions range from everyday consumer purchases to wholesale trade, bill payments, subscriptions, and digital content delivery.

In Saudi Arabia, eCommerce adoption has accelerated due to:

High-speed internet access

Widespread smartphone usage

A digitally fluent youth population

Government-backed fintech and logistics reforms

These elements have reshaped consumer expectations, making online shopping a preferred option for speed, variety, and convenience.

Saudi Arabia E-Commerce Market Growth Drivers

1. Rising Internet and Smartphone Penetration

Saudi Arabia boasts one of the highest internet penetration rates in the Middle East, supported by advanced telecom infrastructure and nationwide mobile coverage. Smartphones are deeply embedded in daily life, enabling seamless access to mobile shopping apps, digital wallets, and online marketplaces.

As mobile-first commerce expands, consumers increasingly prefer shopping through apps rather than traditional retail outlets. The government’s push toward a fully digital economy has further encouraged businesses—both large and small—to establish robust online storefronts.

2. A Young, Tech-Savvy Population

Saudi Arabia’s demographic structure strongly favors eCommerce growth. With a population exceeding 36 million and an average age of around 30, the Kingdom has one of the youngest populations globally. Approximately 25% of citizens fall within the 18–24 age group, a segment highly engaged with digital platforms.

According to the Communications, Space & Technology Commission (CST), nearly 52.3% of the population spends more than seven hours per day online. This high digital engagement translates directly into online shopping behavior, social commerce participation, and digital brand loyalty.

3. Vision 2030 and Government Support

The Saudi government’s Vision 2030 initiative is a cornerstone of the country’s eCommerce expansion. By prioritizing digital transformation, fintech innovation, and logistics modernization, Vision 2030 has created a supportive regulatory and operational environment for online retail.

Key policy outcomes include:

Promotion of cashless transactions

Expansion of secure digital payment systems

Enhanced consumer protection regulations

Investments in logistics hubs and smart warehouses

According to CST data, 63.7% of internet users in Saudi Arabia purchased goods or services online in 2023, with women accounting for 74.6% of these transactions—highlighting both high adoption and inclusive growth.

Despite this momentum, eCommerce currently represents only around 18% of total retail sales, indicating substantial untapped potential during the forecast period.

4. Growth of Digital Payments and Fintech Ecosystem

The increasing adoption of digital payment platforms such as Mada, STC Pay, Apple Pay, and Google Pay has significantly improved transaction convenience and security. Consumers now enjoy faster checkout experiences, fraud protection, and flexible payment options.

In 2024, Mastercard launched a new domestic eCommerce processing infrastructure in Saudi Arabia, strengthening transaction security and efficiency. Additionally, Saudi fintech firm Barq partnered with Mastercard Gateway to deliver customized payment solutions for merchants and consumers, further accelerating trust in digital commerce.

Challenges Facing the Saudi Arabia E-Commerce Market

Logistics and Last-Mile Delivery Constraints

Despite rapid progress, logistics and last-mile delivery remain ongoing challenges. Saudi Arabia’s vast geography and remote regions can lead to delivery delays and higher shipping costs.

While major cities such as Riyadh, Jeddah, and Dammam benefit from advanced logistics networks, rural and less-developed areas still face infrastructure gaps. Addressing these disparities is essential to ensure nationwide eCommerce accessibility and customer satisfaction.

Consumer Trust and Payment Security Concerns

Although digital payments are expanding, a segment of consumers still prefers cash on delivery due to concerns over cybersecurity, fraud, and data privacy. Continued education, stronger regulatory oversight, and transparent payment systems are critical to overcoming these trust barriers.

As secure payment gateways and consumer protection frameworks evolve, confidence in online transactions is expected to improve steadily.

Saudi Arabia B2C E-Commerce Market

The Business-to-Consumer (B2C) eCommerce segment dominates Saudi Arabia’s digital retail landscape. Growth is driven by strong demand for:

Electronics and gadgets

Fashion and apparel

Beauty and personal care

Groceries and food delivery

Platforms such as Amazon Saudi Arabia, Noon, Namshi, and Carrefour offer personalized recommendations, loyalty programs, and same-day or next-day delivery, enhancing customer engagement.

The integration of AI-driven personalization, promotional campaigns, and seamless mobile payments continues to strengthen B2C adoption, making it the most dynamic segment of the Saudi eCommerce market.

Saudi Arabia B2B E-Commerce Market

The B2B eCommerce segment is gaining momentum as businesses digitize procurement and supply chain operations. Companies increasingly rely on online platforms to source raw materials, wholesale goods, and industrial equipment efficiently.

Cloud-based marketplaces, automated inventory systems, and digital invoicing solutions are streamlining B2B transactions across sectors such as construction, manufacturing, healthcare, and retail.

In a significant development, Amazon Saudi Arabia doubled its warehouse capacity in 2023 by opening a 2.7-million-cubic-foot fulfillment center in Riyadh, capable of storing over 9 million products—a move that strengthens both B2C and B2B logistics capabilities.

Saudi Arabia E-Commerce Market Segmentation

By Type

B2C E-Commerce

B2B E-Commerce

Key Players in the Saudi Arabia E-Commerce Market

Renub Research analyzes leading companies from four perspectives—overview, key persons, recent developments, and revenue performance.

Major Market Participants Include:

Amazon.com Inc.

eBay Inc.

Noon

Alibaba Group

Namshi (Emaar Properties)

Jarir Marketing (Bookstore)

Carrefour

These players continue to invest in logistics, localized offerings, Arabic-language platforms, and customer experience innovations to capture long-term market share.

Future Outlook: Saudi Arabia E-Commerce Market

Looking ahead, Saudi Arabia’s eCommerce market is poised for sustained expansion through 2033, driven by digital inclusion, logistics investments, fintech innovation, and evolving consumer preferences.

As Vision 2030 initiatives mature and online retail penetration deepens beyond urban centers, eCommerce will become a central pillar of the Kingdom’s retail and services economy. The convergence of technology, policy support, and consumer readiness positions Saudi Arabia as a regional leader in digital commerce transformation.

Final Thoughts

The Saudi Arabia eCommerce market is no longer an emerging segment—it is a strategic engine of economic diversification. With market size projected to nearly triple by 2033, businesses that invest early in digital platforms, secure payments, and efficient logistics stand to benefit the most.

As trust grows and innovation accelerates, eCommerce will continue reshaping how Saudis shop, sell, and connect in an increasingly digital future.