This post was originally published on this site.

-

Prudential Financial reported past fourth-quarter 2025 results showing net income of US$905 million versus a prior-year loss, alongside full-year net income of US$3.58 billion and a higher quarterly dividend of US$1.40 per share.

-

At the same time, Prudential of Japan is halting new sales for 90 days to address employee misconduct and governance issues, putting more attention on how its international operations support the group’s long-term positioning.

-

We’ll now examine how the mixed earnings performance, alongside the Japan sales suspension, shapes Prudential Financial’s broader investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

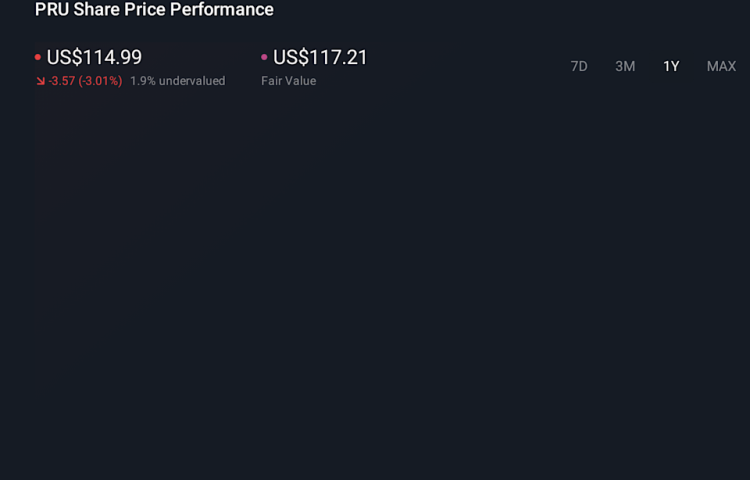

For Prudential Financial, the core belief for shareholders is that a large, diversified insurer and asset manager can translate steady, if unspectacular, growth into consistent cash returns through dividends and buybacks. The latest results reinforce that story on the surface: net income improved year-on-year and the dividend was lifted to US$1.40 per share, while the stock still trades at a discount to both analyst and community fair value estimates. Short term, the key catalysts remain execution in U.S. businesses, capital return, and how effectively the relatively new management team beds in. The 90 day sales halt in Japan adds a fresh operational and reputational risk in one of Prudential’s important markets, and could temper how investors think about growth and governance, even if current earnings impact proves limited.

Despite retreating, Prudential Financial’s shares might still be trading above their fair value and there could be some more downside. Discover how much.

The Simply Wall St Community’s four fair value estimates span roughly US$92.86 to a very large US$244.30 per share, underlining how differently investors can view Prudential’s prospects. Set that against the Japan misconduct issues and leadership changes, and you have a business where the long term story is intact but the near term execution risks really deserve closer attention.

Explore 4 other fair value estimates on Prudential Financial – why the stock might be worth 9% less than the current price!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include PRU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com