This post was originally published on this site.

Investors are severely underestimating the technology giant’s profit potential.

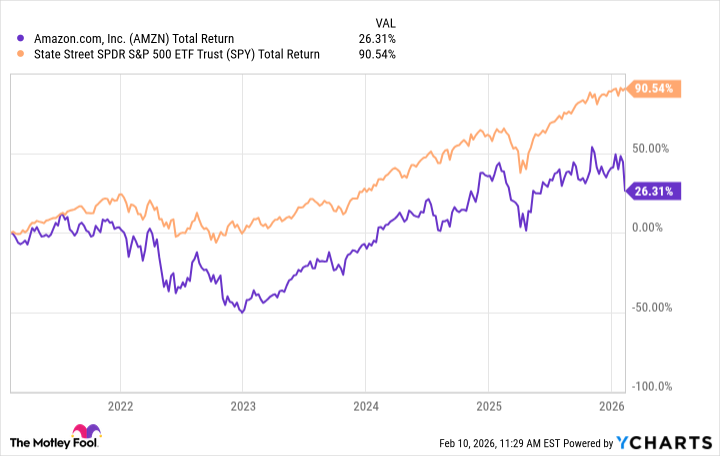

Amazon (AMZN 0.39%) is one of the best-performing stocks of the 21st century. But over the last five years, it has severely underperformed the S&P 500 index, with shares up just 26.3% vs. over 90% returns for the broad market index.

The stock fell yet again after reporting fourth-quarter earnings on Feb. 5, trading around $200 for the first time since the April 2025 tariff tantrum. Wall Street seemed disappointed by the earnings report, but I think they are focusing too much on short-term noise and underestimating the technology giant’s long-term growth potential.

Here’s why this recent stock drop will help fuel further gains for Amazon shareholders through 2026 and beyond.

Image source: Amazon.

Steady e-commerce margin expansion

Investors are focused on artificial intelligence (AI) right now, but Amazon still has another gigantic business with its e-commerce and retail operations. North American sales grew 10% year over year last quarter, reaching $426 billion for all of 2025.

More importantly, profit margins for North American commerce have steadily expanded, reaching a record 9% last quarter and 6.9% for 2025. Fast growth in high-margin advertising and subscription services has led Amazon’s North American retail business to grow to close to $30 billion in operating earnings last year.

With steady growth and continued margin expansion, earnings should grow even more strongly in 2026 and beyond. For example, a 10% operating margin on $500 billion in revenue equals $50 billion in operating income, which is well within reach within the next two to three years.

Today’s Change

(-0.39%) $-0.78

Current Price

$198.82

Key Data Points

Market Cap

$2.1T

Day’s Range

$197.28 – $201.16

52wk Range

$161.38 – $258.60

Volume

3.1M

Avg Vol

47M

Gross Margin

50.29%

Huge potential in AI infrastructure spending

Amazon’s fastest-growing segment is Amazon Web Services (AWS), its cloud infrastructure business. AI spending is helping the entire segment see accelerating revenue growth, which should continue in 2026.

Management plans to spend $200 billion on capital expenditures in 2026, primarily on AWS investments. This is going to hurt short-term free-cash-flow generation but will lead to sustained revenue growth for AWS over the next few years.

AWS revenue grew 24% year over year last quarter. Total sales were $129 billion in 2025. If 24% revenue growth can be maintained over the next three years — as these huge capital investments suggest will happen — then AWS revenue will grow to close to $250 billion. With segment profit margins sustainably over 30%, this would yield $75 billion in operating earnings from AWS alone.

Data by YCharts.

Why now is the time to buy Amazon stock

Investors are worried about short-term cash-flow hits and Amazon’s ability to keep investing in AI growth. However, this is missing the big picture and its profit-generating potential over the next three years.

If AWS can grow to this $75 billion earnings figure while North American retail grows to $50 billion, that is $125 billion in combined operating earnings. Sprinkle in some earnings from the international retail business — which now has over $150 billion in revenue — and consolidated earnings may reach $150 billion in the next few years.

Today, Amazon has a market cap of $2.2 trillion, which would give it an earnings ratio of under 15 based on these earnings estimates. This makes Amazon stock cheap today and a nice buy for investors through 2026 and beyond.