This post was originally published on this site.

Make better investment decisions with Simply Wall St’s easy, visual tools that give you a competitive edge.

-

Pinnacle Financial Partners (NYSE:PNFP) CFO recently purchased additional company shares in an insider transaction.

-

The firm has been recognized with a record number of 2026 Best Bank Awards, leading the industry in client satisfaction accolades.

-

These developments highlight both management’s alignment with shareholders and strong client perceptions of the franchise.

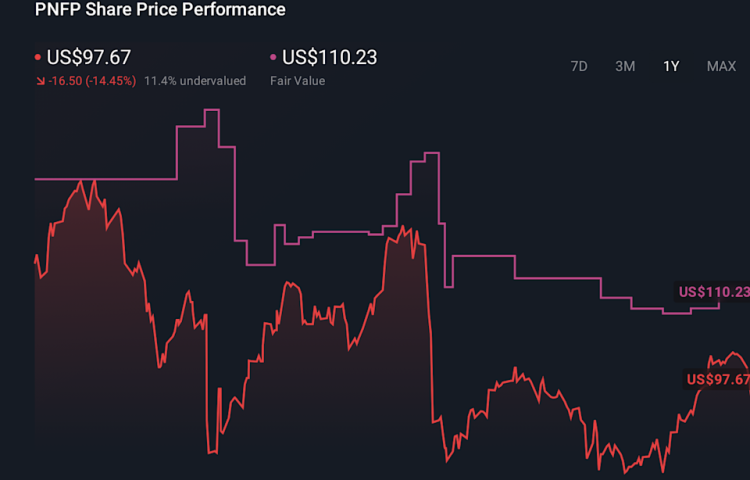

For investors watching NYSE:PNFP, the CFO’s decision to buy more stock at around $96.13 puts personal capital alongside shareholders. The move comes as the bank is coming off a 3 year return of 27.2% and a 5 year return of 24.6%, while the shares are down 19.0% over the past year. That mix of longer term gains and recent pullback provides context for considering how this latest insider trade might be interpreted.

The record haul of 2026 Best Bank Awards, with Pinnacle receiving more recognition than any other bank, points to strong client satisfaction and service quality. For investors, awards like this can be one more input when assessing how a bank is positioned to compete for deposits, loans, and long term relationships, particularly when viewed alongside insider buying activity.

Stay updated on the most important news stories for Pinnacle Financial Partners by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Pinnacle Financial Partners.

The CFO’s purchase of 1,000 shares is a relatively small trade in dollar terms, but it can still matter for sentiment because it comes from the executive directly responsible for the balance sheet and capital planning. Investors often pay attention when a finance chief adds exposure after a period of share price weakness, as it suggests personal conviction in the business case rather than just compensation grants. Combined with a record 50 Coalition Greenwich 2026 Best Bank Awards, the story here is less about a single transaction and more about signaling: management is committing fresh capital while clients are voting with high satisfaction scores. For a regional bank competing with larger peers such as Truist, Regions Financial and Fifth Third, strong client loyalty and a people-first service model can be an important differentiator, especially when there are questions around net interest margin, efficiency and the Synovus integration.

-

The cluster of Best Bank Awards and insider buying aligns with the narrative that a relationship-focused model in high-growth Southern markets can support ongoing loan and deposit growth.

-

Concerns about a weaker 3.2% net interest margin, higher expense ratios and integration risk could challenge expectations for sustained efficiency gains highlighted in the narrative.

-

The CFO’s incremental share purchase and recent analyst commentary on capital strength are not explicitly addressed in the narrative, yet they may influence how investors judge execution on the Synovus combination.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Pinnacle Financial Partners to help decide what it’s worth to you.

-

⚠️ Analysts have flagged at least one key risk, including prior shareholder dilution, which is important when you see fresh insider buying.

-

⚠️ A 3.2% net interest margin and a weaker efficiency ratio over the last four years raise questions about how much cost and margin pressure the bank can absorb as it integrates Synovus.

-

🎁 Pinnacle has been identified as trading at what is described as a good value and analysts see multiple potential rewards, including strong earnings growth forecasts and a reliable 2.08% dividend.

-

🎁 The 50 Best Bank Awards for 2026 suggest high levels of client satisfaction and loyalty, which can support deposit stickiness and fee opportunities versus other regional banks.

From here, you may want to watch whether insider buying at Pinnacle becomes a pattern, not just a one-off trade by the CFO, and how the market reacts to management commentary at events like the KBW 2026 Winter Financial Services Conference. The key questions are whether client satisfaction translates into stable or growing deposits, whether net interest margin and efficiency metrics show progress and how smoothly the Synovus integration proceeds. Comparisons with other regionals on credit quality, capital levels and operating costs will also help you judge whether this mix of insider confidence and awards is reflected in the share price.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for Pinnacle Financial Partners, head to the community page for Pinnacle Financial Partners to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include PNFP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com