This post was originally published on this site.

Aatrey and Kumar together hold a 16.2% stake in the company, according to its IPO prospectus. Based on the current trading price, their combined holding is valued at more than Rs 12,190 crore. Both sold 1.6 crore shares each, realising about Rs 178 crore from the offer for sale component of the issue.

Elevation Capital, Meesho’s single largest shareholder, now holds an 11.9% stake after the IPO, valued at nearly Rs 8,950 crore, giving it a 53-fold paper gain on its investment.

Also Read: On listing day, Vidit Aatrey says Meesho’s journey to Dalal Street has been surreal

Peak XV Partners, another early backer, which currently owns 11.4% of the company, has shares valued at Rs 8,514 crore, a 38-time return on paper.

Y Combinator, which has also emerged as one of the biggest gainers, is sitting on a stake worth Rs 721 crore.

Shareholders who did not participate in the OFS are also sitting on significant gains. The stake of Dutch investor Prosus, which holds 51.9 crore shares, is valued at over Rs 8,371 crore.

The stock opened at Rs 161.2 apiece on the BSE, a 45% premium to its issue price, giving Meesho a market capitalisation of around Rs 77,600 crore.

The IPO, which was subscribed over 81 times, raised Rs 4,250 crore through a fresh issue. It also had an OFS component of 10.5 crore shares.

At the listing ceremony, Aatrey said the investors believed in the idea of Meesho when most people did not understand the company’s mission. “Ringing the bell today means that our mission at Meesho is now everyone’s. It earlier belonged only to the 2,000 people at Meesho and the investors, but not anymore,” the CEO said.

Elevation’s Arora also lauded the founders at the ceremony, and Meesho’s ability to bring ecommerce to the masses. “Recently, someone asked me if India has 280 million annual transacting users, and Meesho has 200 million of them, where is the headroom for growth? I explained to them that India has 280 million annual transacting users because of Meesho,” he said.

Financials

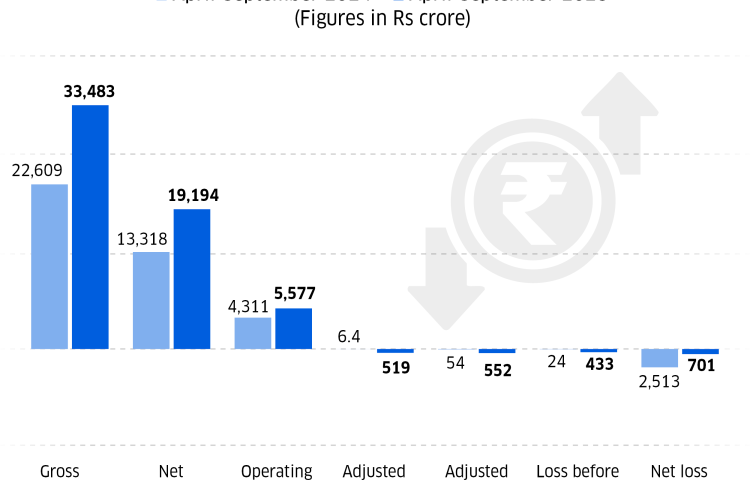

The company reported operating revenue of Rs 5,577 crore in the first half of FY26, up from Rs 4,311 crore a year earlier. Its net loss during this period narrowed sharply to Rs 700 crore from Rs 2,512 crore. For FY25, its operating revene was up 23% to Rs 9,390 crore. However, it posted a net loss of Rs 3,942 crore, mainly due to a one-off tax hit shifting its corporate domicile from the US to India.

In comparison, the company’s net loss in FY24 stood at Rs 328 crore, with an increase in tax expense that year linked to business restructuring.