This post was originally published on this site.

Get insights on thousands of stocks from the global community of over 7 million individual investors at Simply Wall St.

-

Large merchants, including Walmart, are seeking oral arguments in a long running settlement dispute over card interchange fees with Mastercard and Visa.

-

The case focuses on how much merchants pay to accept Mastercard and Visa cards, with potential implications for future fee structures.

-

Separately, Mastercard has partnered with Truist Financial to use Mastercard open finance technology for secure, user controlled open banking connectivity.

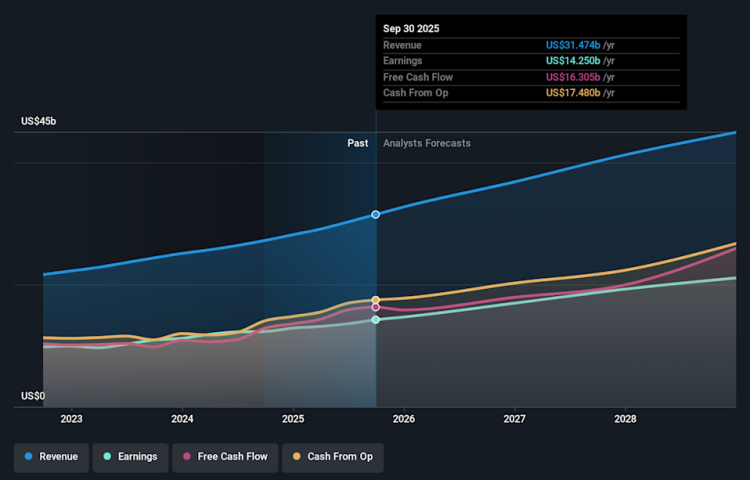

Mastercard (NYSE: MA) is in the spotlight as it balances legal pressure from major retailers with product development in open banking. The stock last closed at $518.36, with returns of 46.1% over 3 years and 60.1% over 5 years, while showing declines over the past week, month, year, and year to date. For investors, that mix of longer term gains and more recent weakness provides context for assessing how these developments might affect sentiment.

The interchange dispute could influence how Mastercard structures merchant fees and manages relationships with large retailers, while the Truist partnership highlights how it is positioning its open finance tools for banks and their customers. For investors, key considerations include how any legal outcomes might affect profitability levers and how open banking solutions fit within Mastercard broader services mix.

Stay updated on the most important news stories for Mastercard by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Mastercard.

The two developments pull Mastercard in different directions. On one side, large merchants pushing for oral arguments on the interchange settlement keep regulatory and pricing pressure front and center. Any outcome that constrains credit card fees or gives merchants more power to steer transactions could influence how Mastercard, Visa and peers like American Express share economics with retailers over time. On the other side, Truist choosing Mastercard as its first direct open banking integration shows how the company is trying to build new revenue streams around data connectivity, security and consent management for banks and fintech apps. That kind of API based, tokenized access can deepen Mastercard’s role in how account data moves, not just how card payments settle, which is where it already competes strongly across global networks.

-

The Truist open banking deal supports the narrative that Mastercard is pushing further into value added services such as data, cybersecurity and API connectivity, broadening its ecosystem beyond card transactions.

-

The long running interchange dispute highlights the regulatory and pricing pressures mentioned in the narrative as potential risks to growth and earnings sustainability.

-

The merchant litigation around card economics and steering rights is a specific legal development that is not fully reflected in the broader narrative about competition from real time payment systems.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Mastercard to help decide what it’s worth to you.

-

⚠️ Interchange fee litigation keeps regulatory and legal risk elevated, which could affect pricing power with merchants over time.

-

⚠️ Greater data connectivity through open banking may increase operational and cybersecurity responsibilities, with reputational risk if there are service or security issues.

-

🎁 The Truist open banking integration signals demand from large banks for Mastercard’s value added services, which can diversify revenue beyond core card processing.

-

🎁 Deeper roles in open finance can strengthen Mastercard’s position versus networks and alternative rails that are also courting banks and fintechs.

From here, you may want to track how the court handles merchant calls for oral arguments and whether any eventual settlement terms change fee structures or card acceptance rules in a way that weighs on Mastercard’s economics relative to Visa and American Express. On the Truist side, the key questions are whether other banks adopt Mastercard’s open finance platform, how broad the fintech connections become, and whether the company reports any traction metrics around usage. Together, those developments will help show how much pressure comes from card fee regulation compared with the potential from newer data and services businesses.

To stay informed on how the latest news impacts the investment narrative for Mastercard, head to the community page for Mastercard to follow the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include MA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com