This post was originally published on this site.

Market snapshot

- ASX 200: +0.4% to 8,596 points (live updates below)

- Australian dollar: flat at 65.43 US cents

- S&P 500: -0.5% to 6,812 points

- Nasdaq: -0.4% to 23,275 points

- FTSE: -0.2% to 9,702 points

- Eurostoxx: -0.2% to 575 points

- Spot gold: +0.1% to $US4,234/ounce

- Brent crude: +1.5% at $US63.33/barrel

- Iron ore: -0.3% to $US106.60/tonne

- Bitcoin: +0.3% at $US86,753

Prices current at around 10:25am AEDT

Live updates on the major ASX indices:

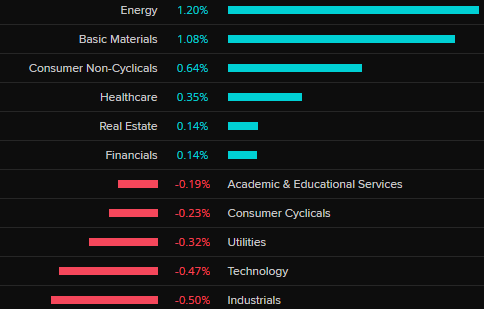

Resources stocks lead ASX higher

The local share market is hanging onto its early gains, with 108 of the top 200 stocks on the rise at the moment.

Here’s how the sectors are faring:

Here are the best performing stocks so far, dominated by resources names:

- South32 +2.7%

- Lynas Rare Earths +2.6%

- Sandfire Resources +2.1%

- Beach Energy +2.1%

- Karoon Energy +2.1%

And it’s a bit of a mixed bag for the worst performers:

- Zip Co -7.9%

- DroneShield -5.9%

- Catapult Sports _5.8%

- Guzman Y Gomez -4.6%

- West African Resources -2.4%

Shares in ASX Ltd are down again after yesterday’s glitch (-0.6%).

Data centre-related stocks had been making gains after a government announcement, accepting demands from the sector to pause ‘mandatory guardrails’ for AI and rely instead on existing technology frameworks.

But they’ve come off their highs and it’s more of a mixed picture now:

- NextDC +1.1%

- Goodman Group +0.7%

- Macquarie Technology -0.5%

- DigiCo Infrastructure REIT -1.2%

- Megaport -0.1%

ASX on the rise in early trade

1h agoMon 1 Dec 2025 at 10:58pm

How much super do you need to retire?

It’s a question a lot of people ask themselves, and there’s quite a few different answers.

Obviously it depends entirely on how you want to retire. European river cruises don’t come cheap, after all!

But if you aren’t planning on a first-class, globetrotting retirement, then Super Consumers Australia (SCA) estimates that a single person can retire comfortably on $322,000.

That is assuming they own their own home, which seems like it will become an increasingly big if as home ownership rates drop from more than two-thirds.

For a couple who own their own home, the figure is $432,000.

This is not enough to keep you off the age pension, in fact SCA say that these levels of super savings will see your retirement about 70% funded by government payments.

Then again, even a couple with $1.2 million saved at age 65 will still draw about a third of their retirement income from the age pension, which does make you question the premise for all the big super tax breaks about taking pressure off the budget…

Unlike some of the other retirement savings estimates, SCA’s figures are based on what retirees actually spend, not what they think they might like to spend.

“We calculated the housing and non-housing spending of homeowners from the ABS Household Expenditure Survey. This is a survey of what everyday Australians spend across different income levels,” SCA notes.

“In our 2025 survey, 90% of retirees who own their home said they were satisfied or neutral about their financial situation, reinforcing that actual spending data is a reliable benchmark to help you understand what you might spend once you retire.”

The $432,000 figure is based on what the typical couple spends in retirement, the $1.2 million figure is based on what people in the top third spend.

SCA assumes you need savings to get you through to 90 years of age, after which you’d fall back onto the age pension.

‘Gentle density’ could unlock a million new homes: CEDA

Australia could unlock about a million new homes if just one in four standalone dwellings in major cities were developed into dual occupancies, according to a report.

Public policy think tank the Committee for Economic Development of Australia (CEDA) and urban consultancy firm Urbis found that, if governments increased so-called “gentle density” in the middle rings of the five biggest cities, Australia could increase its housing stock by 9 per cent.

Gentle or modest density would include the development of terraces, townhouses, low-rise apartments and dual occupancy in well-located and serviced areas.

The report argued that the current debate has largely focused on “the extreme ends of the housing supply spectrum — high-density inner-city developments or new ‘masterplanned’ communities in sprawling outer suburban or regional areas” — while overlooking the potential of medium-density housing.

Here are the details from business reporter Samuel Yang:

1h agoMon 1 Dec 2025 at 10:42pm

ASX retreated for first time in six sessions on Monday

Before local trade gets underway in less than 20 minutes time, catch up on how we got here with finance presenter Alan Kohler.

As he explains, Monday’s retreat was the first in six sessions.

Loading…

Morningstar downgrades ASX Ltd but still sees stock as undervalued

Before the dust had settled on yesterday’s ASX company announcement glitch, analysts at Morningstar were taking the knife to their price target on the stock.

“The failure follows a series of operating failures in recent years, which have drawn regulator scrutiny,” the analysts noted.

“We think [Monday’s] failure is likely to extend the period of regulator scrutiny, which we would otherwise expect to gradually subside from here.

“We therefore expect the exchange to refrain from price increases in the near future and spend more on its infrastructure than it would otherwise, to placate market participants and regulators.”

Morningstar now puts its fair-value estimate for ASX Limited shares at $73 per share, a 5% downgrade, and lowered its forecast for near-term earnings.

However, the analysts still see the stock as “materially undervalued”, given it closed at $56.58 on Monday, “as the market appears to believe the current issues are likely to continue indefinitely”.

“We expect the exchange’s long-term competitive environment to be stable, given the relatively insignificant impact of occasional failures and the limited benefit from introducing competition, given such failures are inherent in any place employing and computers,” Morningstar’s note read.

Crypto rout continues as Bitcoin’s ‘last useful business’ gets Tethered

After a brief pause, the recent rout in cryptocurrencies has resumed.

As I write, Bitcoin is down 5.2% to $US86,456.

NAB’s Rodrigo Catril says the fresh ratchet lower is reported to be due to margin calls on ‘leveraged’ Bitcoin holdings — i.e. those funded using debt.

“Bloomberg noted that nearly $1 billion of leveraged crypto positions were liquidated during a sharp drop in prices on Monday while Bitcoin fell over 8% and Ether was down ~10%,” he notes.

“Leverage positions are seemingly being unwound with some volume with Cryto market enduring over a week long sell-off.”

With his usual impeccable timing, my colleague Ian Verrender has nailed down and explained some of the key factors behind the latest crypto sell-down in this excellent analysis.

Japanese bond sell-off hits global markets

Wall Street fell modestly overnight, which isn’t surprising given its strong run-up last week.

The trigger for the sell-down, other than some profit taking, was a speech by Japan’s central bank governor, which raised fears of a December rate hike.

“Ahead of the BoJ [Bank of Japan] meeting on December 18-19, yesterday governor Ueda gave a speech to leaders on Nagoya and although, as it is often the case, the governor noted pros and cons of raising policy interest, the market was left with a sense that a December hike is now strong possibility,” notes NAB’s senior FX strategist Rodrigo Catril.

“Perhaps what got the market going was Ueda’s comments that any hike would merely be an adjustment to the degree of easing.

“The yen gained following the comments and 2-year government bond yields increased above 1.0%. This is the highest level since 2008 and reflects increased expectations for a hike.

“The market is pricing 22bp [basis points] of tightening for the December meeting, compared with 15bp at the end of last week.”

Those fears of higher rates — in Japan’s case a rise from 0.5 to 0.75%, compared to Australia’s 3.6% cash rate — saw the Nikkei dive 1.9% yesterday.

Wall Street’s 0.4% fall was modest in comparison, but some analysts warn it could just be the beginning, if Japanese money starts to return home as rates increase.

A sell-off in Japanese bonds saw yields on them rise above 1% for two-year maturities, for the first time since the global financial crisis, and a fresh multi-decade high near 1.87% for 10-year bonds.

Swissquote Bank’s Ipek Ozkardeskaya says the flow-on to global markets comes from the massive amount Japanese investors have parked offshore during the ultra-low rate period, including around $US1.2 trillion in US Treasuries.

“Around $US3.4 trillion circulates in global markets from Japanese investors seeking higher returns abroad — capital that could simply be repatriated as domestic yields rise,” she warns.

ASX says company announcements back to normal

Yesterday was not a good day for the stock exchange operator, and not only in terms of its share price falling nearly 3%.

A glitch saw the ASX unable to publish company announcements for several hours on Monday, resulting in dozens of stocks being placed in trading halts as price-sensitive updates couldn’t be published.

In an update on its website on Tuesday morning, the ASX said “all announcements are processing as expected today”.

It also confirmed that all price-sensitive announcements lodged on Monday have been “successfully submitted and published”, but said firms that had non price-sensitive announcements lodged between 8:49am and 11:22am AEDT yesterday should confirm hat their announcements have been published.

“ASX thanks affected issuers who resubmitted their announcements to assist with processing,” the statement on the ASX system status page read.

Professional investors had slammed the ASX glitch, the latest in a litany of problems plaguing the operator in recent years.

Wilson Asset Management lead portfolio manager Matthew Haupt told Kirsten Aiken on The Business it was “very embarrassing” but unlikely to have caused losses for investors.

Loading…

2h agoMon 1 Dec 2025 at 9:46pm

Market snapshot

- ASX 200 futures: +0.1% to 8,589 points

- Australian dollar: -0.1% to 65.40 US cents

- S&P 500: -0.5% to 6,812 points

- Nasdaq: -0.4% to 23,275 points

- FTSE: -0.2% to 9,702 points

- Eurostoxx: -0.2% to 575 points

- Spot gold: +0.1% to $US4,233/ounce

- Brent crude: +1.4% at $US63.27/barrel

- Iron ore: -0.3% to $US106.60/tonne

- Bitcoin: -5.2% at $US86,438

Prices current at around 8:45am AEDT

Live updates on the major ASX indices:

Wall Street slides as Bitcoin tumbles

Good morning and welcome to Tuesday on the markets blog, I’ll be with you for the first few hours.

Wall Street has just settled and it wasn’t a good start to December for the major US indices — the Dow shed more than 400 points or 0.9% while the S&P 500 and Nasdaq had more modest losses.

Global bond yields rose overnight, led by a spike in Japanese yields yesterday, alongside the Yen.

The price of Bitcoin continued to slide, falling below $US86,000 at one point.

Locally, ASX futures are pointing 0.1% higher, so we’ll have to see if there’s a slight bounce back from yesterday’s drop when shares open for trade at 10am AEDT.

The stock exchange operator says it’s business as usual on company announcements after yesterday’s disruption.

Stick with us!

Loading