This post was originally published on this site.

Feb. 3 (Asia Today) — South Korean banks are shifting their corporate lending strategies toward small and medium-sized enterprises, reflecting the Lee Jae-myung administration’s push for “productive finance” aimed at supporting innovative and growth-oriented companies.

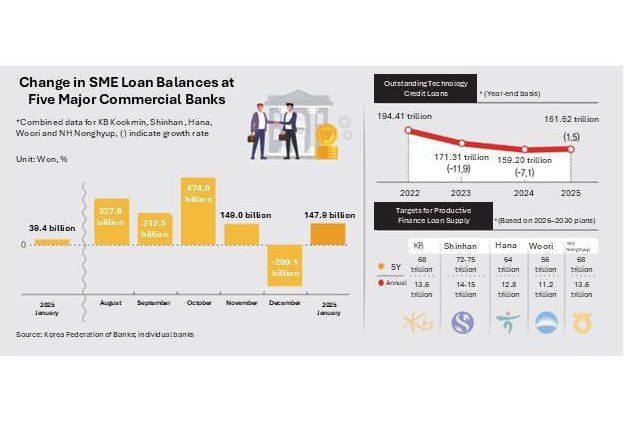

Although overall corporate lending growth among the country’s five major commercial banks slowed in January compared with a year earlier, loans to SMEs surged nearly fourfold, offsetting a sharp pullback in lending to large corporations.

According to the financial sector, the combined corporate loan balance of KB Kookmin Bank, Shinhan Bank, Hana Bank, Woori Bank and NH Nonghyup Bank stood at 847.35 trillion won (about $627 billion) at the end of January, up 2.63 trillion won (about $1.9 billion) from the previous month.

While the five banks’ corporate loan balances fell by 4.74 trillion won (about $3.5 billion) at the end of last year, they returned to growth at the start of 2026. However, the pace was significantly slower than a year earlier, when January lending rose by 5.10 trillion won (about $3.8 billion).

Beneath the headline figures, SME lending expanded sharply. Loans to small and medium-sized firms rose by 1.48 trillion won (about $1.1 billion) in January, compared with an increase of just 394.1 billion won (about $290 million) a year earlier.

By contrast, lending to large corporations slowed dramatically, rising only 1.15 trillion won (about $850 million) compared with a 4.71 trillion won increase (about $3.5 billion) in January last year. Analysts said major companies are increasingly relying on bond issuance and alternative financing instead of high-interest bank loans.

The surge in SME lending reflects banks’ efforts to align with the government’s productive finance policy, which prioritizes funding for advanced strategic industries and innovative firms. Major banks have reportedly set corporate loan growth targets of 5.5% to 6.5% this year, with a larger share allocated to SMEs with technological strength and growth potential.

“We are lowering lending thresholds for companies in high-tech and innovative sectors, even if their credit ratings or collateral are somewhat weaker,” a commercial bank official said. “Competition among banks to attract high-potential firms is intensifying.”

The policy shift has also revived technology-based credit loans, which use a company’s technological capabilities rather than physical collateral as the basis for lending. Outstanding technology credit loan balances at the five major banks reached 161.63 trillion won (about $120 billion) at the end of last year, marking the first increase in three years.

Banks had previously been cautious about such loans due to high risk weights and relatively low profitability, but balances rebounded as benchmark interest rates began to ease and eligibility criteria expanded.

The upward trend is expected to continue this year as banks actively deploy technology credit loans to channel funds into productive sectors. Several institutions are upgrading their evaluation systems. KB Kookmin Bank began incorporating non-financial indicators such as technological competitiveness into corporate credit screening last September, while NH Nonghyup Bank introduced an automated technology credit assessment system using generative artificial intelligence in December.

Financial authorities are expected to announce additional measures to promote technology finance in the first half of the year.

Medium-term lending is also set to expand. South Korea’s five major financial groups plan to inject a combined 430 trillion won (about $318 billion) into productive finance initiatives, implying annual corporate loan supply of more than 50 trillion won (about $37 billion). Funding will focus on advanced industries such as semiconductors and artificial intelligence, as well as promising startups.

Shin Yong-sang, a senior research fellow at the Korea Institute of Finance, said the policy must be designed for long-term sustainability.

“For productive finance to become a lasting financial framework rather than a temporary campaign, institutional support is essential,” he said. “Building specialized evaluation systems for early-stage venture investment is key to creating a virtuous cycle.”

— Reported by Asia Today; translated by UPI

© Asia Today. Unauthorized reproduction or redistribution prohibited.

Original Korean report: https://www.asiatoday.co.kr/kn/view.php?key=20260204010001218