This post was originally published on this site.

Today new KFS contributor Jonas Plaut debuts the first of his four-part series ahead of the deadline, laying the groundwork for how and why the front office is likely to handle the next five weeks.

Good morning! I hope the new year has started off as well as can be expected for everyone reading this. The Knicks are back home tonight facing off against the Hawks at 7:30. Hart and Shamet remain out but Mitchell Robinson is questionable. For the Hawks, Trae Young is questionable.

I’m incredibly excited to debut a new series today, courtesy of longtime Substacker Jonas Plaut. While members of the Stack are no doubt familiar with Jonas, he is the man behind The Cap Crunch, a free newsletter dedicated to making the complicated world of the NBA salary cap easy to discern while also contextualizing those pesky balance sheets so we can understand why all this stuff matters so much to begin with. It is the finest writing on NBA cap/apron mechanics that I’ve read, and I’m honored to share some of his work here. If you love the league and want to think about it like a front office executive, I’d strongly recommend subscribing. It won’t cost you a dime.

Speaking of which, I’m unlocking today’s edition for all subscribers, just because I wouldn’t want anyone to miss this. I hope you enjoy.

Knicks Trade Deadline Deep Dive, Part I

by Jonas Plaut

Overview

The Trade Deadline is one of the clearest roster-building inflection points on the NBA calendar. It marks the last moment for months that contenders can buy and that sellers can sell. The Trade Deadline is a transaction period where intentions become clear: certain organizations attempt to declare themselves as contenders, others turn toward a rebuild, and still others stand pat. And, standing out amid this Trade Deadline landscape is the New York Knicks, a team which is attempting to win its first championship in over 50 years. Under President of Basketball Operations Leon Rose and Head Coach Mike Brown, the Knicks will enter February as a clear playoff team and legitimate championship contender. And yet, the Knicks not only face unresolved questions about how aggressive they should be at the Deadline, but what that aggression should look like.

This analysis will be the first installment in a Knicks Trade Deadline series that will dive in-depth into the team’s options and decision-making pathways. It will serve as an overview, breaking down New York’s league standing, financial position, and the strategic (albeit potentially uncomfortable) questions the Front Office faces as the Trade Deadline approaches. Utilizing roster-building strategy and the Cap as its primary lens, this analysis will place particular focus upon the tension between present contention and future financial and roster-building flexibility. Each is an undercurrent that could very much exert an impact upon the Knicks Front Office’s Trade Deadline plans.

Finally, this will not be a traditional “New York Knicks 2025-26 Trade Deadline Overview” that views the upcoming deadline as “quiet,” that lists out the team’s needs and asset collection, and that then makes “predictable” forecasts. Instead, I take a less traditional approach by describing how the upcoming Trade Deadline for the Knicks could fit into the organization’s larger team building plans, could prove to be an inflection point, and therefore could have an outsized impact on the future of the team.

The Finances

Financial Snapshot

The Knicks currently have the 2nd highest Team Salary in the NBA at $208M. New York sits $148K below the 2nd Apron and $11.7M over the 1st Apron, placing the organization in one of the most restrictive operating bands in the league. Additionally, as it currently stands, the team faces a $45.6M projected Luxury Tax payment.

Having used the Taxpayer Mid-Level Exception (TMLE) on Guerschon Yabusele during the offseason, the team is hard-capped at the 2nd Apron. This means that the team is completely restricted from crossing this financial threshold. The Knicks currently have 14 contracts on the books (which is one below the maximum allowable amount of 15) and have all three Two-Way slots filled (not illustrated in the Cap Sheet above). There are certain other noteworthy details: there are no Unlikely Incentives on the books; the team has already used its applicable signing exception (the TMLE) this past summer and does not currently have access to the Bi-Annual Exception, and the Knicks lack any Traded Player Exceptions (TPEs).

Regarding extension eligibility for players of note, Mitchell Robinson is eligible for an extension this season as he is a Free Agent in the upcoming offseason. Additionally, Deuce McBride became extension eligible on December 30th.

Overall, the Knicks’ Cap Sheet is relatively top-heavy, with the core five players occupying the five largest salary slots. This creates a challenging dynamic when it comes to constructing trades, as the most easily movable salary is limited in size. Resultantly, the effective tradable salary pool is compressed, which, in turn, narrows the market of realistic trade targets.

Looking Ahead: 2026–27 and Beyond

Projecting forward to 2026–27, New York currently has approximately $207M in guaranteed salary, sitting $5.6M above the Luxury Tax, $2.9M above the 1st Apron, and $15.6M under the 2nd Apron. This figure presumes nine standard contracts; however, it notably excludes a potential Robinson contract (who will be a UFA), potential draft picks made by the organization in the 2026 Draft, and a fully filled out roster that meets roster compliance.

To the Front Office’s credit, the Knicks have consistently shown a masterful ability to toe the Apron thresholds while still leaving enough room to complete the roster. The Cap planning and roster maneuvering required to do so at various points has been extremely precise, almost virtuosic. As things stand entering the Trade Deadline, the 2025–26 financial situation is relatively straightforward since the salary slots that the organization will predominantly be working with were already created during the offseason. However, next year is where things could become tricky regarding Apron status (which will be explained in a section below).

Relevant Trade Mechanics at the Deadline

From a roster-building perspective, since the team sits above the 1st Apron, there is a list of roster-building tools to which the team does not have access. For New York, arguably the most relevant one is that it cannot take back more than 100% of the salary it sends out in a trade. This elevates the importance of salary slots and aggregation mechanics.

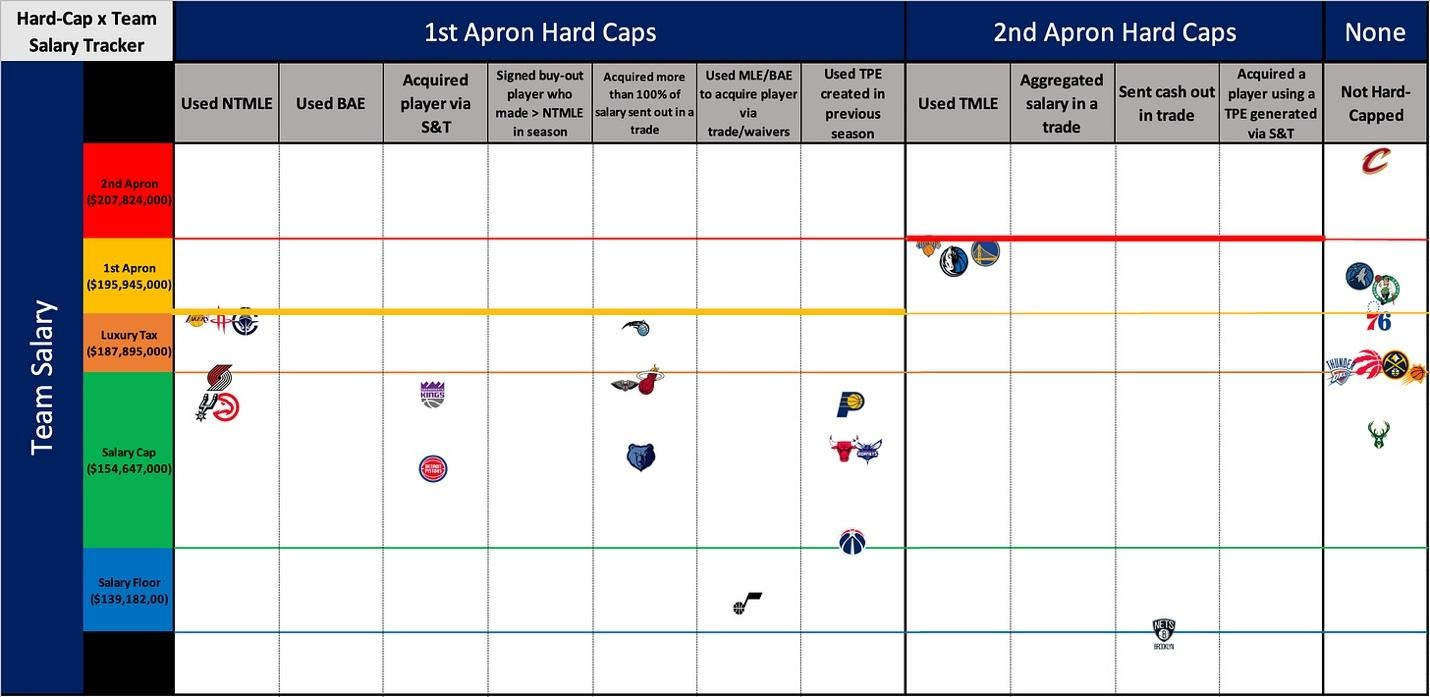

Because the Knicks are still below the 2nd Apron, the team retains the ability to aggregate multiple contracts in trades, a critical distinction that preserves at least a degree of deal-making flexibility. Where New York falls on the broader Hard-Cap landscape underscores just how thin the margin for error is, as illustrated below in a Hard-Cap Map.

Future Financial Situation Impacting Present Planning

It is easy to get caught up in trade ideas focused solely upon improving the Knicks’ immediate championship odds. However, the upcoming Trade Deadline, and the moves made or not made, comprise part of a larger, multi-year Cap puzzle and therefore cannot be viewed in isolation. That said, one of the relevant financial points for the Knicks is the degree of the team’s willingness, or lack thereof, to enter 2nd Apron territory. The Knicks Front Office has done a great job of navigating the Aprons over the past few years despite having an expensive roster. Be that as it may, next year, if the roster and main core remains as currently constructed, the team’s financial maneuvering might become significantly more complicated. With that in mind, I first want to touch upon the concept of a 2nd Apron window.

In NBA discourse, a team’s “window” is usually portrayed as a single on-court concept tied to roster quality and championship odds. In practice, however, there are two distinct but interrelated windows at play: an on-court window and a financial one. The on-court window is inherently uncertain and probabilistic, shaped by health and variance in player development in ways no Front Office can fully control. The financial window, by contrast, is rigid and rule-based. Entering the 2nd Apron is a deliberate, time-bound structural decision with clearly defined consequences. The risk is that once a team crosses into the 2nd Apron, these two windows stop moving independently. Financial restrictions begin to constrain a team’s ability to respond to on-court volatility, stripping away roster-building tools and, more importantly, adaptability. When injuries, underperformance, or variance arise, the mechanisms available to a team to react are severely limited. Under the new CBA, this loss of optionality is the central risk of a 2nd Apron window. It is therefore a risk that Front Offices must account for well before the window actually opens. In my opinion, an ideal window is no longer than two seasons: long enough to maximize a mature core, but short enough to avoid triggering the most punitive downstream effects.

Understanding the 2nd Apron to be both a window and a threshold reframes how teams that cross it should be evaluated. The question is no longer simply whether an organization is willing to spend, but whether it has designed a timeline that could survive the constraints that it knowingly accepted. While the ultimate success is measured by championships, the more immediate question is whether an organization has maintained control over its timeline, preserved paths back to flexibility, and prevented short-term conviction from hardening into long-term constraint. These factors are essential for understanding how teams navigate the structural pressures of the 2nd Apron and how those choices, in turn, shape their pursuit of a title.

How does this apply to the Knicks? If the Front Office is willing to enter the 2nd Apron next season, this decision could fundamentally reshape its Trade Deadline calculus. Further, this transaction window would effectively represent the last meaningful opportunity for the Front Office to deploy its full roster-building toolkit before severe restrictions set in. In that scenario, it could make sense for the Knicks to solidify the roster now, whether by targeting players with Full Bird Rights on expiring deals or by accepting additional guaranteed money attached to terms that extend beyond this season. However, this approach carries real risk. Cleveland’s recent experience serves as a cautionary tale: a franchise that maximized its final window of flexibility, doubled down on an expensive core, and now finds itself with limited mechanisms to course-correct amid uncertainty. Once a team lives above the 2nd Apron, workable salary, trade leverage, and structural flexibility quickly evaporate.

The question raised by Cleveland therefore becomes: is this outcome a warning sign for other organizations? If yes, how does that reality shape New York’s approach to the upcoming Trade Deadline? These questions sit at the heart of the Knicks’ decision-making and, therefore, of my analysis (both now and forthcoming). Additionally, since the Knicks Front Office has worked so hard to stay under the 2nd Apron over the last two years to maintain a degree of flexibility, would the team stick to (or abandon) this goal of continuing to keep its options open for potential maneuvering down the line? Further, if the Knicks stay the course, would this, in turn, impact what happens at the Trade Deadline with Mitchell Robinson and Deuce McBride?

What is the Deal with Mitch and Deuce?

It might not be what fans want to hear, but the futures of McBride and Robinson are intertwined with what occurs at the upcoming Trade Deadline. And it is the future of these players (particularly with Mitch since he is out of contract after this season) that best illustrates the potential tension between weighing present contention this season versus future Cap health and construction. Once the Robinson contract decision is made, the Knicks’ Apron trajectory will be locked in.

As previously stated, no singular decision is made in isolation. Every signing, trade, and draft pick carries with it a cascading impact and fits within the Front Office’s greater strategic plan. Front Offices sequence Cap Sheets and embed timelines and windows of opportunity into these plans many years in advance, paying close attention to, among other things, projected finances, Apron thresholds, potential extensions, and financial inflection points. This has been particularly true of the Knicks under Rose and, more specifically, Brock Aller.

What is also true of this Front Office is that it has often chosen to anticipate financial and roster-building decisions. Immanuel Quickley and Julius Randle serve as primary examples. To be blunt, the Knicks have often relied upon a strategy of either extending before Free Agency (often at a number acceptable to the Front Office) or formulating a trade. The primary example of when the Front Office allowed a player to hit the open market is Robinson in 2022. (OG Anunoby was technically heading toward Free Agency but re-signed in an exclusive negotiating window days before it began). As previously discussed, next season, the Knicks will have limited space available to fill out the roster (as currently constructed) while staying under the 2nd Apron. If Robinson were to sign a new contract with the Knicks with the remaining core staying the same (more or less), the team would most likely go over the 2nd Apron. This rounds back to the point about whether this trajectory is the one that the Front Office would want to take.

The questions therefore become: Is Rose willing to let Mitch hit Free Agency and potentially lose him (and his valuable salary slot) for no appreciable gain? If the answer is “no,” would the team look to trade Mitch at the Deadline, or perhaps even extend him? Or is the organization willing to take a course of action that it has often opted against? By this, I mean opting to not make a decision. In other words, would the Knicks kick the can down the road by letting the situation play out, seeing what happens during the rest of the season and playoffs, and then making a decision1. McBride is certainly tied to this conversation. However, since he has one more year left on his deal and provides significant ROI (which is crucial for teams bucking up against the Aprons), McBride’s future will be determined with lesser urgency and will have less resonating significance.

Additional Deadline Questions

Pulling back from the finances, the Aprons, and roster-building strategies, it is important to turn to potential questions that the Front Office might be asking in the lead-up to the Trade Deadline. These questions, and their subsequent answers, will likely dictate the courses of action that the Knicks will pursue. The situation is entirely fluid. Unforeseen developments and events will most certainly impact plans (both positively and negatively) and will present new and/or differing opportunities. That said, below are the main questions that I am keeping in the back of my mind when evaluating potential courses of action.

Tyler Kolek – Is this Real?

Any time a young player that an organization drafts and develops begins to pop, fans take note. One or two good games here and there is usually enough to keep fans hopeful about a player’s future. However, when that player begins to stack good performances and has a substantial impact on the team winning, hope turns into belief. This is what seems to be happening with Tyler Kolek right now. His two-way improvement has been undeniable. When he checks in, his presence and confidence take hold and are palpable. What is impressive is that his contributions are adding up to being what any good team needs. What has become a budding partnership that Kolek has formed with Jordan Clarkson, along with his demonstrated ability to play alongside Brunson (alleviating Brunson of a degree of the pressure of always being a primary ball handler), have been key.

However, the question still needs to be asked: is this real? Not to pour cold water upon the “Kolek-kraze,” but there is a difference between being a regular season performer and someone who can be relied upon in a playoff setting. Leon, Brown, and company must determine if the answer is “yes,” as it will play a role in the team’s Trade Deadline plans. Since Training Camp there has been buzz that the Knicks were looking for more ball-handlers, particularly at the point guard (PG) position. The rumors have continued to circulate in-season, with the team having been heavily linked to Pelicans PG Jose Alvarado. What remains to be determined is: does Kolek’s strong play change the team’s plans? Further, is the answer to this perceived roster-hole internal? If “yes,” this would narrow down the team’s needs, and allow the Front Office to be more focused regarding what type of player profile it will pursue at the Trade Deadline.

Should We Buy the Depth? Position, Archetype, or Best Available?

Using the Kolek question as a springboard: what exactly will the Knicks look for at the Trade Deadline from a player perspective? And is the depth that the Front Office acquired enough to be trusted in the playoffs? There are multiple layers of answers to these questions.

Before McBride’s injury, Brown had been (more or less) playing an 8-man rotation, with spot minutes for players deeper on the bench. With McBride back and Shamet’s return to play on the horizon, the rotation would be bumped up to 10, which Brown has deployed in his past coaching roles (and that’s not even considering Mohammed Diawara and Kevin McCullar Jr, who did not factor into these discussions just a week ago, but may now). That said, when analyzing these 10, there is an imbalance in both general size and positional size. Kolek, McBride, Clarkson, and Shamet are all guards, and if the team gets to a point where all four are healthy at the same time, it will be challenging to find minutes for all of them. Adding Brunson to the calculus further complicates matters as his game time significantly lessens the available minutes pool. And if Knicks are acquiring ANOTHER rotation player at the Trade Deadline, without subtracting anyone from the current rotation, minutes would be further constricted.

However, depth is not negative. Last year, arguably the two deepest teams in the NBA (the Thunder and the Pacers) made the Finals. Each routinely played 9-man (and at certain times 10-man) rotations in the Finals. Additionally (and I hesitate to mention this), another primary factor that must be considered is the likelihood of injury. In last year’s playoffs, injuries determined many a series. The four healthiest rosters (including the Knicks) made the Conference Finals. One can never predict a variable that is fully unpredictable. However, one can try to build out an eco-system that can take a hit. The reality is that if any of the main players goes down, none of the smaller moves that the team might be considering at the Trade Deadline will be able to make up for the loss. That said, getting one more piece in the door might help to absorb part of the potential blow.

Finally, I am sure that certain readers are surprised that the following sentence has not yet appeared in this piece: the Yabusele signing has not gone according to plan. The writing for Yabusele seems to be on the wall. Prior to the Pelicans game, he had fallen out of the rotation, likely due to his play. Perhaps this is also, in part, a result of trying to keep him healthy for trade purposes. It has made the Knicks appear to be slightly thin in the front court. Taking this factor into account, coupled with Kolek potentially checking off the Knicks’ ball-handler box need, are the signs pointing to the direction of the Knicks pursuing a wing or forward, or will the recent emergence of Diawara and McCullar Jr lessen that need? And if “yes,” there are several different profile archetypes that fall within the front court umbrella. If this is the direction the Front Office chooses to go in, it remains to be determined which way the organization will turn. Will it prioritize a specific player that fits in with one of the many styles that this multi-dimensional Knicks team can shift into? A player who will be comfortable receiving DNPs in certain games because of the potential new-found depth. Or will the Front Office try to acquire the best overall player, leaving the rest to be figured out afterwards? These questions will be analyzed in further detail over the coming weeks.

Final Points To Keep In Mind

I want to be upfront. This overview has not touched upon every aspect of the Knicks strategy leading up to the Trade Deadline. Roster-building strategy is inherently complex and multi-layered. There are other factors at play here, and points to be made, such as: who comprises the Knicks core; the team’s ability to aggregate veteran minimum salaries in this time-window; the Knicks draft pick collection; roster spot shenanigans involving pro-rated veteran minimum contracts; and the impact of Apron restrictions. Among others, these points will be addressed and expanded upon in future weeks.

That said, I want to list a series of additional points and factors that are relevant to the Knicks Deadline situation. Starting off this week, we have:

-

If the Knicks are acquiring a player with a lower-tiered salary slot (which the team presumably will be unless something unforeseen occurs), the team is likely acquiring a player with flaws. The fundamental question is what type of profile or archetype is the Front Office looking for? And as a result, what limitations are the Front Office willing to accept and attempt to reinforce with the infrastructure currently in place.

-

The one pick that I do want to mention is the 2026 top-8 protected Washington Wizards 1st, which will likely convert into two 2nd round picks, one of which could end up being pick 31 (the first pick in the 2nd Round). While it is not a 1st round pick, this asset still carries value for multiple reasons. In the 2025 Draft, the Phoenix Suns traded pick 36 and two future 2nds to jump up to get the 31st pick.

-

The last thing that I want to mention is semi-ironic. Over the summer, due to the Knicks’ Cap situation, the team signed Yabusele to a contract worth $185K less than the full TMLE ($5.68M). At the time this was important for the team’s Cap Sheet to fill out the roster elsewhere. Fast forward to now, and the Knicks might need that extra $185K in matching salary given the team’s financial position. Thus, six months later this tiny financial decision could have a greater impact than previously forecasted.

Check back next week for PART II of Jonas Plaut’s Knicks Trade Deadline Deep Dive, and be sure to subscribe today to his free Substack The Cap Crunch.

🏀

“Injustice anywhere is a threat to justice everywhere.”

Macri: reading this, I wondered about recent comments from Mike Brown noting that the Knicks’ medical staff were working with Robinson’s agent regarding his injury management plan. Simply put, does the fact that they’re all working together bode well for the notion that all parties are comfortable kicking said can down the road and working on a new contract in the summer, when Robinson will be an unrestricted free agent?