This post was originally published on this site.

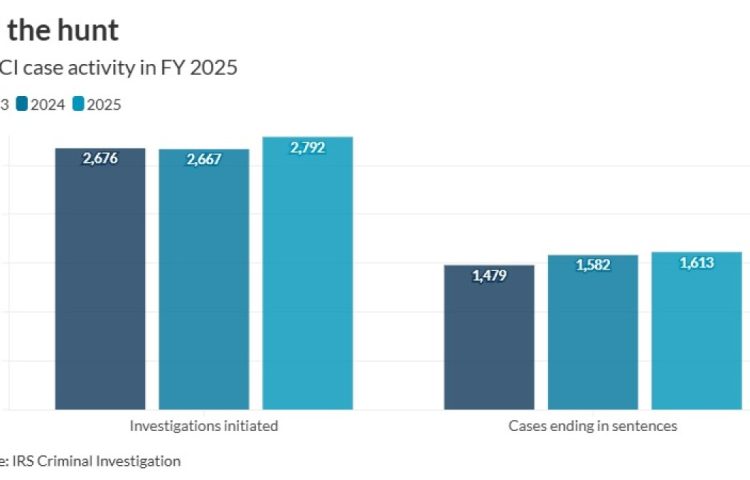

Even as some of its agents were called away to support other federal operations, IRS Criminal Investigation had a banner year in Fiscal 2025, identifying $10.59 billion in financial crimes — almost 16% more than in 2024.

Processing Content

As part of that, according to its Fiscal Year 2025 Annual Report, IRS-CI uncovered $4.5 billion in tax fraud, an astonishing 111.8% more than the year before. It also issued 25% more search warrants, and referred 14% more cases for prosecution by the Department of Justice.

While the unit spent the majority of its time (almost 64%) on tax crimes, it also investigated narcotics-related crime, cybercriminals, and bank fraud, among other areas. Team members played major roles in the federal government’s efforts at policing Washington, D.C., and Memphis, Tennessee, and some also assisted Immigration and Customers Enforcement in their activities this year.

“Our work plays an integral role in shutting down criminal networks that try to exploit government programs and launder funds,” said IRS-CI chief Guy Ficco in a statement Friday. “We continue to evolve — integrating new technological tools, expanding our global partnerships, and streamlining operations — to make it harder for criminals to hide.”

As an example, in 2025 IRS-CI launch CI-FIRST (or Feedback in Response to Strategic Threats), a public-private partnership to improve and streamline interactions between banks and IRS investigators.

Similarly, IRS-CI’s new Optimizing Financial Records Requests initiative, or OFRR, aims to streamline and standardize IRS-CI requests and how financial institutions respond to them.

With all that, the unit also had time to pursue abusive tax preparers, initiating 206 investigations, recommending prosecution in 169 cases, and securing sentencing in 83, with an average sentence of 27 months.

“IRS-CI’s team combines financial expertise with investigative precision to protect taxpayers and hold criminals accountable,” said IRS CEO Frank Bisignano in a statement. “They provide both a tangible return on investment, while providing for the safety and security of American citizens.”

The IRS’s Fiscal Year 2025 ran from Oct. 1, 2024, to Sept. 30, 2025.