This post was originally published on this site.

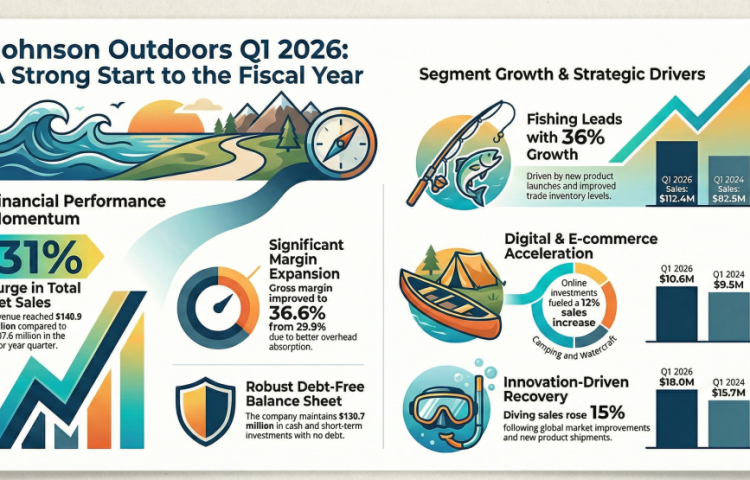

Johnson Outdoors Inc (JOUT.NASDAQ), a Wisconsin-based manufacturer of outdoor recreation products spanning fishing, watercraft, camping, and diving, has entered fiscal 2026 with a renewed emphasis on innovation, digital expansion, and operational efficiency. Management reports stabilization in the outdoor recreation market, alongside strong consumer reception to new products, setting the stage for the upcoming peak selling season.

Strategic Focus: Innovation and Digital Momentum

The company’s leadership outlined a clear strategy centered on product innovation and e-commerce expansion. Innovation is viewed as the engine for sustainable growth, while digital channels are emphasized to meet consumers where they are.

Management highlighted three core priorities for the fiscal year:

- Innovation Pipeline: Sustaining a flow of new, market-preferred products across all segments to maintain competitive advantage.

- Digital Expansion: Growing e-commerce and digital commerce infrastructure to improve consumer accessibility and engagement.

- Operational Efficiency: Continuing cost-reduction and process-optimization initiatives to protect margins amid ongoing supply chain volatility and material cost fluctuations.

Operational Execution and Market Dynamics

Leadership noted that recent performance trends are primarily driven by unit volume growth rather than pricing adjustments, signaling genuine consumer demand. Retail partners are reported to be in healthy inventory positions, having stabilized after prior fluctuations, ensuring readiness for the primary selling season.

The company emphasized that new product launches are increasingly successful, contributing to segment leadership and brand strength. Efforts to optimize internal processes, improve supply chain responsiveness, and enhance inventory management were also highlighted as critical to operational stability.

Segment Highlights and Product Updates

- Fishing: Growth is fueled by the continued popularity of the Humminbird Explore Series and MEGA Live 2 fish finders. Demand for the full line of Minn Kota trolling motors remains strong.

- Diving: The SCUBAPRO Hydros Pro 2 buoyancy control device launched globally, building on an award-winning predecessor with improved fit, comfort, and performance.

- Camping & Watercraft: Jetboil cooking systems continue to exceed expectations, while Old Town remains a market leader. Digital tools have enhanced the discovery and purchase process for kayaks and canoes.

Global Operations and Geographic Considerations

The diving segment shows broad improvement across international markets. However, management noted that profit distribution across geographies introduces complexity in U.S. tax planning, particularly due to the presence of a U.S. valuation allowance on deferred tax assets. This creates a “wonky” environment for projecting long-term effective tax rates until global profit stabilization occurs.

Competitive Positioning and Strategic Risks

Johnson Outdoors operates in a highly competitive landscape, where innovation and brand differentiation are critical to maintaining leadership. Management highlighted risks including:

- Geopolitical Instability: Potential impacts from U.S. trade policies, tariffs, and political shifts in key markets.

- Supply Chain Volatility: Disruptions in raw material sourcing and fluctuating commodity prices.

- Consumer Confidence: Changes in discretionary spending affecting outdoor recreation demand.

The company remains vigilant regarding strategic acquisitions, competitor product introductions, and external disruptions, although no specific M&A activity, credit rating updates, or government schemes were disclosed.

Outlook and Operational Priorities

Without quantitative guidance, management underscored ongoing priorities:

- Maintaining a strong pipeline of consumer-preferred products.

- Expanding digital and e-commerce channels to drive growth.

- Enhancing operational efficiency to safeguard margins and responsiveness.

The company’s leadership reinforced its commitment to sustaining segment leadership, supporting retail partners, and improving consumer engagement across all core areas.

Bottomline

Johnson Outdoors begins fiscal 2026 with a strategy firmly anchored in innovation, digital transformation, and operational execution. Strong unit-volume growth, positive reception of new products, and healthy trade inventory levels set a foundation for the peak selling season. While external risks remain, the company’s focus on product development, digital channels, and efficiency initiatives positions it to maintain brand strength and competitive relevance in a complex global market.