This post was originally published on this site.

Key Takeaways

- Bitcoin at $78,000 is nearing shutdown prices for many mid-tier miners like S19 XP+ and M60S.

- Antminer S21 series rigs could suffer losses if BTC drops to the $69,000–$74,000 range.

- Efficient models like S23 remain profitable even at much lower prices around $44,000.

Bitcoin is trading at $78,489 following a volatile slump, putting miner profitability on a knife’s edge.

If BTC slides further below $69,000–$74,000, mid-tier rigs may reach a tipping point, forcing a wave of shutdowns.

This could reduce network hashrate, trigger difficulty adjustments, and ripple across the broader market.

Try Our Recommended Crypto Exchanges

Sponsored

Disclosure

We sometimes use affiliate links in our content, when clicking on those we might receive a commission at no extra cost to you. By using this website you agree to our terms and conditions and privacy policy.

Antpool Warns of Bitcoin Miner Exodus

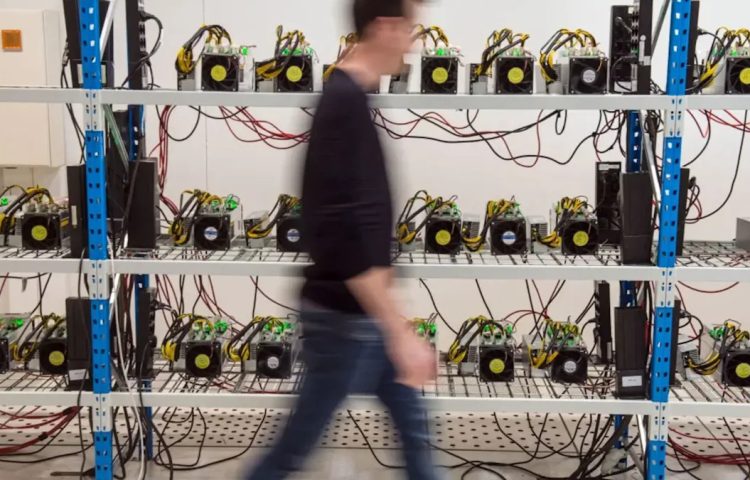

A further slump in Bitcoin’s price could spark a miner exodus, as profit margins shrink.

Recent data from Antpool , a leading Bitcoin mining pool, shows that many popular rigs are operating near their profitability thresholds based on current network difficulty and an assumed electricity cost of $0.08 per kWh.

Bitcoin mining profitability depends on the delicate balance between revenue from block rewards and transaction fees versus operational costs—primarily electricity.

The “shutdown price” is the BTC level where daily operating costs match daily revenue. Below this, miners are better off turning off machines than taking losses.

For instance, if electricity accounts for 22% of a rig’s current revenue, the shutdown price is 22% of Bitcoin’s price.

Older and Mid-Tier Miners Are in Danger

Several older or mid-tier rigs, including Antminer S19 XP+ Hyd, Whatsminer M60S, and Avalon A1466I, are dangerously close to breaking even.

These machines consume more power relative to their output.

At Bitcoin’s current $78,000 level, they generate little to no profit—or may even be operating at a slight loss.

The Antminer S21 series, a significant contributor to global mining hashrate, has shutdown prices between $69,000 and $74,000 per BTC.

A drop of 10–15% from current levels could push many of these rigs offline.

Newer, high-performance rigs like the Antminer U3S23H and S23 Hyd remain profitable even if Bitcoin falls below $44,000, thanks to their superior energy efficiency.

These machines can weather price drops and stay online longer, gaining an advantage over less efficient competitors.

What Happens When Bitcoin Miners Shut Down

When unprofitable machines power down, the overall network hashrate declines.

Bitcoin’s protocol automatically adjusts difficulty downward; the next adjustment, expected around Feb. 8, could reduce difficulty by 14–18%.

This makes mining easier and more profitable for remaining operators.

Short-term, shutdowns can create extra selling pressure as miners liquidate BTC to cover costs.

Over time, however, the network self-corrects, removing weaker players and paving the way for recovery.

Efficient operators with cheap electricity gain market share, while high-cost regions face pressure first.

Shutdown thresholds vary by energy costs: higher where power is expensive, lower where it’s cheap.

Historically, widespread shutdowns signal tough periods but also mark potential market bottoms in Bitcoin cycles.

Top Picks for Bitcoin