This post was originally published on this site.

Never miss an important update on your stock portfolio and cut through the noise. Over 7 million investors trust Simply Wall St to stay informed where it matters for FREE.

-

A class action lawsuit has been filed against Hyatt Hotels Corporation (NYSE:H) alleging violations of California labor laws.

-

The claims focus on meal and rest breaks, overtime pay, wage statements, and reimbursement of business expenses for certain employees.

-

The case centers on staffing levels and work conditions at Hyatt properties in California.

-

The legal action raises questions about Hyatt’s labor practices and related compliance processes.

For you as an investor, this case goes to the heart of how Hyatt runs its hotel operations and manages its workforce. Hyatt, as a major hospitality group, relies heavily on hourly and shift-based staff, so any legal scrutiny of breaks, overtime, and expenses speaks directly to everyday operating practices. Labor issues can quickly ripple into how a brand is perceived by both guests and employees.

Looking ahead, you may want to watch for any updates on the scope of the class, potential settlements, and changes to workplace policies that Hyatt might introduce in response. Even before any resolution, the company could face incremental legal costs and may review staffing models, scheduling tools, and training programs to address the allegations raised in the lawsuit.

Stay updated on the most important news stories for Hyatt Hotels by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Hyatt Hotels.

Why Hyatt Hotels could be great value

-

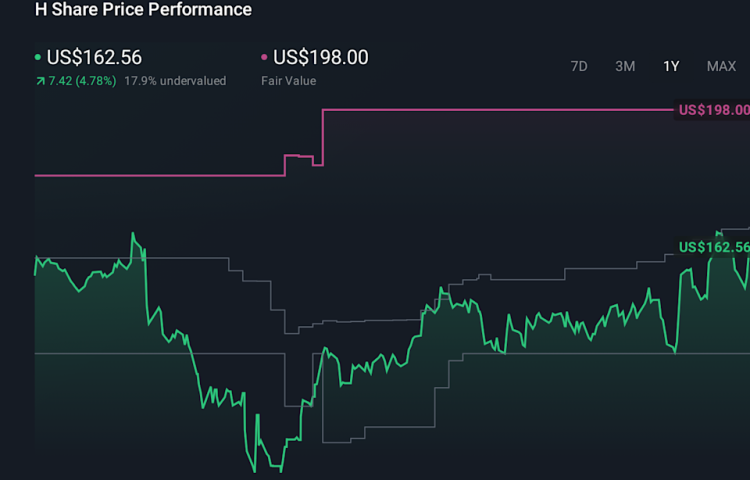

⚖️ Price vs Analyst Target: At US$162.87 versus a consensus target of US$175.91, the price sits about 7% below analyst expectations.

-

❌ Simply Wall St Valuation: Shares are described as trading 195.6% above estimated fair value, which flags a rich valuation.

-

❌ Recent Momentum: The 30 day return of roughly 1.5% decline suggests recent weakness in the share price.

Check out Simply Wall St’s in depth valuation analysis for Hyatt Hotels.

-

📊 This lawsuit puts operating practices and labor compliance under the microscope, which sits right at the core of Hyatt’s hotel model.

-

📊 Keep an eye on any disclosures about legal provisions, margin pressure in California properties, and commentary on staffing or scheduling changes.

-

⚠️ Existing flags such as debt not being well covered by operating cash flow may limit flexibility if legal or compliance costs rise.

For the full picture including more risks and rewards, check out the complete Hyatt Hotels analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include H.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com