This post was originally published on this site.

-

CNO Financial Group reported past fourth-quarter 2025 results with revenue rising to US$1,143.1 million, while net income and earnings per share from continuing operations fell versus a year earlier and missed analyst profit expectations.

-

The combination of stronger sales but weaker profitability and book value per share highlighted pressure on the company’s margins despite higher top-line activity.

-

We’ll now examine how the contrast between robust revenue growth and softer earnings quality could influence CNO Financial Group’s investment narrative.

Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

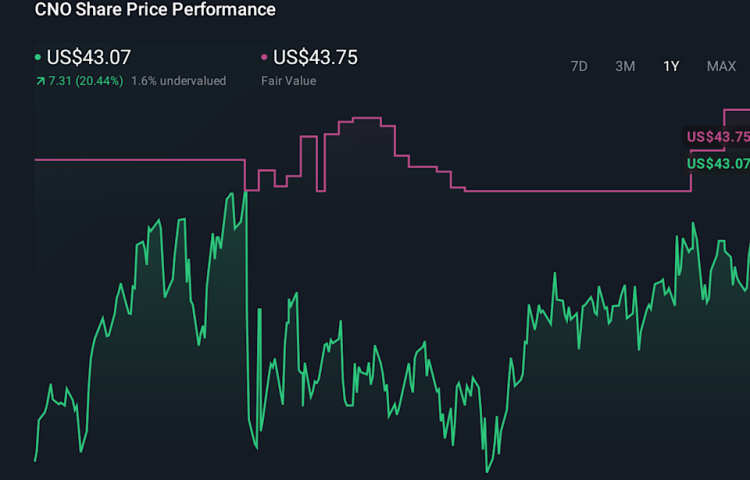

To be comfortable owning CNO Financial Group, you really need to believe in its steady, cash-generating insurance franchise, disciplined capital returns and an experienced, mostly independent board, even if growth is not expected to outpace the broader market. The latest quarter fits awkwardly into that story: revenue surprised positively at US$1,143.1 million, but net income and EPS fell sharply versus last year and missed expectations, raising fresh questions about margin resilience and the quality of earnings growth. In the near term, key catalysts such as buybacks, the dividend and any refinement to earnings guidance now sit against this weaker profitability backdrop, while new board appointments on the risk and investment side may draw extra attention. Given the modest share price reaction so far, the immediate impact looks more about sentiment on earnings quality than a reset of the long term thesis.

Yet behind the higher sales, one profitability risk deserves closer attention from shareholders. CNO Financial Group’s shares have been on the rise but are still potentially undervalued by 43%. Find out what it’s worth.

The Simply Wall St Community’s single fair value estimate clusters at US$47.25, offering one concentrated view of upside. Set that against the recent earnings miss and margin pressure, and it becomes clear why different investors may weigh CNO’s risks and potential very differently.

Explore another fair value estimate on CNO Financial Group – why the stock might be worth as much as 12% more than the current price!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CNO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com