This post was originally published on this site.

-

CNH Industrial recently drew attention ahead of its Q4 2025 earnings release on 17 February 2026, with investors focused on margin trends and the performance of its finance arm, while analysts looked for signals from agriculture and construction equipment demand.

-

Separately, CNH Industrial’s India subsidiary is restarting full-scale tractor exports to the US following tariff reductions under a new India–US trade agreement, backed by a planned ₹1,800 crore investment in new manufacturing capacity that could reshape the company’s export footprint.

-

Next, we’ll examine how the resumed India–US tractor exports might influence CNH Industrial’s longer-term growth narrative and risk profile.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

To own CNH Industrial, you need to be comfortable with a cyclical equipment maker that is trying to defend margins while shifting toward higher value technology and services. The upcoming Q4 2025 results keep margin resilience and the finance arm in focus, and the India export news does not materially change that near term. The biggest risk remains pressure on margins given high leverage and sensitivity in the finance business if credit quality or funding costs worsen.

The India subsidiary’s plan to restart full scale tractor exports to the US, supported by about ₹1,800 crore of new capacity, ties in directly with CNH’s push to grow in emerging markets and diversify away from a pressured North American ag cycle. If successful, this could gradually reduce geographic concentration risk and support future equipment volumes, particularly once dealer inventories normalize and demand recovers from current trough levels.

Yet beneath this diversification push, investors still need to be aware of the company’s exposure to high leverage and the possibility that…

Read the full narrative on CNH Industrial (it’s free!)

CNH Industrial’s narrative projects $18.7 billion revenue and $1.6 billion earnings by 2028.

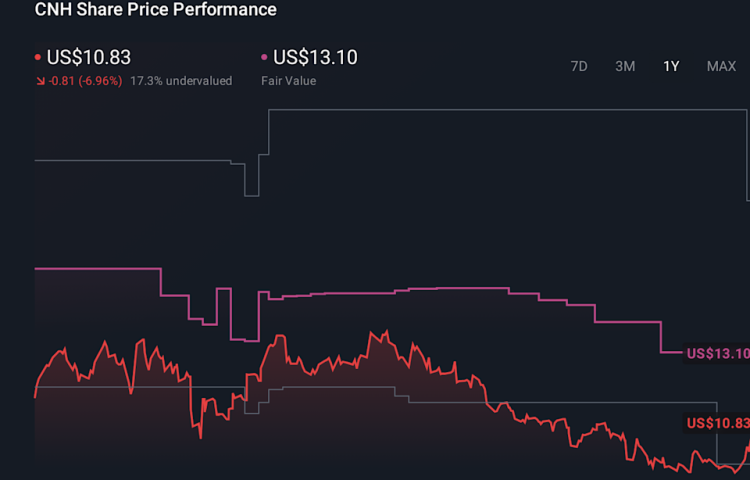

Uncover how CNH Industrial’s forecasts yield a $12.81 fair value, in line with its current price.

Some of the most optimistic analysts were assuming CNH could reach about US$20.1 billion in revenue and US$2.3 billion in earnings by 2028, far above consensus, and they saw India and other emerging markets as a key driver of that story. The new India US export deal could support that view, or it could expose how sensitive those expectations are to trade and regional risks, so it is worth comparing how different these bullish assumptions are from more cautious outlooks.

Explore 6 other fair value estimates on CNH Industrial – why the stock might be worth less than half the current price!

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CNH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com