This post was originally published on this site.

Here’s what investors need to know about the future of the market.

The stock market is an incredible wealth-building machine, but the downturns can be nauseating for even the most seasoned investors.

While prices are still soaring for now, around 80% of Americans are at least somewhat worried about a potential recession, a 2025 survey from financial association MDRT found. Nobody can say for certain whether we’ll face a downturn this year, but history suggests it’s a possibility.

Here’s what you need to know.

Image sources: Getty Images.

What history says about times like these

First, it’s important to note that past performance doesn’t predict future returns. Even with strong historical patterns, today’s stock market is wildly different in many ways from that of even 10 or 20 years ago.

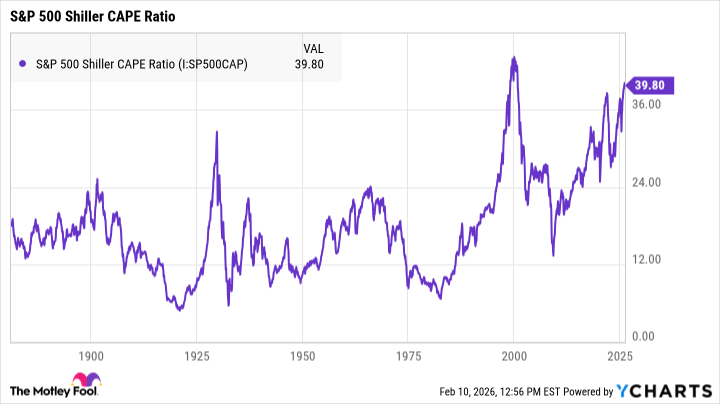

While it’s wise to avoid making major investment decisions based on historical data, this context can help outline your future strategy. And one market indicator to keep in mind is the S&P 500 Shiller CAPE Ratio, or the cyclically adjusted price-to-earnings ratio.

This ratio is calculated by dividing the current price of the S&P 500 (^GSPC +0.05%) by the 10-year moving average of its inflation-adjusted earnings. It’s historically been a strong indicator of market valuations, and a higher ratio suggests the index may experience lower returns over the coming years.

S&P 500 Shiller CAPE Ratio data by YCharts

Its long-term average sits at around 17. It hit an all-time high of around 44 just before the dot-com bubble burst, which triggered one of the longest bear markets in U.S. history. As of this writing, it currently sits at close to 40 — the second-highest figure in history.

What does this mean for you?

While the data suggests that a downturn could be looming, no stock market indicator is 100% accurate. Higher company valuations also complicate metrics like these. The tech industry has fueled unprecedented growth in the last few decades, so it’s normal for valuations to be on the higher side without necessarily being overvalued.

That said, stock prices can’t continue climbing forever, so it’s only a matter of time before we face a downturn of some sort. It may not be a record-breaking recession or crash, but it’s wise to start preparing your portfolio anyway.

Right now, double-check that you’re only investing in quality stocks with long-term growth potential. Weak companies can still experience surging stock prices, but they may struggle to bounce back from a downturn. Healthy companies with solid underlying fundamentals, though, are far more likely to recover from volatility and thrive over time.

Loading up on solid investments is perhaps the most effective way to guard your portfolio against downturns. The more quality stocks you own, the better your chances of surviving even the worst recession, crash, or bear market.