This post was originally published on this site.

- Schiff argues Bitcoin is in a long-term bear market when priced in gold.

- Gold’s rebound above $5,000 has reinforced the narrative shift toward real assets.

- Schiff also criticized U.S. political support for crypto.

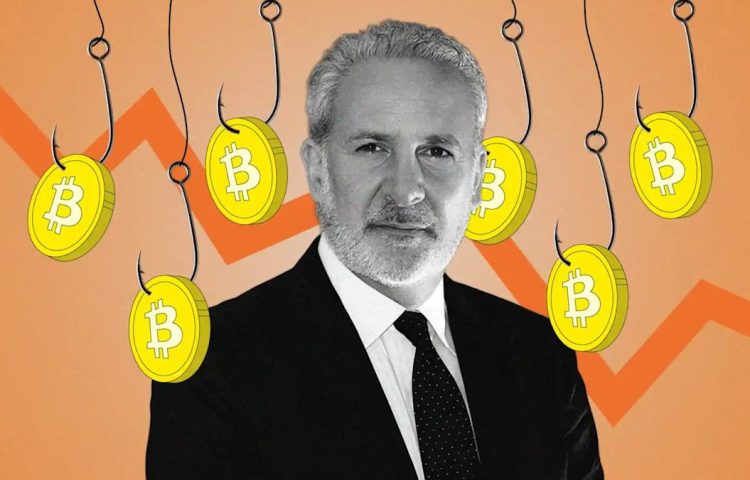

Peter Schiff has renewed the debate over whether Bitcoin has entered a prolonged bear market priced in gold, as Bitcoin’s price continued to plummet and gold rebounded sharply.

Bitcoin critic Schiff also argued that China was “too smart” to get involved with Bitcoin, pushing back on recent comments from President Donald Trump.

Try Our Recommended Crypto Exchanges

Sponsored

Disclosure

We sometimes use affiliate links in our content, when clicking on those we might receive a commission at no extra cost to you. By using this website you agree to our terms and conditions and privacy policy.

Bitcoin Bear Market? Peter Schiff Thinks S0

Schiff pointed to Bitcoin’s performance when priced in gold rather than U.S. dollars, claiming it has entered a bear market.

“That didn’t take long. Gold is already back above $5,000,” Schiff wrote in a post on X on Wednesday.

“Soon those who shorted it last week will be in a lot of trouble. Meanwhile, with Bitcoin below $76,000, it’s now worth 15 ounces of gold, down 59% from its Nov. 2021 high.”

“Bitcoin is in a long-term bear market priced in gold,” he added.

In a follow-up post, Schiff defended his methodology for valuing Bitcoin against the precious metal.

“Well gold is real money, and Bitcoin is supposed to be digital gold,” he wrote. “So pricing it in gold makes the most sense.”

Bitcoin proponents typically measure gains in dollar terms. Schiff, however, has repeatedly argued that gold-adjusted prices offer a clearer picture of purchasing power and long-term value.

Peter Schiff Criticizes U.S. Crypto Push

As well as claiming a Bitcoin bear market, Schiff also used the moment to criticize political support for crypto in the United States, contrasting it with China’s focus on industrial investment and gold accumulation.

“Trump says he believes in crypto and wants to make the U.S. the Bitcoin capital of the world because, if we don’t do it, China will,” Schiff wrote.

“But Chinese leadership is too smart to care about Bitcoin.”

“While we’re wasting capital and resources, they’re building factories and buying gold,” he added.

China has steadily increased its official gold reserves in recent years, while maintaining strict controls on cryptocurrency trading and mining.

On Monday, Trump said : “…I’m a big crypto person. I’m the one that probably helped crypto more than anybody because I believe in it.”

“If we don’t do it, then China is going to do it. Right? If we don’t do crypto, then China is going to do it. And it’s just like AI. We’re leading AI by a lot.

[embedded content]

“And if we weren’t leading, China would have led. They’re very capable. They’re very good.”

Gold Rebounds After Historic Sell-Off

Gold prices rose for a second straight session on Wednesday as investors returned to the metal following one of the sharpest sell-offs in decades, aided by a softer U.S. dollar and renewed demand for defensive assets.

Gold futures climbed more than 3% to trade above $5,100 per troy ounce, while spot prices rose above $5,080, according to market data.

The rebound followed a dramatic pullback late last week after prices briefly surged to a record high near $5,600.

The metal suffered its steepest one-day drop since the early 1980s on Friday, falling more than 9%.

“The path of least resistance for commodities and mining shares is still mostly higher in an environment where investors and central banks globally are actively reallocating capital en masse to real assets due to macro factors … our point? Buy the dip,” analysts at Jefferies told Yahoo Finance.

Top Picks for Bitcoin