This post was originally published on this site.

Embedded finance has evolved beyond a supplementary revenue channel to become the deciding factor between companies that forge lasting customer relationships and those that fall behind, according to new research examining how mid-sized and large firms are deploying financial services within their platforms.

The study, “Embedded Finance as a Strategic Initiative,” conducted by PYMNTS Intelligence in collaboration with Green Dot, surveyed 515 senior leaders across banking, FinTech, HR software, retail and technology sectors. The research reveals that while nearly all companies now offer at least one embedded finance capability, success hinges not on adoption rates but on how firms measure value and select implementation partners.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Key Findings Include:

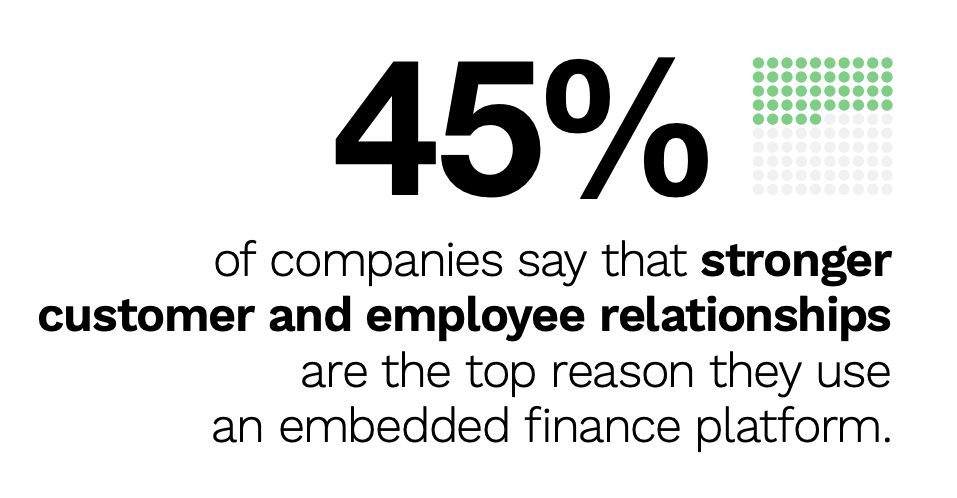

- Nearly 90% of companies cite customer and employee relationships as their primary driver for offering embedded finance, outpacing traditional motivations like new revenue streams or cost savings.

- More than three-quarters of firms plan upgrades within 12 months, with 37% targeting implementation within six months. This urgency signals embedded finance has become a competitive imperative rather than an experimental initiative.

- Among companies not currently offering payroll capabilities, 61% plan to add them. This makes payroll benefits the most sought-after feature, suggesting firms recognize employee financial wellness as a retention and recruitment tool.

The research uncovers a notable disconnect between implementation challenges and overall satisfaction. While 93% of companies report encountering friction in areas like platform transparency, technical integration, compliance and strategic alignment, satisfaction with embedded finance capabilities remains equally high at 93%. This paradox suggests that despite operational hurdles, the business outcomes justify the investment.

Partnership dynamics reveal another layer of strategic thinking. Roughly 70% of companies outsource their embedded finance delivery, with trust and business alignment ranking as the top selection criteria for 88% of firms. Technology and customization capabilities follow at 76%, while value and pricing appear far down the priority list at just 41%. Only 8% of companies identify cost as their primary concern when choosing a provider, underscoring that embedded finance decisions are driven by strategic fit rather than budget constraints.

The study also highlights divergent adoption patterns across industries. FinTech and technology firms lead in embedded payments at 75% and 73% respectively, while HR solutions providers show the strongest uptake of money movement capabilities at 74%. Retailers and technology companies demonstrate particular urgency in their upgrade timelines, with 41% and 40% respectively planning enhancements within six months, compared to the overall average of 37%.

At PYMNTS Intelligence, we work with businesses to uncover insights that fuel intelligent, data-driven discussions on changing customer expectations, a more connected economy and the strategic shifts necessary to achieve outcomes. With rigorous research methodologies and unwavering commitment to objective quality, we offer trusted data to grow your business. As our partner, you’ll have access to our diverse team of PhDs, researchers, data analysts, number crunchers, subject matter veterans and editorial experts.

Advertisement: Scroll to Continue