This post was originally published on this site.

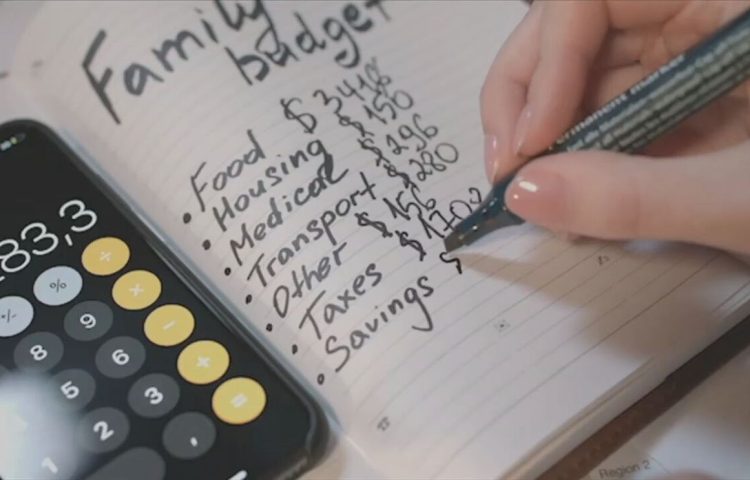

LITTLE ROCK, Ark. (KATV) — As the holiday season wraps up, many are left assessing the financial impact of their festive spending. Financial advisor Justin Travis from Trek Wealth Solutions suggests that creating a budget or spending plan aligned with cash flow can help manage holiday expenses.

“Building a budget or a spending plan that can align with your cash flow. So, you know, okay, if you know, the holidays are tight, as it is for a lot of people this time of year, but we can plan well in advance. Some institutions offer a holiday fund or some kind of holiday savings account, and that can be a great way set up an automatic transfer, you know, $10 $20 $50 whatever it is for your level of spending throughout the year, so that when the holidays come around, you have some money saved,” Travis said.

For those already facing holiday debt, Travis advises taking stock of the situation. “Let’s get a running total of what occurred, and then, okay, well, if, if that’s a problem, where did it happen? Did it come from savings? Did it come from, you know, taking a loan out or putting debt on a credit card, and from there, we’re able to build a plan. Okay, well, if it came from savings, let’s, let’s build a strategy to replenish that savings. If it came from a credit card, well, are we able to manage this credit card debt or loan payment, or is this something we need to look to refinance,” Travis said.

The National Retail Federation estimates that households accumulate over $1,000 in holiday spending debt meaning understanding your financial habits is extremely important. Travis emphasized this notion. “So much of our- the way we think and feel about money, comes from how we were raised, or our past money experiences,” he said.

He also added that it’s never too early or too late to start. “Just like anything else, it’s one step at a time. You can’t look at the end goal and think, ‘Oh, that’s too daunting. How am I ever gonna get that?’ or ‘how am I ever gonna get out of this, this hole that I’m in?’ You’ve got to start. And that again, usually starts with a budget.” Travis said.

Ultimately, the goal is to avoid a cycle of debt that extends into the next holiday season. While money may not buy happiness, maintaining healthy finances can significantly enhance one’s quality of life.