This post was originally published on this site.

It’s about time — and time, after all, is money.

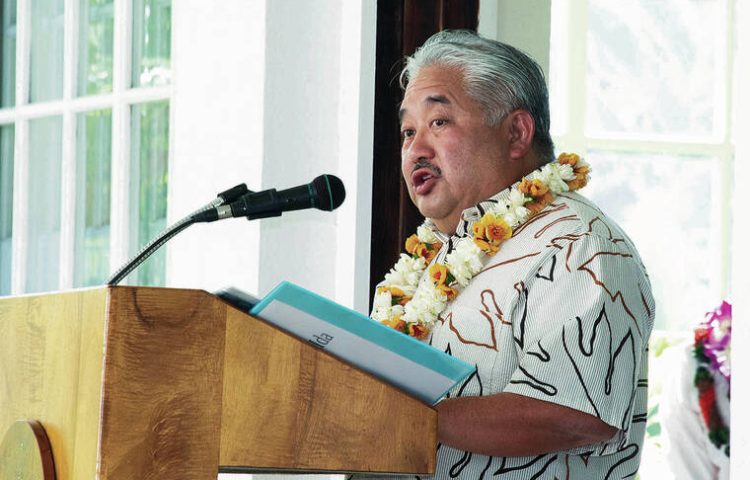

The state Department of Education just announced that it’s making financial literacy a prerequisite for graduation from high school — a move that’s long overdue. The requirement starts this fall with incoming ninth-graders — the Class of 2030 — though it’s good that the DOE is encouraging high schools to nudge financial literacy education for students graduating before then, over the next three years, as part of their “personal transition plan” toward commencement. Such literacy can only benefit every graduate heading into adulthood — so that they’re more able to manage their finances, “make informed decisions, avoid common financial pitfalls, and know where to turn for support,” as DOE Superintendent Keith Hayashi says.

Still, the coursework must be as helpful and impactful as possible, not just a pro-forma check off the pre-graduation box. The DOE’s new program gives the schools flexibility — perhaps too much — in how financial-literacy instruction is delivered. The wide-ranging options: a standalone elective course, integration into existing classes, self-paced learning options, or other designs that align with the DOE program’s standards.

Those standards, based on the National Standards for Personal Finance Education from the Council for Economic Education (CEE) and Jump$tart Coalition for Personal Financial Literacy, aim to prepare Hawaii’s students to be smart consumers. Six major themes are covered: earning income, spending, saving, investing, managing credit and managing risk.

But the looseness of the DOE program’s instructional methods bears scrutiny: some advocates have called for a standalone financial literacy class, rightly so.

A glance of stats on U.S. debt, amid concerns of inflation and affordability of good and services, underscore the need for financial literacy. That pertains as much to students on the cusp of adulthood, as it does to today’s adults already well into the workforce.

Don’t miss out on what’s happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It’s FREE!

As many households struggle with daily necessities and unexpected emergencies, more Americans are taking on credit card debt and holding it longer.

Nearly half of Americans with a credit card carry a balance, with 22% of them worrying that it will never be paid off, according to a new Bankrate survey. Further, 61% who have credit card debt have been in debt for at least one year, a surge from 53% in late 2024.

Indeed, it can be a snowballing decline into financial stress and debt — but it doesn’t have to be. Young people can be taught basic skills that strike the right balance of spending and saving. Having some understanding of monetary terms, managing bank accounts, sensible saving and use of wages, plus investing of money, can make significant differences in life.

As of 2024, 35 states require students to take a course in personal finance to graduate high school, according to CEE, which every two years does a comprehensive look into K–12 economic and financial education in the U.S.

To be useful, financial literacy education must meet the moment — in how today’s youngsters use, and even perceive, money.

For most, gone are the days of writing checks to cover bills, let alone using cash to pay for goods and services. Digital transactions have taken over — think Venmo, Zelle, PayPal and Apple Pay, to name just a few. Think Uber and Lyft for instant transportation. Even ordering and paying for food and drinks are mere clicks away.

It’s easy — too easy — to spend nowadays, without touching dollars or really comprehending the value of money. But while checks may be a thing of the past, basic money management remains a foundational skill for all.

It starts with knowing the difference between a “want” versus a “need.” Budgeting for daily needs such as food, and for recurring bills such as for utilities. Making sense of price growth and higher interest rates in relation to wages, spending and savings. All that helps in making informed decisions about college debt and other big-ticket expenses to come, such as a car and housing, whether it be rent or a mortgage.

Clearly, financial literacy is vital, and DOE must make its new program as effective as possible for students. Ultimately, though, there’s no substitute for leading by example. It’s on the adults at home to show the kids how goals are achieved through budgeting, saving and investing — so that they grow up to do the same.