This post was originally published on this site.

Manufacturing no longer ends at the loading dock—it ends on a doorstep. D2C storefronts push factories to swap pallets for parcels yet still promise two-day delivery and near-perfect inventory accuracy.

Since August 29, 2025, every inbound parcel—even those under $800—faces new tariffs and paperwork, squeezing already-thin margins (Reuters). Meanwhile, 94 percent of 3PL executives call artificial intelligence the most influential technology, up ten points in two years, according to the 2025 Inbound Logistics study. If a partner can’t stream real-time data into your ERP and predict demand, keep searching.

This guide spotlights eight battle-tested partners and platforms that keep product flowing and costs in check.

How we sorted the field

We interviewed 21 operations leaders from mid-market factories and combed through 35 recent RFP scorecards to pinpoint what really matters when a manufacturer adds an e-commerce cart button. Seven filters rose to the top:

- Integration: Your ERP and storefront must sync in real time rather than rely on re-keyed data.

- Visibility: Raw materials at the plant and finished goods at the 3PL should appear on one dashboard.

- Network reach: Two-day ground to at least 90 percent of U.S. customers is the baseline; export options come next.

- Special handling: Bulky parts, kitting, or light assembly require purpose-built equipment, not a generic pick line.

- Speed and reliability: Order accuracy must stay above 99.8 percent, with written SLA credits for misses.

- Cost clarity: Transparent pick-pack and storage fees eliminate month-end surprises.

- Industry experience: Certifications and B2B retail compliance separate manufacturing pros from general-purpose e-commerce vendors.

Rather than cram every provider into one giant chart, we routed them by the first pain point they solve. Need packaging uniformity? Head to the Brand-First lane, where custom packaging and fulfillment services like Zenpack are designed to keep branding, materials, and outbound execution under one system. Shipping 150-pound equipment? The Heavy-Item lane is the home base. This structure lets you ignore partners built for someone else and zero in on the one built for you.

Zenpack: brand-first fulfillment under one roof

Think of your product’s trip from press line to porch. Packaging is the hero of that story, yet most 3PLs treat it last. Zenpack’s logistics service flips the order by designing, testing, and shipping on the same campus.

The company began as a custom-packaging studio, so structural engineers spec boxes that pass ISTA 3A drop standards, UPS’s benchmark for parcel durability, before the first SKU hits the shelf. Because those cartons never leave the building, one team manages structural files, inventory, and pick tickets. Your ERP sees a single node, and planners gain real-time visibility into finished-goods velocity.

Dual-channel logic is built in. Zenpack’s warehouse management system automatically routes pallet orders to a bulk line and D2C orders to a parcel lane, eliminating manual splits. With hubs in San Jose, New York City, and Taipei, you can stage inventory near Asian contract manufacturers while still reaching both U.S. coasts within two days via ground service.

If a box arrives crushed, packaging and fulfillment sit only 50 feet apart to diagnose the root cause, avoiding finger-pointing between vendors. That end-to-end accountability is why we lead with Zenpack when a manufacturer’s first priority is protecting the brand experience.

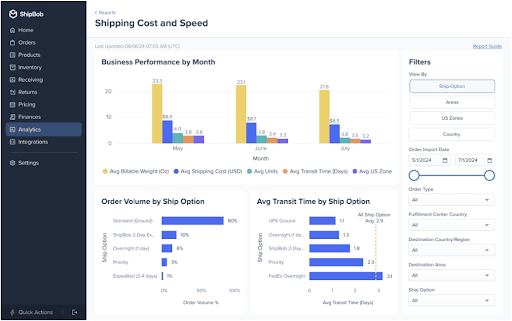

ShipBob: plug-and-play scale for high-volume D2C

When delivery speed drives conversions, ShipBob’s network of more than 60 warehouses across North America, Europe, and Australia puts two-day ground shipping within reach of nearly every customer. Onboarding is just as quick: connect Shopify or your ERP through a native app, map SKUs, and start shipping in about a week, with no extra middleware required.

The numbers are public. ShipBob has processed more than 250 million orders with a 99.97 percent accuracy rate, and 99.6 percent of parcels leave on time. These figures refresh weekly on the company’s public performance dashboard, giving CFOs a link they can bookmark, not just a slide.

Distributed inventory is where the platform really shines. Its algorithm reviews your order history, recommends node splits, and automatically re-balances stock. Brands that follow the model often cut fulfillment costs by 15 percent and trim cart abandonment by more than 20 percent, according to a Semaine Health case study.

ShipBob is not ideal if you ship pallet loads of machinery or require ISO clean rooms, but for small to mid-size manufacturers sending thousands of parcels each month, it offers a turnkey path to Amazon-level service without building your own network.

Red Stag Fulfillment: the heavy-lifter for bulky or high-value SKUs

Forklifts, oversize racks, and eight-point security checks are standard here, not add-ons. Red Stag built its workflow for products most parcel 3PLs avoid, from gym rigs to precision optics.

Every inbound pallet is photo-documented, bar-coded, and stored in bays sized for the load, driving inventory shrinkage to nearly zero. The company backs this with a written promise: mis-ship an order or lose a unit and you receive a fifty-dollar credit, as spelled out in its service guarantee. That accountability shows up in a 99.997 percent order-accuracy record and a mid-70s Net Promoter Score, according to a 2025 industry review by Simpl Fulfillment.

Network reach matches the muscle. Two high-throughput hubs in Knoxville, Tennessee, and Salt Lake City, Utah, sit on opposite sides of the Mississippi River, putting 96 percent of U.S. households within two-day ground service, the same review notes. Application interfaces feed weights and dimensions straight into your ERP, so finance sees true landed costs while customer service tracks every scan event in real time.

If your product fits in a shoebox, keep scrolling. If it ships on a pallet or triggers carrier surcharges, Red Stag removes the anxiety and replaces it with a predictable, guaranteed flow.

Flexe: elastic capacity when forecasts get fuzzy

A flawless forecast can unravel overnight. A viral video, tariff change, or raw-material shortage may spike demand or strand inventory. Flexe turns that volatility into an advantage.

Instead of owning buildings, Flexe operates a digital marketplace that taps into more than 3,000 warehouses across North America. Need two hundred thousand square feet in Dallas for holiday overflow but only twenty thousand by March? Reserve the space for as little as four weeks and exit when the rush fades, with no multiyear lease or idle fixed cost.

A single API feeds orders into every temporary node, while one dashboard shows inventory levels, carrier scans, and SLA hits in real time. Most brands go live in under four weeks, according to Flexe’s implementation guide, so customers stay unaware that their orders just switched zip codes.

Manufacturers lean on Flexe to

- test a new region without a permanent footprint,

- absorb peak seasons that dwarf average volume, and

- create a safety valve for strikes or weather disruptions.

Think of warehouse space like a utility: switch it on, pay only for what you use, switch it off when normal returns.

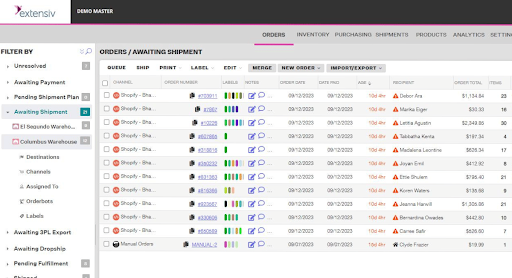

Extensiv: a 3PL control tower in your browser

One warehouse partner feels safe until a hurricane shutters the port you rely on. Extensiv turns that single-point risk into optionality without adding more software.

Its Fulfillment Marketplace connects brands to more than 1,500 pre-vetted 3PLs already running the Extensiv Warehouse Manager platform, according to the company’s launch announcement. Enter your SKU profile and target regions, and the system returns a shortlist of providers that follow the same playbook, so inbound receipt, cycle counts, and final scans all use consistent rules. Switching or adding nodes becomes a simple dropdown selection instead of an IT project.

Once live, Extensiv’s distributed order management engine weighs inventory levels, carrier zones, and service-level promises before routing each order. A web sale in Los Angeles ships from L.A., while a wholesale case for Toronto leaves Buffalo. Brands typically go live in under four weeks, according to the platform’s implementation guide, and pay nothing for listings because 3PLs cover the marketplace fees.

Manufacturers rely on Extensiv to

- compare multiple bids without a months-long RFP,

- run region-specific partners under one data umbrella, and

- keep redundancy tight so a facility outage delays orders by hours rather than weeks.

You still own carrier contracts and special projects, but the repetitive tasks—rate shopping, routing, and inventory sync—run in the background, giving your ops team a true browser-based control tower.

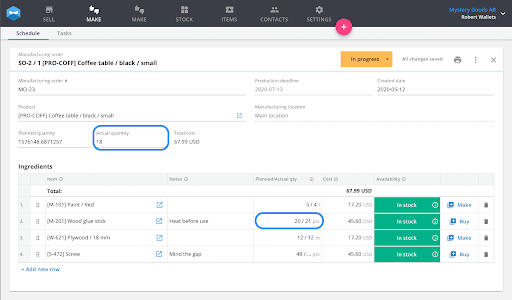

Katana MRP: factory-floor visibility meets e-commerce urgency

Most inventory apps treat finished goods as static: build batch, ship batch. Reality is messier. Katana pairs production planning with real-time order sync, so you always know what is on the line, what is in the rack, and what just sold online.

Connect Shopify, WooCommerce, or Amazon in minutes and Katana reserves stock the moment an order lands. If inventory runs short, it converts demand into a manufacturing order with the bill of materials and routing steps already filled in. The shop supervisor sees the job, the buyer sees raw-material gaps, customer service sees a reliable ship date, and no one touches a spreadsheet.

Multilocation support tracks goods at the plant, a 3PL, or a service van; barcode-triggered transfers keep counts honest. Add Katana’s open API and you can push data into BI dashboards or pull sensor readings back to the work-in-progress screen.

Results surface quickly. A 2025 Unwilted case study reports zero overselling during demand spikes and round-the-clock inventory accuracy between Katana and Shopify. Katana’s own benchmarks show users lifting inventory turnover by 1.2× after tightening reorder points, freeing cash for the next product line.

If you already run a heavyweight ERP, Katana may feel redundant. For growing factories underserved by legacy systems, it delivers enterprise-grade orchestration at SaaS speed and cost.

Conclusion

E-commerce logistics is no longer a downstream function—it is a core manufacturing capability. The shift from pallets to parcels, the erosion of de minimis exemptions, and the rise of AI-driven planning mean that fulfillment performance now directly affects margins, working capital, and brand equity.

The eight partners highlighted in this guide succeed for one shared reason: they treat logistics as a system, not a handoff. Whether that system prioritizes packaging integrity (Zenpack), elastic capacity (Flexe), heavy-item precision (Red Stag), or global compliance (DHL), the winning models collapse silos between production, inventory, and delivery.

For manufacturers adding or scaling D2C, the takeaway is simple:

choose a partner aligned to your first constraint, not your aspirational volume. Speed without visibility creates stockouts. Scale without cost clarity erodes margin. Technology without operational depth fails under pressure.

The right 3PL or platform does more than ship boxes—it protects cash flow, stabilizes forecasts, and turns operational complexity into a competitive advantage.

Frequently Asked Questions

What is the biggest mistake manufacturers make when choosing a 3PL for e-commerce?

Selecting a provider based on headline shipping rates rather than systems integration and inventory visibility. Without real-time ERP and storefront sync, manufacturers end up overselling, expediting production, or carrying excess safety stock—costs that far outweigh a lower pick fee.

Can one partner realistically handle both B2B pallet shipments and D2C parcel orders?

Yes, but only if the provider was designed for dual-channel execution. Platforms like Zenpack and Ryder (Whiplash) separate bulk and parcel workflows at the WMS level, preventing labor conflicts and mis-picks that plague retrofitted operations.

When should a manufacturer consider a flexible warehouse network instead of a fixed 3PL?

If demand is volatile, seasonal, or influenced by external shocks (tariffs, viral demand, weather), an elastic model like Flexe reduces risk. It allows short-term capacity expansion without long-term leases or stranded inventory.

How important is AI in modern fulfillment operations?

AI is no longer experimental—it is foundational. According to the 2025 Inbound Logistics study, 94% of 3PL executives rank AI as the most influential technology in their operations. Practical use cases include demand forecasting, inventory placement, labor optimization, and dynamic order routing.

Do manufacturers need a separate inventory system if they already have an ERP?

Not always. Large enterprises often rely on ERP extensions, but growing manufacturers frequently benefit from systems like Katana MRP, which bridge production planning and e-commerce in real time. The decision hinges on speed, usability, and how well the ERP handles live order reservations.

How do new tariff rules affect e-commerce logistics decisions?

With the August 29, 2025 removal of the U.S. $800 de minimis threshold, nearly all inbound parcels now require duty processing. This makes landed-cost visibility, bonded warehousing, and customs expertise—strengths of providers like DHL Supply Chain—far more critical than before.