This post was originally published on this site.

The fourth quarter earnings season is more than halfway over, and the S&P 500 is on track for solid earnings growth.

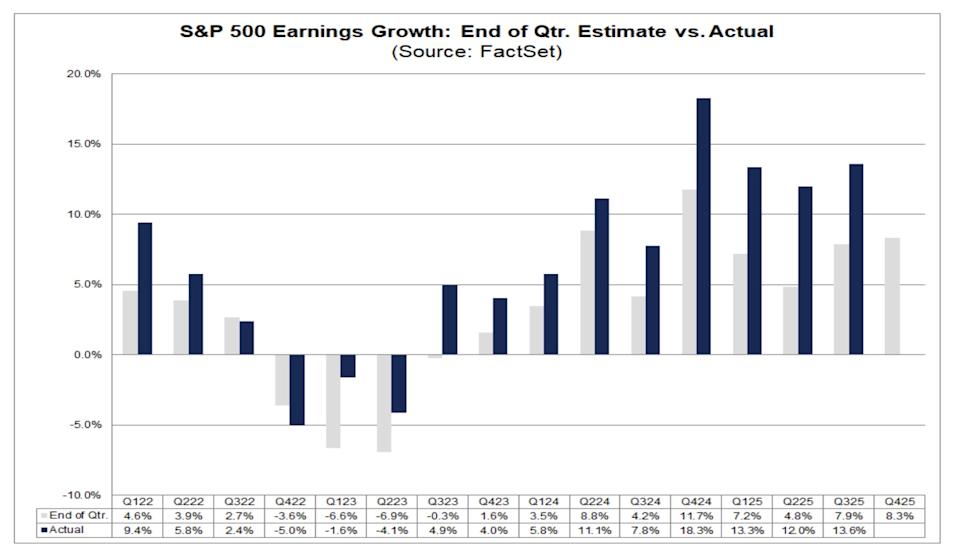

As of Feb. 6, 59% of S&P 500 (^GSPC) companies have reported fourth quarter results, according to FactSet data, and Wall Street analysts estimate a 13% increase in earnings per share for the fourth quarter. If that rate holds, it would represent the 10th consecutive quarter of annual earnings growth for the index and the fifth consecutive quarter of double-digit growth.

Heading into the reporting period, analysts were expecting an 8.3% jump in earnings per share, down from the third quarter’s 13.6% earnings growth rate. Wall Street has raised its earnings expectations in recent months, especially for tech companies, which have driven earnings growth in recent quarters.

Massive Big Tech capital expenditures set the tone for the AI trade. Plus, the themes that drove the markets in 2025 — artificial intelligence, the Trump administration’s tariff and economic policies, and a K-shaped consumer economy — continue to provide plenty for investors to parse.

This week, investors will digest results from Coca-Cola (KO), Spotify (SPOT), Robinhood (HOOD), Lyft (LYFT), Ford (F), Rivian (RIVN), Moderna (MRNA), Airbnb (ABNB), and Coinbase (COIN).

LIVE 175 updates

Read the latest financial and business news from Yahoo Finance