This post was originally published on this site.

E-Commerce Flexible Cartons Market Forecast and Outlook 2026 to 2036

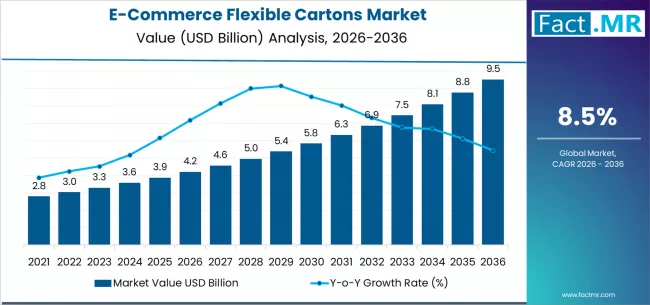

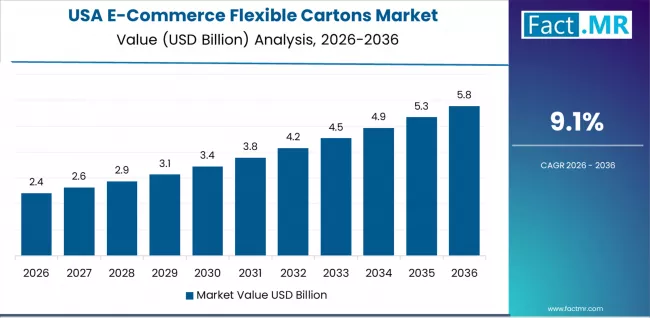

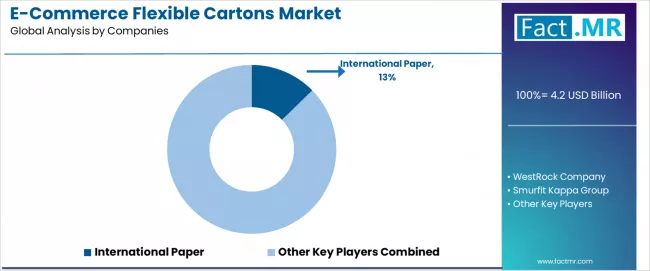

The global e-commerce flexible cartons market is experiencing transformative growth, driven by the structural shift in retail and evolving consumer expectations for delivery, projected to expand from USD 4.21 billion in 2026 to USD 9.52 billion by 2036, advancing at an 8.5% CAGR. This expansion is tied to the need for packaging that excels in the last-mile logistics environment, prioritizing damage protection, space efficiency, and brand presentation.

Key Takeaways from the E-Commerce Flexible Cartons Market

- Market Value for 2026: USD 4.21 Billion

- Market Value for 2036: USD 9.52 Billion

- Forecast CAGR (2026-2036): 8.5%

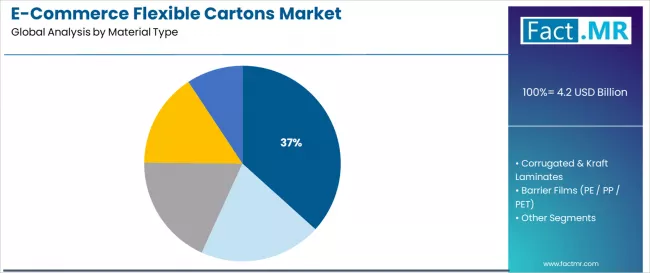

- Leading Material Type Segment (2026): Paperboard Flexible Cartons (37%)

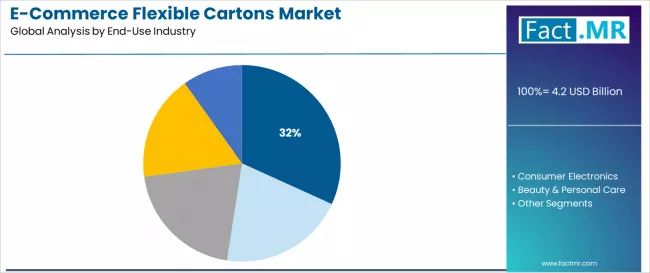

- Leading End-Use Industry Segment (2026): Apparel & Accessories (32%)

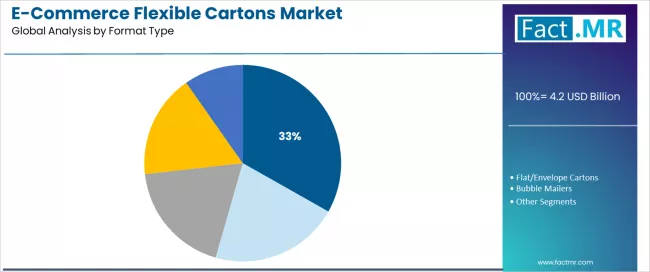

- Leading Format Type Segment (2026): Stand-up Pouches (33%)

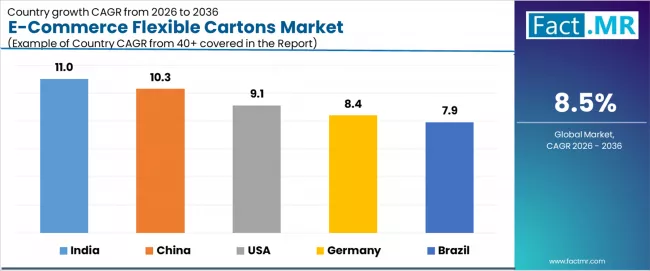

- Key Growth Countries: India (11.00% CAGR), China (10.30% CAGR), USA (9.10% CAGR), Germany (8.40% CAGR), Brazil (7.90% CAGR)

- Key Players in the Market: International Paper, WestRock Companies, Smurfit Kappa Group, Amcor plc, DS Smith

Paperboard flexible cartons lead material types with a 37% share, valued for their optimal balance of strength, lightness, and high-quality printability for branding. The apparel and accessories sector is the primary end-use industry (32%), where packaging must protect products while serving as an unboxing experience.

Stand-up pouches represent the leading format (33%), reflecting demand for lightweight, protective, and shelf-ready designs that reduce void fill and shipping costs. Market innovation is focused on developing smart, right-sized packaging that minimizes waste and integrates seamlessly with automated fulfillment systems.

Sustainability is a critical driver, accelerating the adoption of mono-material structures and biodegradable films to meet regulatory and consumer demands. India (11.00% CAGR) and China (10.30% CAGR) are pivotal growth markets, fueled by explosive e-commerce adoption, rising domestic consumption, and government policies promoting sustainable packaging within vast digital marketplaces.

Metric

| Metric | Value |

|---|---|

| Market Value (2026) | USD 4.21 Billion |

| Market Forecast Value (2036) | USD 9.52 Billion |

| Forecast CAGR (2026-2036) | 8.5% |

Category

| Category | Segments |

|---|---|

| Material Type | Paperboard Flexible Cartons, Corrugated & Kraft Laminates, Barrier Films (PE/PP/PET), Biodegradable/Compostable Films, Others |

| End-Use Industry | Apparel & Accessories, Consumer Electronics, Beauty & Personal Care, Food & Beverages, Others |

| Format Type | Stand-up Pouches, Flat/Envelope Cartons, Bubble Mailers, Cushion Wraps & Laminates, Others |

| Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, MEA |

Segmental Analysis

By Material Type, Which Segment Offers the Best Balance of Performance and Branding?

Paperboard flexible cartons hold a leading 37% market share, as they provide an ideal combination of structural rigidity for protection, lightweight properties to minimize shipping costs, and an excellent printable surface for high-impact graphics and branding.

This material is particularly favored for its sustainability narrative, being readily recyclable and often incorporating high recycled content. Its versatility allows it to be engineered into various format types, making it the foundational material for brand-conscious e-commerce packaging that must survive the logistics chain and delight customers upon arrival.

By End-Use Industry, Which Sector Prioritizes Unboxing Experience and Lightweight Protection?

The apparel and accessories sector is the dominant end-use industry, accounting for 32% of the market. For this category, packaging serves a dual critical function: it must prevent damage and wrinkles during transit while delivering a premium, Instagram-worthy unboxing experience that reinforces brand value.

Flexible cartons for apparel are designed to be lightweight to keep shipping costs low, yet durable enough to protect against punctures and moisture, often incorporating integrated headers or clear windows for immediate product visibility.

By Format Type, Which Design Maximizes Logistics Efficiency and Product Visibility?

Stand-up pouches lead the format segment with a 33% share, favored for their space-efficient design, lightweight nature, and ability to offer excellent product visibility and shelf-presence even when shipped directly to consumers.

Their flexible structure minimizes void space within outer shipping boxes, reducing material use and dimensional weight charges. Advanced features like resealable zippers and spouts add functionality, making them suitable for a wide range of products from accessories to dry food items within the e-commerce flow.

What are the Drivers, Restraints, and Key Trends of the E-Commerce Flexible Cartons Market?

The primary market driver is the relentless global growth of e-commerce, which requires packaging specifically engineered for the unique stresses of parcel shipping and last-mile delivery, rather than traditional retail shelf display.

Consumer demand for sustainable packaging and stringent extended producer responsibility regulations are forcing retailers and brands to adopt recyclable, compostable, or reusable flexible solutions. The need to optimize fulfillment costs through right-sized, lightweight packaging directly impacts profitability, making efficient carton design a strategic priority.

A significant market restraint is the higher per-unit cost of many advanced, sustainable flexible materials compared to traditional plastics, which can pressure margins in highly competitive e-commerce segments.

The complexity of sorting and recycling multi-material laminates in curbside systems can undermine their environmental claims. Furthermore, the existing infrastructure in fulfillment centers is often calibrated for standard corrugated boxes, requiring investment to handle a wider variety of flexible carton formats efficiently.

Key trends include the rapid adoption of automated, on-demand packaging systems that create right-sized flexible cartons at the point of fulfillment, eliminating waste. There is strong growth in mono-material plastic films designed for full recyclability.

Smart packaging features, such as integrated QR codes for tracking, authentication, and recycling instructions, are becoming more common. The development of water-based barrier coatings to replace plastic laminates on paperboard is also gaining significant traction as a recyclable alternative.

Analysis of the E-Commerce Flexible Cartons Market by Key Countries

| Country | CAGR (2026-2036) |

|---|---|

| India | 11.00% |

| China | 10.30% |

| USA | 9.10% |

| Germany | 8.40% |

| Brazil | 7.90% |

How is India’s Digital Commerce Boom and Sustainability Push Driving Growth?

India’s leading CAGR of 11.00% is propelled by an unprecedented expansion of its e-commerce customer base, supported by digital payment adoption and increasing internet penetration. Government initiatives like the Plastic Waste Management Rules are pushing brands toward sustainable alternatives, boosting demand for paperboard and compostable flexible cartons.

The market demands extremely cost-effective solutions that can withstand a complex logistics network while meeting rising consumer expectations for unboxing experiences and environmental responsibility.

What is the Impact of China’s Manufacturing Ecosystem and Domestic Consumption?

China’s 10.30% growth is fueled by its dual role as the world’s primary manufacturing hub for consumer goods and a colossal domestic e-commerce market. Chinese packaging suppliers are innovating rapidly to provide cost-competitive, high-performance flexible solutions for both export and domestic brands.

The scale of production enables rapid iteration and adoption of new material technologies, such as advanced barrier papers, to meet global brand specifications and stringent new domestic sustainability standards.

Why Does the USA’s Mature E-commerce Landscape and Regulatory Diversity Sustain Demand?

The USA’s 9.10% growth is anchored in its vast, mature e-commerce sector where packaging optimization is a key lever for profitability. The patchwork of state-level packaging regulations drives demand for versatile, compliant solutions.

Major retailers and brands are investing in sophisticated flexible cartons to enhance brand recognition, improve supply chain efficiency, and meet ambitious corporate sustainability goals, with a strong focus on curbside-recyclable paper-based formats.

How is Germany’s Engineering Focus and Green Legislation Shaping the Market?

Germany’s 8.40% CAGR reflects its strict packaging laws (VerpackG) and high consumer environmental consciousness. The market demands flexible cartons with flawless functionality in automated sorting systems and clear, certified recyclability.

German packaging engineers focus on developing high-performance, mono-material solutions and efficient designs that minimize material use without compromising protection, aligning with the country’s rigorous engineering and environmental standards.

What Role Does Brazil’s Expanding Middle Class and E-commerce Adoption Play?

A growing middle class, increased internet access, and the rapid expansion of regional e-commerce platforms drive Brazil’s 7.90% growth. The market requires durable flexible cartons that can protect products across vast distances and sometimes rugged logistics conditions.

There is growing interest in sustainable materials, but price sensitivity remains high, driving innovation in cost-effective recycled paperboard and lightweight laminates that reduce shipping costs for both sellers and consumers.

Competitive Landscape of the E-Commerce Flexible Cartons Market

Global integrated paper and packaging conglomerates that leverage their material science expertise and vast supply chains dominate the competitive landscape. Competition intensifies around the development of proprietary sustainable materials, such as high-barrier recyclable papers, and the integration of packaging design with automated fulfillment technology.

Success is increasingly tied to providing end-to-end solutions, including e-commerce packaging consulting, lifecycle analysis, and secure, scalable supply to major fulfillment centers and direct-to-consumer brands.

Key Players in the E-Commerce Flexible Cartons Market

- International Paper

- WestRock Company

- Smurfit Kappa Group

- Amcor plc

- DS Smith

Scope of Report

| Items | Values |

|---|---|

| Quantitative Units | USD Billion |

| Material Type | Paperboard Flexible Cartons, Corrugated & Kraft Laminates, Barrier Films (PE / PP / PET), Biodegradable / Compostable Films, Others |

| End-Use Industry | Apparel & Accessories, Consumer Electronics, Beauty & Personal Care, Food & Beverages, Others |

| Format Type | Stand-up Pouches, Flat/Envelope Cartons, Bubble Mailers, Cushion Wraps & Laminates, Others |

| Key Countries | India, China, USA, Germany, Brazil |

| Key Companies | International Paper, WestRock Companies, Smurfit Kappa Group, Amcor plc, DS Smith |

| Additional Analysis | Performance testing of cartons in simulated parcel shipping environments; life-cycle assessment of flexible vs. rigid e-commerce packaging; consumer perception studies on unboxing experiences; compatibility of new materials with high-speed automated packaging lines; analysis of packaging-as-a-service business models in e-commerce. |

Market by Segments

-

Material Type :

- Paperboard Flexible Cartons

- Corrugated & Kraft Laminates

- Barrier Films (PE/PP/PET)

- Biodegradable/Compostable Films

- Others

-

End-Use Industry :

- Apparel & Accessories

- Consumer Electronics

- Beauty & Personal Care

- Food & Beverages

- Others

-

Format Type :

- Stand-up Pouches

- Flat/Envelope Cartons

- Bubble Mailers

- Cushion Wraps & Laminates

- Others

-

Region :

- North America

- USA

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Western Europe

- Germany

- UK

- France

- Spain

- Italy

- BENELUX

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- Czech Republic

- Rest of Eastern Europe

- East Asia

- China

- Japan

- South Korea

- Rest of East Asia

- South Asia & Pacific

- India

- ASEAN

- Australia

- Rest of South Asia & Pacific

- MEA

- Saudi Arabia

- UAE

- Turkiye

- Rest of MEA

- North America

References

- Boz, Z., Korhonen, V., & Koelsch Sand, C. (2023). Consumer considerations for the implementation of sustainable packaging: A review. Journal of Cleaner Production, 252, 119889.

- Coelho, P. M., Corona, B., & Klooster, R. (2024). Sustainability of reusable packaging: Current situation and trends. Resources, Conservation and Recycling, 160, 104919.

- Deshwal, G. K., & Panjagari, N. R. (2023). Review on role of packaging in e-commerce. Packaging Technology and Science, 36(4), 211-224.

- Huang, J., & Liang, J. (2024). E-commerce packaging logistics: Challenges and innovative solutions. International Journal of Logistics Research and Applications, 27(1), 45-62.

- Kumar, S., & Murphy, M. (2023). E-commerce and the environment: A review of packaging waste management. Waste Management & Research, 41(8), 1289-1302.

- Magnier, L., & Crie, D. (2023). Communicating packaging eco-friendliness: The role of pictorial and verbal claims. International Journal of Research in Marketing, 40(2), 398-416.

- Molina-Besch, K., & Wikström, F. (2024). The environmental impact of packaging in the e-commerce sector. Packaging Technology and Science, 37(2), 89-104.

- Spreafico, C., & Russo, D. (2024). Quantifying the environmental benefits of right-sized packaging in e-commerce. Journal of Industrial Ecology, 28(1), 178-191.

- Williams, H., & Wikström, F. (2023). The influence of packaging attributes on consumer food waste behavior. Waste Management, 145, 44-51.

- Wyrwa, J., & Barska, A. (2024). Innovations in sustainable packaging for the e-commerce sector. Sustainability, 16(5), 2024.