This post was originally published on this site.

Arca, which aims to be a leading digital asset financial institution, predicted that in 2026 digital assets will absorb parts of traditional finance (TradFi) rather than replace them.

In a report, Arca said the mistake of the past two years has been forcing digital assets onto “slow, antiquated” TradFi rails through ETFs, digital asset treasuries and legacy settlement systems.

“That was one step forward and two steps back,” added Arca. “The real opportunity is moving high-quality traditional assets like equities, bonds, and real estate onto better technological rails via blockchain.”

Jean-Marie Mognetti, chief executive and co-founder of crypto fund manager CoinShares, predicted in a blog that “2026 will be the year of utility for digital assets.”

“The market is turning towards utility, cash flow, and integration,” he said. “If 2025 was the year of the graceful return, 2026 looks positioned to be a year of consolidation into the real economy.”

Arca argued that blockchain’s value proposition will become obvious when investors can trade crypto and traditional assets from the same wallet, with the same settlement logic. For example, stablecoins have enabled more than $300bn of dollar-denominated debt to live onchain and Arca expects equities, credit, and real assets to follow, which it estimated is an opportunity worth more than than $600 trillion.

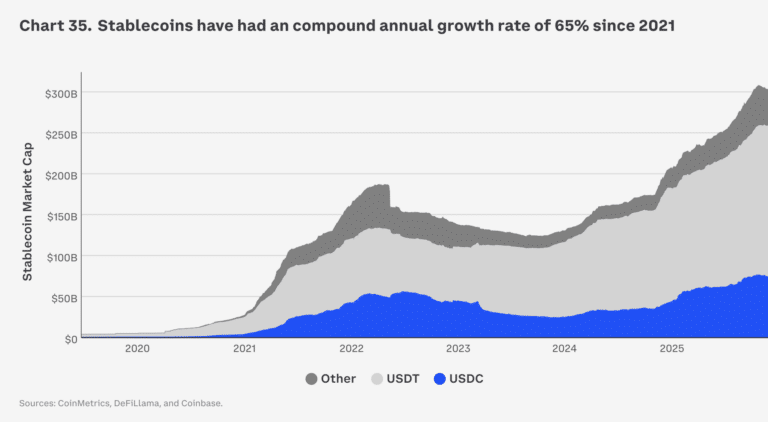

Coinbase Institutional forecast in its outlook for 2026 that total stablecoin market cap could reach $1.2 trillion by the end of 2028.

“In our view the stablecoin market is at an inflection point, with its growth resting on key factors like efficient ramps broad distribution networks, and the evolving roles of market players,” added Coinbase.

Jianing Wu, institutional research at digital asset investment manager Galaxy, expects TradFi-partnered stablecoins to consolidate in 2026 as users gravitate towards those with the broadest acceptance.

“Success depends on distribution scale: the ability to plug into banks, payment processors, and enterprise platforms,” she added. “Expect more stablecoin issuers to partner or integrate with one another’s systems to compete for meaningful market share.”

Derivatives

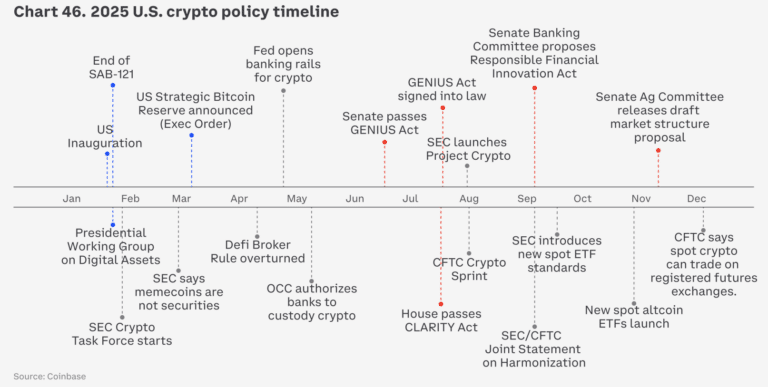

Coinbase Institutional said in its outlook for 2026 that the evolving regulatory landscape has been one of the pivotal developments that has transformed crypto into an “emerging pillar” of global market infrastructure. In particular, the U.S. passed the GENIUS Act which provided a federal framework for stablecoins.

“We think this combination of regulatory clarity and technological innovations will drive a transformative year for the crypto market in 2026,” said Coinbase. “This is the foundation on which the next phase of institutional adoption is being built.”

Coinbase highlighted the advance of institutional adoption in 2025 including the launch of spot crypto ETFs, the emergence of digital asset treasuries, and tokenization and stablecoins moving deeper into core financial workflows. These trends are expected to compound in 2026 according to the report as the Securities and Exchange Commission has allowed shorter ETF approval times, stablecoins are taking a larger role in delivery-vs-payment (DvP) mechanisms, and tokenized collateral is becoming more accepted across traditional transactions.

The firm predicted anticipate a substantial increase in the adoption and sophistication of crypto derivatives. In 2025 Coinbase acquired crypto options platform Deribit, in order to offer spot, term futures, perpetual futures, and options on one venue. In the U.S., Coinbase Derivatives also launched U.S. perpetual-style futures. Decentralized exchanges (DEXs) processed over $1.2 trillion of perpetual futures each month in 2025 according to the report.

Perpetual futures could evolve to potentially unlock increased capital efficiency, fueled by integrations with other DeFi protocols, such as allowing market participants to simultaneously hedge market risk while earning passive yield on assets, said Coinbase. In addition, the firm predicted that equity perpetual futures are positioned to become the next major trading vehicle for retail investors looking for highly leveraged, low-friction access to traditional financial markets.

“As global retail participation in U.S. equities continues its secular rise, the market is poised for disruption by tokenized equities,” added Coinbase.

Tokenization

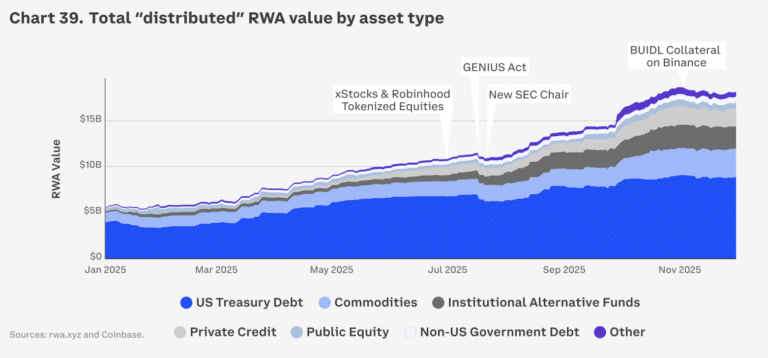

The tokenization of real-world assets has shifted from a fringe experiment to a structural theme in global markets according to Coinbase.

“Regulation has been a key driver for adoption,” said Coinbase. “ The result is that tokenization is being absorbed into existing regulatory perimeters, not being left outside them.”

However, Coinbase also highlighted that onchain real-world assets are still small relative to the total addressable market. Tokenized public stocks and equity funds are still under $1bn, compared to $28bn for tokenized Treasuries and private credit.

Thad Pinakiewicz, market & onchain intelligence at Galaxy Research, predicted that a major bank or brokerage will begin accepting onchain deposits of tokenized equities and treat them as fully equivalent to traditional securities in 2026.

“But we think the strategic importance is high,” said Coinbase. “This convergence of traditional finance and decentralized technology holds the potential to reshape investment strategies, enable fractional ownership in blue-chip names and enhance liquidity for cross-border investors.”

In 2026 Coinbase believes that tokenized Treasuries are likely to remain the core entry point for traditional money moving onchain. In addition, tokenized private credit is likely to remain a primary driver of growth.

Mognetti said that as stablecoins become settlement rails for a more digital and international economy, and tokenized financial products move to real issuance, DeFi will increasingly look less like an alternative and more like what it is becoming: “finance, delivered with different technology.”