This post was originally published on this site.

Make better investment decisions with Simply Wall St’s easy, visual tools that give you a competitive edge.

-

Delta Air Lines (NYSE:DAL) has agreed to purchase 31 new Airbus widebody jets as part of a fleet modernization focused on international and premium routes.

-

The company announced a $1.3 billion profit sharing payout to employees, described as a record distribution tied to its recent financial performance.

-

Delta reported an upcoming leadership change, with Julia A. McConnell set to replace William C. Carroll as principal accounting officer.

For investors, these updates touch on several key parts of the NYSE:DAL story at once, from aircraft investment to employee compensation and senior finance leadership. Delta operates a large global network focused on both domestic and international travel, and widebody orders often indicate how an airline is positioning its long haul and premium offerings. At the same time, a sizeable profit sharing pool shows how management is aligning incentives with the workforce.

The transition in the principal accounting officer role may prompt some readers to pay closer attention to Delta’s future financial reporting and disclosures. The combination of fleet commitments, employee payouts, and leadership changes provides additional information to monitor as you track how the company carries out its long term plans and capital allocation priorities.

Stay updated on the most important news stories for Delta Air Lines by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Delta Air Lines.

For you as an investor, the key thread tying this news together is how Delta is choosing to deploy leadership, capital and employee incentives at the same time. The appointment of Julia A. McConnell as principal accounting officer, following senior roles at WestRock, Carter’s, PepsiCo and PwC, points to an emphasis on experienced oversight of reporting, controls and capital decisions as the Airbus order and profit sharing commitments move ahead. The record US$1.3b profit sharing payout and continued quarterly dividend of US$0.1875 per share show that management is currently prioritizing both employee and shareholder returns, while the absence of buybacks over the recent quarter indicates a focus on other uses of cash. The widebody order, starting deliveries in 2029, fits with Delta’s focus on premium and international travel where it competes with carriers like United Airlines and American Airlines. Against that backdrop, recent insider share sales and analysts’ mixed outlooks make governance and leadership continuity, especially in finance, an area you may want to watch closely.

-

The widebody order and focus on premium and international flying line up with the narrative that Delta is leaning into premium services, alliances and loyalty to support revenue resilience.

-

Recent insider selling and sector concerns around cyclicality and main cabin demand could challenge the idea that execution alone will support the earnings assumptions behind the narrative.

-

The transition to a new principal accounting officer and the large profit sharing decision are not fully reflected in the narrative, yet they are important for understanding how Delta balances growth initiatives with governance and employee incentives.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Delta Air Lines to help decide what it’s worth to you.

-

⚠️ Analysts have flagged four key risks for Delta, including expectations that earnings could shrink on average over the next three years, which may make the current level of investment and capital returns harder to sustain if conditions weaken.

-

⚠️ The insider transaction history, with more sells than buys over the past year, may raise questions for some investors about leadership’s confidence in the share price, especially as the company commits to long dated fleet spending.

-

🎁 Delta’s earnings grew 44.8% over the past year and are assessed as high quality, which supports the company’s ability to fund investments like the Airbus order and the US$1.3b profit sharing payout.

-

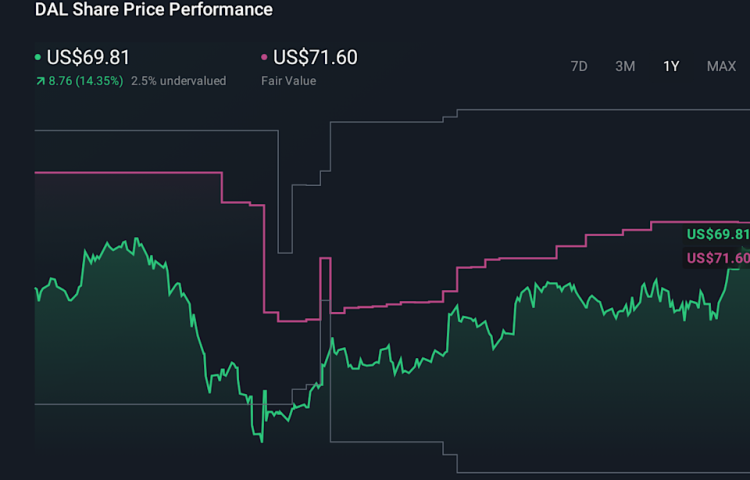

🎁 Analysts currently see the shares trading at a discount relative to their fair value estimate and to peers, which, combined with a quarterly dividend, may appeal to investors who prioritize both cash returns and perceived value.

From here, you may want to watch how Delta executes on its fleet modernization timeline, including any updates to funding, delivery schedules or route plans as the Airbus A330-900 and A350-900 aircraft move closer to service. The handover from William C. Carroll to Julia A. McConnell on April 1, 2026 puts a spotlight on the consistency and clarity of future financial reporting, especially around profit sharing, dividends and capital spending. Insider trading activity, particularly from senior executives, will remain useful context alongside any changes in dividend policy or buyback activity, which was flat in the recent quarter. Finally, keep an eye on how Delta’s premium and international focus compares with peers like United and American, and whether management commentary continues to support the earnings and margin expectations reflected in current narratives.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for Delta Air Lines, head to the community page for Delta Air Lines to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com