This post was originally published on this site.

Market Overview:

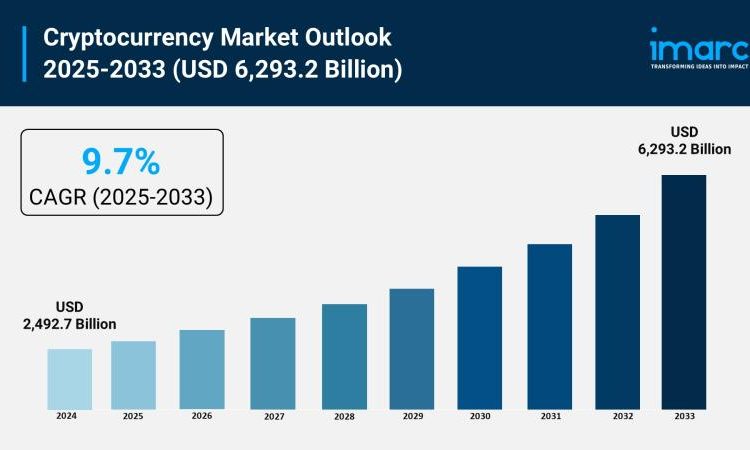

The cryptocurrency market is experiencing rapid growth, driven by institutional capital and regulated investment vehicles, progressive global regulatory frameworks, and integration of tokenized real-world assets (RWA). According to IMARC Group’s latest research publication, “Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033”, the global cryptocurrency market size reached USD 2,492.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6,293.2 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/cryptocurrency-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Cryptocurrency Market

● Institutional Capital and Regulated Investment Vehicles

The entry of large-scale financial institutions is a primary catalyst for the current expansion of the global cryptocurrency market. Major asset managers have integrated digital assets into their core offerings, with spot Bitcoin and Ethereum exchange-traded funds (ETFs) now managing over $115 billion in combined assets. Specifically, products like BlackRock’s IBIT have surpassed $75 billion in holdings, providing a regulated bridge for traditional investors. Furthermore, corporate treasury adoption has reached a new milestone; as of the most recent reporting cycle, at least 172 publicly traded companies hold Bitcoin on their balance sheets, collectively representing roughly 5% of the circulating supply. This “institutionalization” of the asset class has shifted market sentiment from speculative trading to long-term capital allocation, supported by investment banks like Goldman Sachs that now utilize proprietary digital asset platforms to facilitate regulated token issuance and settlement for global clients.

● Progressive Global Regulatory Frameworks

Clearer legislative guidelines in major economies are reducing the “regulatory risk” that previously sidelined conservative investors. In Europe, the full implementation of the Markets in Crypto-Assets (MiCA) regulation has established a unified licensing standard for service providers across all member states, ensuring consumer protection and financial stability. Similarly, the United States has seen significant policy shifts, including the passage of the GENIUS Act in July 2025 to regulate stablecoins and the proposal of the CLARITY Act to define market structures. These initiatives have encouraged domestic innovation, as evidenced by a sharp rebound in venture capital investment into US-based crypto firms. In India, the government’s Budget 2026 introduced specific penalty provisions such as ₹200 per day for non-filing and ₹50,000 for inaccurate reporting-to bring digital asset transactions in line with established financial reporting standards, thereby fostering a more transparent and compliant domestic trading environment.

● Integration of Tokenized Real-World Assets (RWA)

The convergence of traditional finance (TradFi) and decentralized finance (DeFi) through the tokenization of tangible assets is creating substantial new market value. The RWA sector has matured into a significant on-chain segment, with the total value of tokenized assets reaching approximately $18 billion by the end of last year. This growth is driven by the migration of traditional instruments like U.S. Treasury bills, private loans, and real estate onto blockchain rails. For example, tokenized treasuries have expanded rapidly, with some networks reporting year-over-year growth exceeding 350%. Financial giants are leading this transition; JPMorgan’s JPM Coin now facilitates billions of dollars in daily instant settlements for corporate clients. By enabling fractional ownership and 24/7 trading for historically illiquid assets, tokenization is broadening the scope of the cryptocurrency market from a digital-only ecosystem to an essential layer of global capital market infrastructure.

Key Trends in the Cryptocurrency Market

● The Rise of Autonomous AI-Powered Crypto Agents

A major shift in the market is the emergence of “Agentic Commerce,” where artificial intelligence agents independently manage, trade, and govern digital assets. These autonomous systems utilize specialized protocols like x402 to settle high-frequency microtransactions without human intervention. Currently, AI-led prediction markets and decentralized protocols are seeing weekly volumes approach $5 billion, as these agents are better equipped to hedge against market uncertainty in real-time. Beyond trading, blockchain is increasingly serving as the “accountability partner” for AI, providing an immutable audit trail for machine-driven decisions. Real-world applications are already scaling, with projects like Worldcoin and Provenance Labs being utilized by enterprises to verify content authenticity and detect deepfakes, effectively positioning cryptocurrency as the native currency and security layer for the burgeoning AI economy.

● Transition to Specialized Application Chains

The industry is moving away from a “one-size-fits-all” blockchain model toward a network-of-networks architecture composed of application-specific chains (AppChains). These specialized networks are designed to optimize performance for particular use cases, such as gaming, high-frequency trading, or supply chain management. For instance, the Solana ecosystem has seen its popularity among retail users grow by 9 percentage points recently, largely due to its high throughput and low-cost environment for decentralized applications. This trend is supported by “modular” blockchain infrastructure, which allows developers to plug in custom layers for security or data availability. As a result, the market is seeing a proliferation of “invisible” blockchain applications where the end-user interacts with a seamless interface similar to traditional web apps-while the underlying specialized chain handles complex cryptographic security and asset settlement in the background.

● Evolution of Stablecoins as Global Payment Infrastructure

Stablecoins have evolved from mere trading collateral into a dominant global payment rail for remittances and corporate payroll. Recent data shows that stablecoins now account for 30% of all on-chain transaction volume, with annual volumes exceeding $4 trillion. This trend is particularly evident in emerging markets and cross-border commerce, where traditional banking fees are high and settlement times are slow. Large-scale implementations, such as the eNaira in Nigeria and the Sand Dollar in the Bahamas, demonstrate how digital versions of fiat are modernizing national economies. Furthermore, roughly 60% of US cryptocurrency owners now use or hold dollar-pegged stablecoins like USDC for practical financial activities. This shift is turning the cryptocurrency market into the “internet’s dollar,” providing a 24/7, programmable alternative to the legacy SWIFT system for international money transfers.

Access the Latest 2026 Data & Forecasts: https://www.imarcgroup.com/checkout?id=2546&method=3451

Leading Companies Operating in the Global Cryptocurrency Industry:

● Advanced Micro Devices Inc.

● Alphapoint Corporation

● Bitfury Holding B.V.

● Coinbase Inc.

● Cryptomove Inc.

● Intel Corporation

● Microsoft Corporation

● Quantstamp Inc.

● Ripple Services Inc.

Cryptocurrency Market Report Segmentation:

By Type:

● Bitcoin

● Ethereum

● Bitcoin Cash

● Ripple

● Litecoin

● Dashcoin

● Others

Bitcoin dominates the market with approximately 72.9% share, serving as a primary entry point for various investors and regarded as digital gold.

By Component:

● Hardware

● Software

Software leads with around 70.0% market share, facilitating applications and protocols essential for managing digital assets and driving innovation in the cryptocurrency ecosystem.

By Process:

● Mining

● Transaction

Transactions account for about 67.6% of the market, representing the primary function of cryptocurrencies as mediums of exchange with high liquidity and fast settlement times.

By Application:

● Trading

● Remittance

● Payment

● Others

Trading leads the market with approximately 40.6% share, encompassing exchanges and speculative activities, characterized by high volumes and dynamic trading strategies.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Europe holds over 39.5% of the market share, driven by regulatory frameworks and increasing blockchain adoption, particularly in countries like Germany and the UK.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.