This post was originally published on this site.

ChatGPT predicts a continued rally for Bitcoin after it crossed $92,500 on December 12, while also pointing to gold pushing new highs above $4,300 per ounce.

With both assets moving up simultaneously, investors are watching for signals on where momentum might flow next – especially with emerging alternatives like Bitcoin Hyper gaining traction just before a scheduled price jump.

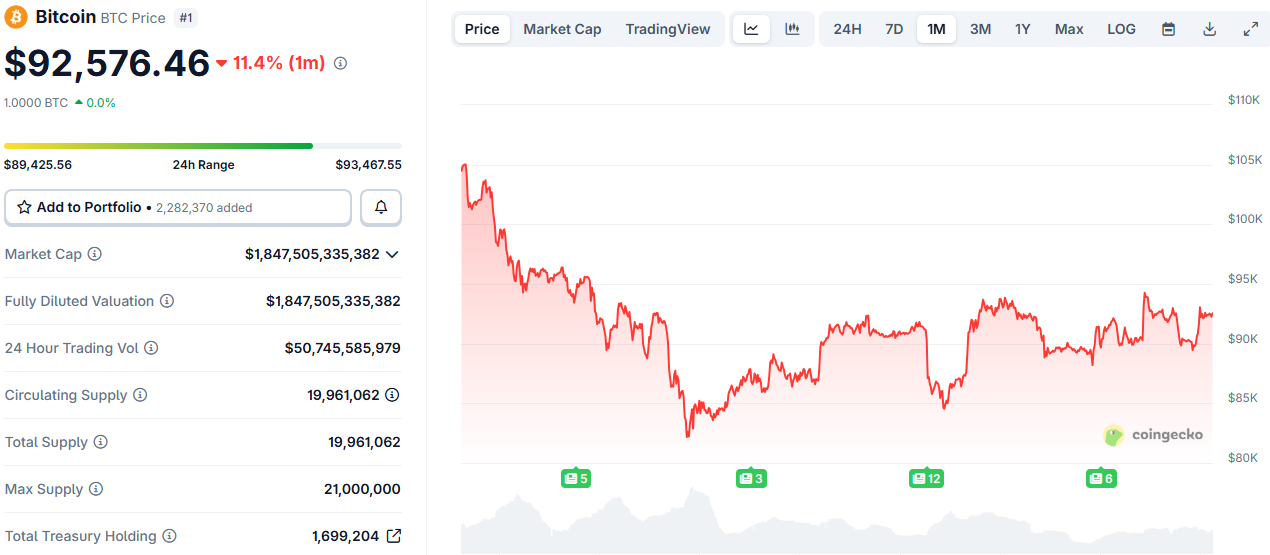

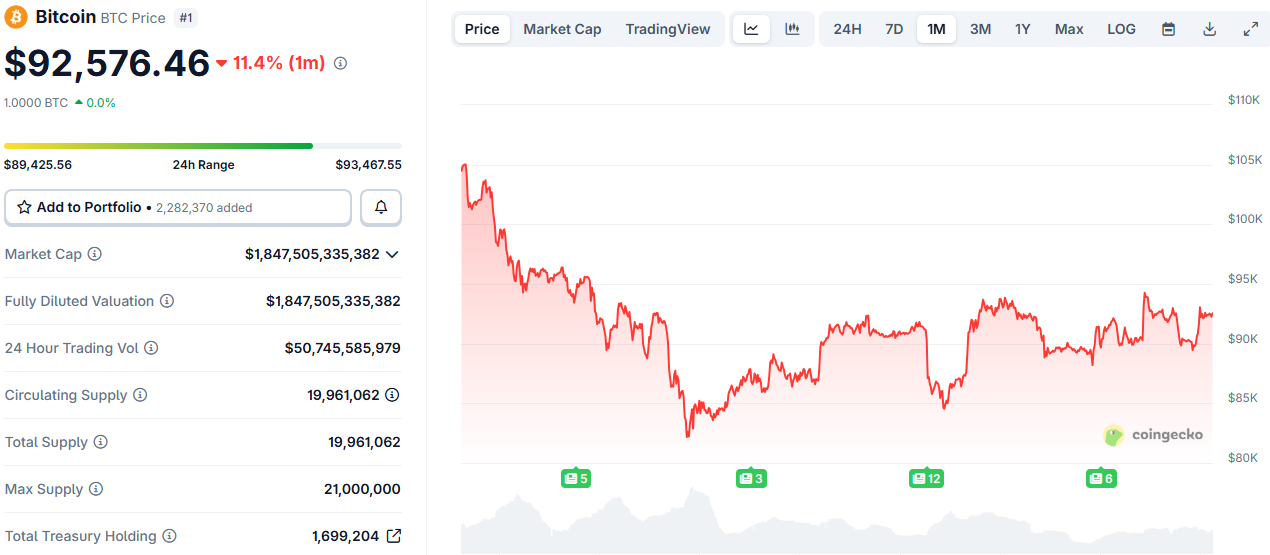

Bitcoin’s $92K Breakout: Technical Momentum Holds

Bitcoin climbed 2.55% in the past 24 hours to hit $92,588.81, supported by a 24-hour volume of $63.59 billion, despite that volume being 8.98% lower than the previous day.

The market cap reached $1.84 trillion, a solid sign of capital retention even in a volatile environment. The circulating supply stands at 19.96M BTC, nearing the 21M max supply limit.

ChatGPT predicts that the next resistance zone will likely emerge near the $95,000 mark, which coincides with the psychological ceiling just ahead of the $100K level.

If price holds current levels for the next 48 hours, models suggest a 60% probability of testing $96,800 within the week. RSI trends show room for further upside, and the declining volume might indicate a pause – not a reversal.

The model also emphasizes the importance of on-chain metrics. The Vol/Mkt Cap ratio sits at 3.43%, which ChatGPT considers “moderate accumulation.” If this shifts above 4.5% while price remains flat, it could signal a selloff or distribution event.

Gold’s Climb Past $4,300 Tells a Parallel Story

On the same day, gold surged 0.80%, reaching $4,316.18 per ounce, with intraday spikes hitting $4,320.13. The precious metal is tracking steady interest amid broader macro concerns.

ChatGPT predicts that the recent push in gold may be short-lived compared to Bitcoin’s momentum, but still views $4,350 as a reachable ceiling by year-end if global currency instability persists.

Despite its reputation as a hedge, gold’s rally appears to be mirroring Bitcoin’s instead of counterbalancing it – a trend that has only intensified in 2025.

ChatGPT also points to the increasingly algorithmic nature of gold markets, driven by ETF inflows and spot price hedging strategies.

ChatGPT Predicts BTC-Gold Divergence Coming Soon

Historically, gold and Bitcoin tend to move inversely, especially in times of monetary policy shifts. But ChatGPT predicts that the current dual rally is a temporary correlation anomaly. As soon as January, it expects either:

- Bitcoin to break free and head toward six figures, or

- Gold to retreat back to $4,150 levels as risk assets take precedence

Based on sentiment and capital flow data, the AI favors Bitcoin as the dominant play in the short term. It calculates a 70% probability that BTC outperforms gold by over 5% in the next 10 trading days.

One reason for this prediction is the growth in speculative crypto flows – particularly toward new altcoins.

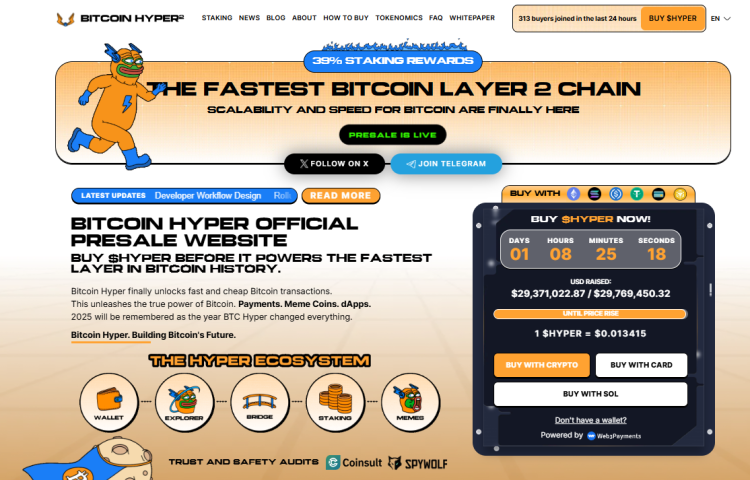

Bitcoin Hyper Gathers Steam Before Price Increase

With less than two days before the next price tier, Bitcoin Hyper is closing in on its presale milestone of $29.77 million, having already raised $29.37 million.

The current rate is $0.013415 per $HYPER, and ChatGPT marks this token as part of the larger shift toward high-growth alternatives that traders consider when Bitcoin nears resistance.

ChatGPT predicts that as BTC approaches saturation zones, investor capital will temporarily pivot to mid-cap presales that offer upside with defined timelines – which is exactly where Bitcoin Hyper fits.

The project’s interface shows only 1 day and 8 hours remaining before the next price jump, making its short-term setup particularly interesting for momentum traders.

This speculative rotation doesn’t reduce Bitcoin’s long-term trajectory but highlights how traders often look for leverage plays when flagship tokens pause or consolidate.