This post was originally published on this site. With the Federal Reserve resuming rate cuts, many investors and advisers might be reassessing their short-term liquidity strategies. Thanks to their stable value, minimal duration and attractive yields, money market funds have become enormously popular in recent years, amassing a record high…

Browsing CategoryMoney Market Funds

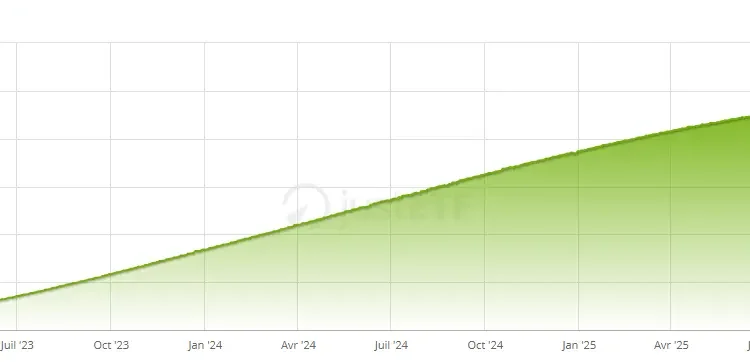

Money Market Funds Attracted $935B Last Year. Expect Half That in 2026

This post was originally published on this site. Show me the money … money market funds, that is. Money market funds attracted $935 billion in new assets last year, surpassing 2024 totals and defying the belief that Federal Reserve rate cuts would trigger mass outflows, according to Morgan Stanley research.…

How To Open A Money Market Account: 5 Steps

This post was originally published on this site. Ilya Ginzburg/EyeEm/Getty Images Key takeaways Opening a money market account requires the same documentation as any other bank account including a government-issued ID and your Social Security number, along with a way to fund the account. Read the fine print prior to…

Best money market account rates today, January 7, 2026 (secure up to 4.1% APY)

This post was originally published on this site. Find out which banks are offering the best MMA rates right now. As interest rates continue to fall following the Fed’s recent rate cuts, it’s more important than ever to ensure you’re earning a competitive rate on your savings. One option you…

Savings And Money Market Rates Forecast For 2026

This post was originally published on this site. Top yields for savings and money market accounts are expected to continue the downward slide in 2026. Still, top savings rates will likely outpace the rate of inflation according to the latest forecast from Bankrate senior industry analyst, Ted Rossman. The highest…

Savings And Money Market Rates Forecast For 2026

This post was originally published on this site. Top yields for savings and money market accounts are expected to continue the downward slide in 2026. Still, top savings rates will likely outpace the rate of inflation according to the latest forecast from Bankrate senior industry analyst, Ted Rossman. The highest…

Best Money Market Funds 2026: Comparison

This post was originally published on this site. While interest rates remain at still relatively attractive levels, money market funds and money market ETFs continue to hold a special place in investment strategies. Long confined to a simple waiting solution, these low-risk investments allow you to put your savings to…

Money-Market Fund Assets Are at a Record and Poised to Keep Growing. Here’s Why.

This post was originally published on this site.

Equity Funds Rally as Investors Pour Money in Final Week of 2025

This post was originally published on this site. In the final week of December 2025, global equity funds saw a large surge of fresh money. Investors put about $26.54 billion into these funds worldwide. That level of buying shows strong confidence at the end of the year. The rally came…

Best money market account rates today, January 2, 2026 (up to 4.1% APY return)

This post was originally published on this site. Find out which banks are offering the best MMA rates right now. The Federal Reserve cut the federal funds rate three times in 2024 and three times in 2025. As a result, deposit interest rates — including money market account rates —…