This post was originally published on this site.

In personal finance vernacular, it’s a common saying that “cash is king.” Given the current rate-cutting cycle and the rise of the “debasement trade,” that reign could be over. Bonds may pose a challenge for the proverbial crown. Thornburg Investment Management discussed this possibility further in a recent market insight: “Why Cash Is No Longer King: Bonds Should Reign” by Thornburg client portfolio manager Phillip Gronniger.

As Gronniger noted, 2022 was a memorable year as the Fed began an aggressive rate-hiking campaign. As yields spiked, investors were piling into money market funds at a feverish pace. In turn, it opened up opportunities to purchase bonds at a value-oriented price where investors can now reap the benefits of price appreciation as the Fed cuts rates. Additionally, Gronniger cited that as bonds mature to reach par value, this could lead to better returns compared to cash instruments—”a pull to par” effect.

“As fixed income securities approach maturity, discounted bonds rise in price, while those at a premium fall to par,” explained Gronniger. “Additionally, with the Fed cutting rates, fixed income securities also offer price appreciation potential, adding to coupon payments and boosting total returns — likely surpassing money market yields that are declining.”

History Supports Fixed Income

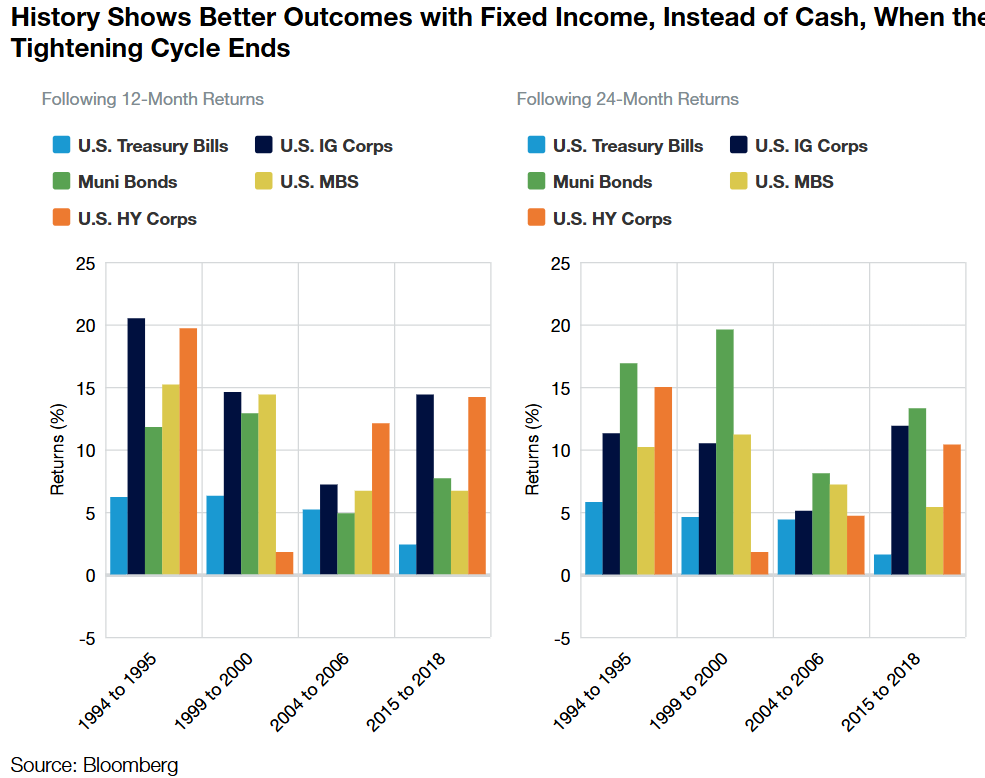

History is also on the side of bonds in a rate-cutting cycle when compared to cash. After the Fed recently implemented its second rate cut of the year, the likelihood of more cuts to come could further support the case for bonds over cash. Thornburg looked at data from four central bank tightening cycles since the mid-90s to gauge how both cash and fixed income performed, and the results certainly favor the latter.

“Using indices for Treasury bills and both investment-grade and non-investment-grade securities, results suggest that owning fixed income has offered better returns than holding cash, as illustrated in the chart below,” Gronniger said. “With the Fed now cutting rates as well as the increased potential for economic weakness ahead, fixed income may again provide superior outcomes compared to cash.”

With the potential for total returns that oust cash instruments, active exchange-traded funds (ETFs) have the potential to capture this upside.

Active Opportunities in ETFs

Active management is almost imperative given the current market environment. The nuances and complexities inherent in the bond market make it necessary, especially in a rate-cutting cycle that could apply downward pressure on yields.

“Active management remains important for capturing excess returns and maintaining income, especially through short-duration, investment-grade bonds and other securities outside standard benchmarks, such as those within the asset-backed securities and residential mortgage space, which we believe represent some of today’s most compelling opportunities,” Gronniger said.

That said, Thornburg has a pair of funds not tethered to an index, starting with a core option in the actively managed Thornburg Core Plus Bond ETF (TPLS). The fund focuses on constructing a high-quality bonds portfolio that can maximize income opportunities.

For added income diversification, another fund to consider is the Thornburg Multi Sector Bond ETF (TMB). The fund allows its portfolio managers to tailor its holdings to extract the best income opportunities across a diverse pool of fixed income assets, including Treasury futures.

Regardless if the Fed is cutting, raising, or keeping rate steady, both can be all-weather solutions for investors due to their active management.

Click here to learn more about TMB.

To get more insights on how Thornburg applies active management to their fixed income ETFs, watch the VettaFi Q3 Fixed Income Symposium. Thornburg’s Head of Fixed Income and Managing Director Christian Hoffmann joined TMX VettaFi’s Head of Research Todd Rosenbluth to discuss how active ETFs can adjust to the Fed’s new rate-cutting regime.

For more news, information, and strategy, visit the Portfolio Strategies Content Hub.