This post was originally published on this site.

- The threat of quantum computing is “cloud in the air,” said Eliezer Ndinga of 21Shares.

- Unless developers do something about the vulnerability, Bitcoin will remain in its current price range.

- Timelines surrounding the potential threat are uncertain.

Fears of quantum computing breaking Bitcoin’s encryption continue to plague Bitcoin investors.

In fact, Eliezer Ndinga, global head of research at 21Shares, reckons that unless developers address the concern, Bitcoin won’t enjoy a rally anytime soon.

But if developers act? It’s clear, blue skies.

“If we get past the quantum threat, then Bitcoin can go to $180,000,” Ndinga told DL News. For now, however, “it’s a cloud in the air.”

Every day more market watchers are cropping up and labelling quantum computing Bitcoin’s most pressing threat. Adding to Ndinga, Sergio Ermotti, CEO of Swiss investment bank UBS, said that Bitcoin needs to prove itself able to overcome quantum computing. Ray Dalio and BlackRock have made similar comments.

They aren’t the only ones, however. Just last week, Christopher Wood, of Jefferies Group, removed Bitcoin from his long-standing portfolio recommendation. Instead, he’s urging investors to double down on gold and gold-mining stocks.

“In the world of institutional allocation, virtually everyone I have talked to is quietly concerned about Bitcoin,” Nic Carter, a general partner at Castle Island Ventures, previously told DL News.

Of late, Bitcoin developers and the broader community are finding themselves fighting over a vulnerability that hadn’t been taken seriously.

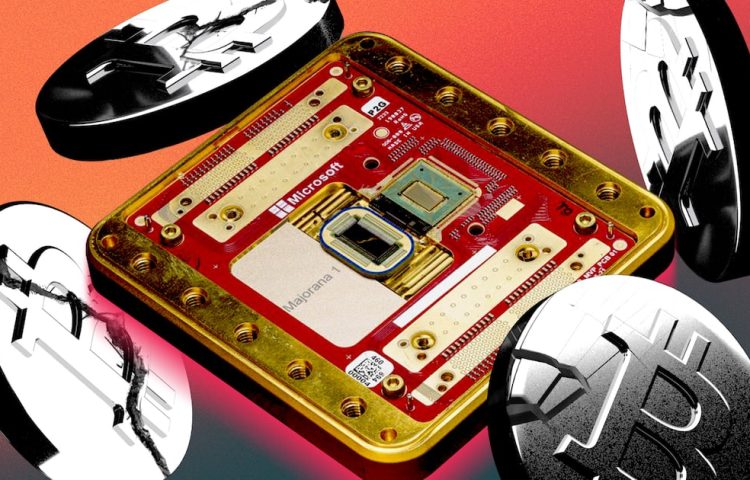

Why are investors so fearful now? Because advances in quantum computing are coming at a rapid pace, and if the technology falls into the wrong hands, it could potentially break Bitcoin’s entire encryption model.

Researchers at Chaincode Labs discovered that 20% to 50% of all Bitcoin could be stolen by actors using quantum computers. We’re talking about $400 billion to $900 billion that could be lost — including Satoshi Nakamoto’s alleged 1 million Bitcoin stash.

Quantum conscious?

In an interview with DL News, the first thing that Ndinga said was that quantum computing is a real threat.

“The challenge is that we’re drowning in information but starving for a reason,” Ndinga said. “Crypto has to get past its teenage years and address this seriously.”

When asked to rate the quantum threat on a scale of one to ten, Ndinga broke it down into two dimensions: timing and magnitude.

“On magnitude, you’re talking about potentially 50% of all Bitcoin at risk,” he said. “On timing, it’s harder to pin down. We could be talking about a couple of years or a couple of decades.”

That uncertainty is exactly what’s creating headwinds for institutional investors, according to Ndinga. And unless he acknowledges the vulnerability, he’ll lose credibility among investors.

“I won’t be taken seriously if I don’t talk about quantum computing,” he said.

BIP 360

While institutional concern mounts, there are Bitcoin developers working on solutions — although progress is slow.

One of the proposals is BIP 360, authored by developers Hunter Beast and Ethan Heilman, and podcaster Isabel Foxen Duke.

“Nearly everyone has been very grateful that we are taking the problem seriously,” Beast told DL News. “Our whole motto is: prepared, not scared.”

Rather than forcing a sudden network-wide upgrade, BIP 360 would introduce a new type of Bitcoin address that allows users to voluntarily move funds into quantum-resistant protections, reducing long-term exposure without breaking existing wallets, the Lightning Network, or Layer-2 systems.

BIP 360 is now into its second year of development, and according to Beast, it remains one of the most widely-discussed draft BIPs in Bitcoin’s history. That means little, however, since the notoriously lethargic Bitcoin Investment Proposal process means activation could still be years away.

Beast acknowledged the urgency but cautioned against rushing.

“We must remain thoughtful and diligent, while not rushing a half-baked solution,” he said. “Fortunately, the general consensus is that we still have time.”

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him atpsolimano@dlnews.com.

Related Topics