This post was originally published on this site.

CORRECTION (Feb. 3, 8:15 PM UTC): Corrects the earlier story that said Galaxy CEO attributed a $9 billion bitcoin sale to a quantum computing threat and updates the story throughout.)

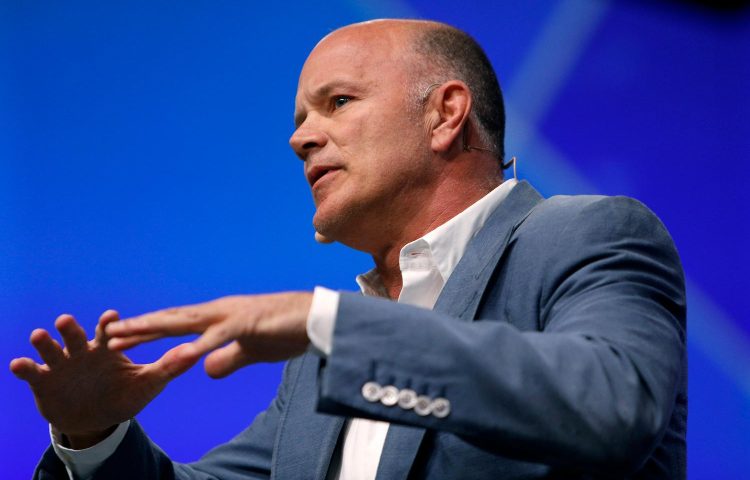

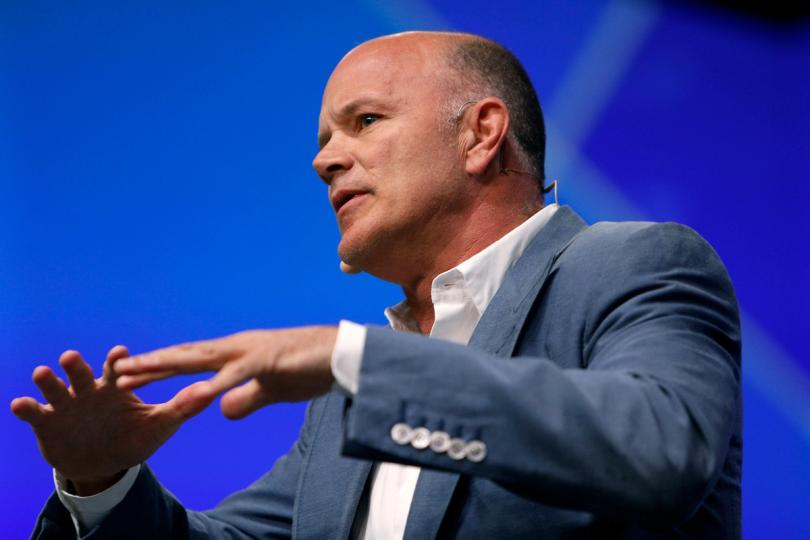

Galaxy CEO Mike Novogratz doesn’t see quantum computing as a big risk for Bitcoin, even though some are selling their holding using the threat a an excuse.

STORY CONTINUES BELOW

“Quantum has been the big excuse for people,” he said during the earnings conference call on Tuesday. But Novogratz doesn’t view this as a big threat as it is being made out to be. “I think in the long run, quantum will not be a huge issue for crypto. It’ll be a big issue for the world, but crypto, Bitcoin especially, will be able to handle it. But that’s been the excuse [for selling],” he added.

And he has a point. In recent times, the debate over quantum computing and its potential to affect Bitcoin’s encryption has been heating up. Just last month, Jeffries’ global head of equity strategy, Christopher Wood, removed a 10% allocation to bitcoin from his model portfolio due to the threat posed by quantum computing.

Recently, Coinbase has acknowledged that quantum computing could be a real, long-term threat to the cryptocurrency market, while the Ethereum Foundation this month formally elevated post-quantum security to a strategic priority by creating a dedicated Post-Quantum team.

While Novogratz said quantum computing technology is real, it’s still in its early stages, and the Bitcoin network will be ready when the technology actually takes off. “As we get closer to quantum, we’re gonna get closer to quantum resistant. And you will have the Bitcoin code changed in time,” he said.

Regardless of the threat, the debate rages on. Some Bitcoin developers have pushed back, saying machines capable of breaking Bitcoin’s cryptography do not exist today and are unlikely to for decades. But for some investors, the risk to bitcoin’s “store of value” fundamentals is real, despite how distant or theoretical it might seem.

OG’s selling

Another fact that Novogratz touched on during the earnings call is whether the long-term bitcoin holders, or “OGs,” are selling their stash.

The question of OGs selling their stash began last year, when Galaxy said it had facilitated a $9 billion sale of more than 80,000 bitcoin for a Satoshi-era investor. The firm said the sale — one of the largest notional bitcoin transactions ever — was part of the seller’s estate planning strategy.

That sale sparked debate over whether the early bitcoin community, which has long championed “HODLing” or holding onto their bitcoin through volatility, has lost its faith.

Novogratz thinks that OGs taking profit is real, and once selling starts, it just becomes a cycle. “Then you sell a little more, you sell a little more, and it is so hard to HODL.”

“There were a tremendous amount of these religious believers in this concept of HODLing and not letting go of your bitcoin,” he said. “And somehow that fever broke, and you started seeing some selling.”