This post was originally published on this site.

Quantum computing is advancing quickly and is raising new questions about the long-term security of blockchain systems. Because Bitcoin relies on cryptography to secure transactions and ownership, researchers are examining whether future quantum computers could weaken or break these protections.

These concerns are not limited to academic research. Christopher Wood, global head of equity strategy at Jefferies, recently removed bitcoin from his model portfolio, citing the risk that advances in quantum computing could undermine its cryptographic foundations. He warned that any successful breach would challenge bitcoin’s role as a long-term store of value.

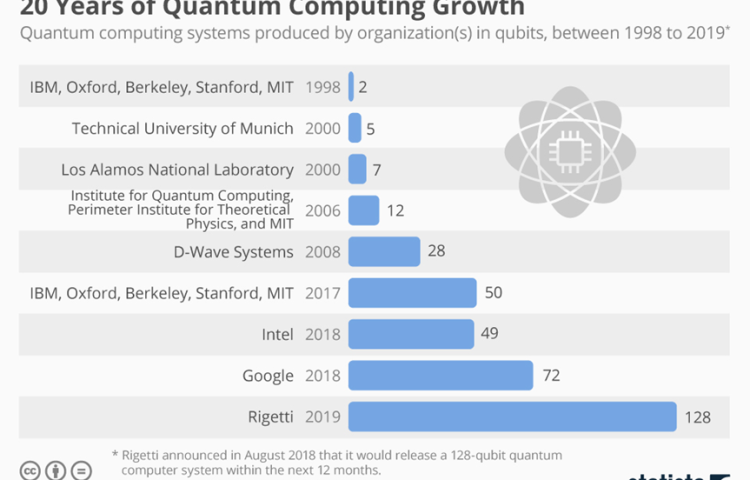

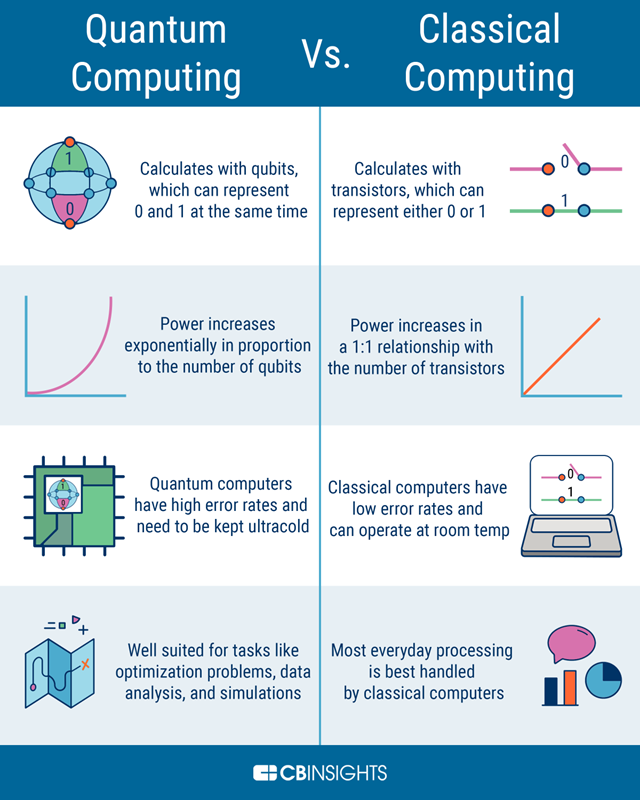

Quantum computing is often described as the next major step in computing technology. Unlike classical computers, which process information using bits that are either 0 or 1, quantum computers use quantum bits, or qubits. Qubits can represent multiple states at the same time thanks to a property known as superposition. Combined with other quantum effects such as entanglement and interference, this allows quantum computers to process certain types of problems far more efficiently than traditional machines.

A simple analogy helps clarify the difference. Timothy Hollebeek, Industry Standards Strategist at DigiCert, compares classical computing to navigating a maze by trying one path at a time, while a quantum computer can explore all possible paths simultaneously. This parallel processing ability explains why quantum machines are particularly well-suited to complex mathematical problems, such as factoring large numbers or identifying patterns in vast datasets.

Recent advances illustrate this potential. Google’s quantum chip, Willow, reportedly solved a specific computational problem in under five minutes—one that would take classical supercomputers an impractically long time. It is approximately 13,000x faster than the best supercomputers in the world. Results like this help explain why quantum computing attracts attention in fields such as medicine, logistics, and materials science.

Despite the excitement, quantum computing remains at an early stage of development. Today’s machines face major technical constraints. Qubits are extremely fragile, require temperatures near absolute zero, and are highly sensitive to noise, which introduces errors. Even under controlled conditions, maintaining a stable quantum state for more than a brief moment is difficult. Google’s Willow chip, for example, operates with 105 qubits, while practical, fault-tolerant systems would likely require thousands of stable, interconnected qubits.

The rise of quantum computing naturally raises questions about the long-term security of digital systems that rely on cryptography, including cryptocurrencies. Indeed, because bitcoin’s design is based on mathematical assumptions about computational limits, any major shift in computing power invites closer examination.

“Quantum computers are not a question of if, but when,” notes Timothy Hollebeek, Industry Standards Strategist at DigiCert. This statement captures why technological advances like quantum computing are increasingly discussed as a potential long-term risk for Bitcoin.

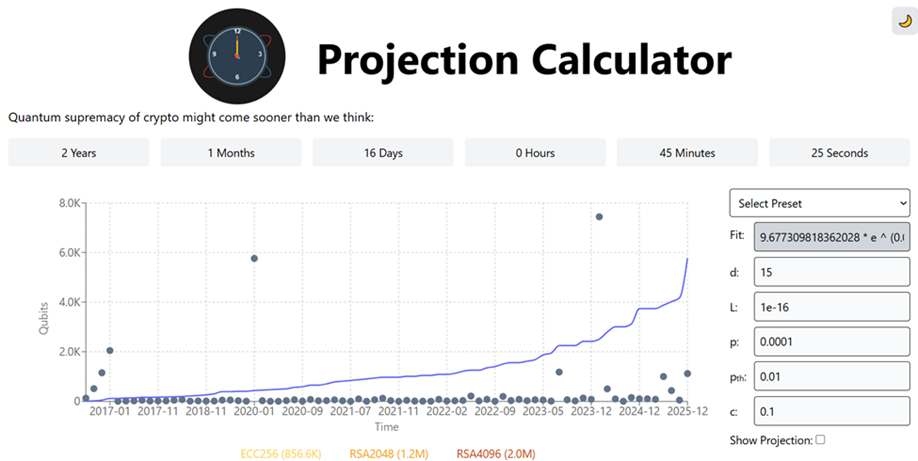

Source: Projection Calculator

The most serious concern involves Shor’s Algorithm, a quantum algorithm capable of breaking the digital signature scheme (ECDSA) that bitcoin uses to prove ownership of funds. In today’s classical computing environment, deriving a private key from a public key is effectively impossible. In a future where large-scale quantum computers exist, this could change. An attacker could, in theory, recover a private key from a public key in a relatively short time, allowing them to move funds without the owner’s consent.

This risk is unevenly distributed across the bitcoin network. Approximately 25% of all bitcoins over 5mn BTC are stored in “vulnerable” addresses, including early P2PK addresses and any reused P2PKH addresses. This group also includes Satoshi Nakamoto’s estimated 1.1 million BTC. These addresses are more exposed because their public keys are already visible on the blockchain, making them susceptible to quantum attacks. If a quantum attacker were able to move even a portion of these coins, the resulting supply shock could be catastrophic, severely undermining confidence in bitcoin’s ownership model and putting strong downward pressure on its price.