This post was originally published on this site.

Nvidia and Bitcoin have produced blistering returns for investors during the past few years.

Nvidia (NVDA 3.30%) stock and Bitcoin (BTC 0.47%) are completely different assets, but they are both at the top of their respective markets.

Nvidia supplies the best graphics processing units (GPUs) for data centers, which are the primary chips used for developing artificial intelligence (AI) models. Its market capitalization of $4.3 trillion makes it the largest company in the semiconductor industry (and the world).

Bitcoin, on the other hand, has a market cap of $1.8 trillion, placing it at the top of the cryptocurrency industry.

Both assets have delivered spectacular long-term returns for investors, but they are having a quiet 2025 compared to past years. Nvidia stock has climbed by just 31% this year, and Bitcoin is actually down by about 4% as I write this. But a new year is right around the corner, so which one could be the better buy for 2026?

Image source: Nvidia.

The case for Nvidia

Nvidia’s latest GPU architecture is called Blackwell Ultra, and it offers up to 50 times more performance than its Hopper architecture from 2022, so the company has come a long way in just three years. However, the latest AI reasoning models like OpenAI’s GPT-5.1, Anthropic’s Claude 4.5, and Alphabet‘s Gemini 3 require an increasing amount of computing power, which is fueling a growing demand for more capacity.

Advertisement

In fact, Nvidia Chief Executive Officer Jensen Huang says reasoning models consume anywhere between 100 times and 1,000 times more “tokens” than the older one-shot large language models (LLMs), because they spend so much time “thinking” in the background to weed out errors and produce the best outputs. Therefore, even Blackwell Ultra GPUs aren’t enough in some cases, which is why Nvidia plans to launch an entirely new architecture called Rubin in 2026.

Rubin could deliver 3.3 times more performance than Blackwell Ultra, which implies it could be a whopping 165 times more powerful than Hopper. Therefore, investors should expect to see significant demand for those chips in the new year.

Based on management’s forecasts, Nvidia is on track to generate a record $212 billion in revenue during its fiscal year 2026 (which ends on Jan. 31, 2026), representing a potential 62% increase from the prior year. About 90% of that revenue will come from its data center segment alone, so AI GPU sales are unquestionably driving its business right now.

Nvidia’s fiscal year 2027 will kick off in February 2026, and Wall Street’s average estimate (provided by Yahoo! Finance), suggests its revenue could soar by another 48% to reach $316 billion. Therefore, next year is shaping up to be another blockbuster year for the chipmaker.

Today’s Change

(-3.30%) $-5.97

Current Price

$174.96

Key Data Points

Market Cap

$4.3T

Day’s Range

$174.62 – $182.81

52wk Range

$86.62 – $212.19

Volume

6.2M

Avg Vol

191M

Gross Margin

70.05%

Dividend Yield

0.02%

The case for Bitcoin

The case for owning Bitcoin hasn’t changed much during the past few years, because the cryptocurrency hasn’t really evolved. It’s fully decentralized, which means no company or government can control it. It also has a capped supply of 21 million coins, which creates the perception of scarcity. Because of those qualities, a growing number of investors consider it to be a legitimate store of value, kind of like a digital version of gold.

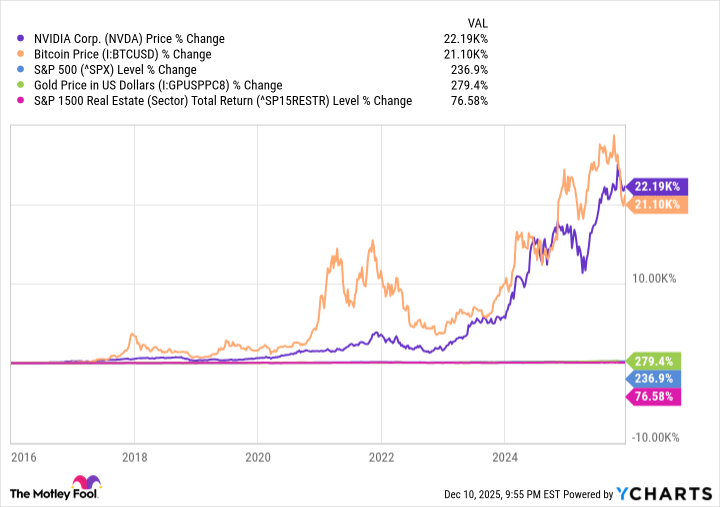

Bitcoin has delivered an eye-popping return of 21,100% during the past decade, crushing every major asset class from stocks to real estate to actual gold. However, investors who bought Nvidia stock instead would have done slightly better:

The broad availability of spot Bitcoin exchange-traded funds (ETFs) has expanded the cryptocurrency’s investor base, by allowing financial advisors and institutional investors to own it in a safe and regulated manner. Many of those investors avoided Bitcoin in the past because owning it was deemed far too risky; digital crypto wallets are susceptible to hacks, and centralized exchanges occasionally fail and wipe out all of their clients (as FTX in 2022).

Longer-term, some industry experts think Bitcoin will become more than just an investment vehicle. Strategy co-founder Michael Saylor believes every asset in the world will eventually be tokenized on the blockchain, and he thinks Bitcoin would be the perfect reserve currency for this new financial system because of its decentralized nature.

Saylor says Bitcoin could reach $21 million per coin by 2045 if his vision becomes reality, representing a potential upside of 23,000% from its current price of about $91,000. But I have my doubts.

Today’s Change

(-0.47%) $-423.88

Current Price

$90028.00

Key Data Points

Market Cap

$1.8T

Day’s Range

$89963.00 – $90601.00

52wk Range

$74604.47 – $126079.89

Volume

35B

The verdict

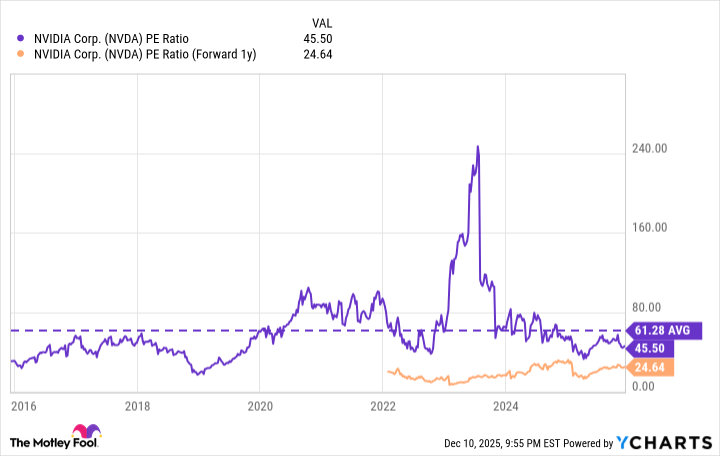

It’s very difficult to value Bitcoin, so it’s almost impossible to predict its next move. On the other hand, valuing Nvidia stock is quite simple, and it actually looks cheap right now.

The stock is trading at a price-to-earnings (P/E) ratio of 45.5, which is a steep discount to its 10-year average of 61.2. Plus, based on Wall Street’s forecast for fiscal 2027 earnings of $7.46 per share, Nvidia stock is trading at a forward P/E ratio of just 24.6.

NVDA PE Ratio data by YCharts

In other words, assuming Wall Street’s earnings estimate is accurate, Nvidia stock would have to climb by 85% during the next 12 months just to maintain its current P/E ratio of 45.5, and it would have to soar by 148% to trade in line with its 10-year average P/E of 61.2.

In summary, we can make some reasonable assumptions about Nvidia’s potential performance in 2026, whereas the same can’t be said for Bitcoin. As a result, I think the chipmaker is a much better investment for the new year.