This post was originally published on this site.

Dublin, Jan. 07, 2026 (GLOBE NEWSWIRE) — The “B2C Ecommerce Global Market Size & Forecast by Value and Volume Across 80+ KPIs – Databook Q4 2025 Update” report has been added to ResearchAndMarkets.com’s offering.

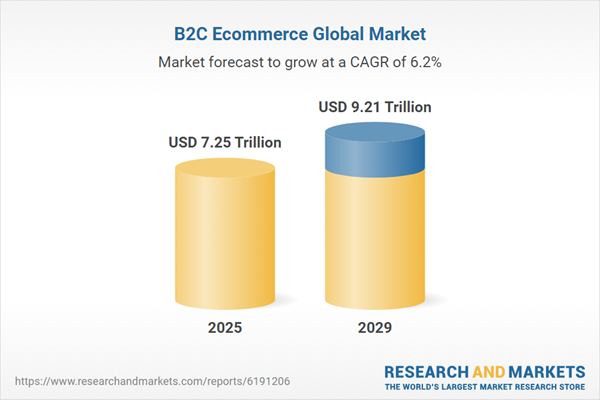

The global ecommerce market is expected to grow by 7.3% annually, reaching US$7.25 trillion by 2025.

Over the next 2-4 years, competitive intensity will increase as cross-border discount platforms scale globally and social-commerce ecosystems deepen their integration with commerce. Platforms with strong logistics, financial services infrastructure, and local-market compliance are expected to retain an advantage. Regulatory scrutiny, particularly in the U.S., EU, and Indonesia, may reshape platform models but is unlikely to reduce overall competition.

The ecommerce market has experienced robust growth during 2020-2024, achieving a CAGR of 9.5%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 6.2% from 2025 to 2029. By the end of 2029, the ecommerce market is projected to expand from its 2024 value of US$6.75 trillion to approximately US$9.21 trillion.

Key Trends and Drivers

Digital Payments Expand as Ecommerce Checkout Becomes More Localised

- Countries are seeing rapid transitions toward locally relevant digital payment instruments integrated directly into ecommerce checkout. In India, UPI-based ecommerce flows have expanded as platforms like Flipkart and Amazon India integrate real-time payment rails. In Brazil, Pix adoption continues to influence online checkout preferences, with retailers integrating instant transfers to reduce card-processing costs. In Europe, markets such as the Netherlands and Germany are seeing a rise in the use of bank-based payment methods (iDEAL, Giropay), reinforced by retailer acceptance policies.

- Retailers aim to lower transaction costs, reduce fraud exposure, and shorten settlement cycles. The broader shift toward embedded finance, supported by banks and fintechs, also enables retailers to offer seamless payments. Regulatory support, such as India’s push for UPI internationalisation or Brazil’s central bank innovation agenda, further accelerates adoption.

- Digital payments will continue to displace traditional card-led ecommerce in several markets. The shift will intensify as retailers prioritise cost efficiency and as fintech-retailer partnerships deepen. Cross-border ecommerce players will also adopt more local payment methods to reduce friction, especially in emerging markets.

Social and Content-Driven Commerce Reshapes Online Purchasing Pathways

- Social platforms are increasingly influencing ecommerce transaction journeys. In China, Douyin has expanded into product categories such as beauty and apparel, enabling one-click purchases during content engagement. In the U.S., Meta’s recent commerce integrations on Instagram Shops support in-app checkout for small merchants. Southeast Asian markets are seeing strong traction for TikTok Shop (Indonesia, Vietnam, Malaysia) following its recent regulatory-compliant re-entry into Indonesia.

- The retail sector’s shift toward short-form video and influencer-led discovery has created new pipelines for generating product demand. Merchant adoption is also rising because platforms provide built-in traffic, integrated logistics partners, and performance marketing tools. Regulatory adjustments such as Indonesia’s separation of social media and ecommerce functions are prompting platforms to reconfigure, not retreat.

- The trend will intensify, though country-specific regulatory requirements will constrain it. China will remain the global benchmark, while Southeast Asia will scale rapidly. Western markets will grow more gradually, shaped by platform privacy requirements and merchant willingness to rely on closed ecosystems.

Cross-Border Commerce Gains Momentum as Consumers Seek Imports and Price Advantages

- Cross-border ecommerce continues to expand, driven by platforms offering competitively priced international goods. In the U.S., Temu has widened its assortment across home goods and fashion. In Europe, Shein and AliExpress continue to attract younger customers purchasing low-ticket discretionary goods. In the Middle East, platforms like Amazon UAE and Noon are strengthening cross-border capabilities, especially for electronics and lifestyle categories.

- Several factors converge:

- Rising consumer price sensitivity in inflation-hit markets.

- Improved international logistics, supported by expanded air freight and bonded-warehouse models, as seen in the UAE and Saudi Arabia.

- Government trade policies enabling small-parcel imports, such as de minimis thresholds in the U.S. and the EU’s B2C import VAT schemes.

- Cross-border flows are likely to intensify as logistics networks improve and discount-driven platforms expand their global reach. However, regulatory scrutiny, especially on customs valuation, environmental impact, and data compliance, may slow down certain models in Europe and the U.S., leading to more structured import frameworks rather than a decline in activity.

Omni-Channel Retail Integration Accelerates as Large Retailers Reconfigure Store Networks

- Retailers globally are integrating ecommerce with store formats to build unified fulfillment and inventory models. In the U.S., Walmart and Target continue to use stores for pickup and same-day delivery. In the UK, Tesco and Sainsbury’s expand click-and-collect and micro-fulfillment investments. In Japan, Aeon and Rakuten deepen digital-retail partnerships to connect online inventory with physical stores.

- Ecommerce logistics costs remain high, prompting retailers to leverage existing store networks to improve last-mile efficiency. Consumer expectations for flexible pickup/delivery windows also drive integration. Retailers’ internal digital transformation agendas, such as inventory visibility systems and store-based picking, are enabling more scalable hybrid models.

- This trend will continue to strengthen as retailers seek margin stability. More store formats will be redesigned for hybrid fulfillment. Partnerships between ecommerce platforms and traditional retailers will increase, particularly in Asia and Europe, where dense store networks support rapid delivery models.

Current State of the Market

- Global ecommerce competition remains fragmented, with big regional differences in platform concentration. In the U.S., Amazon remains the dominant player in general merchandise, while Walmart is expanding its online position by leveraging its store network for fulfillment. In China, competition is more fragmented, with Alibaba, JD.com, Pinduoduo, and Douyin each operating different models spanning marketplace, first-party retail, and content-commerce.

- Europe exhibits a multi-player environment, with Amazon dominant in core Western European markets and local retailers such as Otto in Germany and El Corte Ingles in Spain competing through omni-channel strengths. Emerging markets, including India, Indonesia, and Brazil, show rapid expansion of domestic and cross-border platforms, creating a more diversified landscape.

Key Players and New Entrants

- Major incumbents Amazon, Alibaba, Walmart, JD.com, and Mercado Libre continue to scale logistics networks and financial services as differentiators. Social-commerce platforms such as TikTok Shop and Douyin are expanding ecommerce roles, particularly in Southeast Asia and China. New entrants include ultra-low-cost platforms such as Temu, which has expanded its presence in the U.S. and parts of Europe. In India, Reliance’s JioMart is expanding categories and merchant onboarding, intensifying competition with Flipkart and Amazon India.

Recent Launches, Mergers, and Acquisitions

- The past year saw several strategic shifts. Shopify and TikTok expanded their partnership to support cross-border merchant onboarding. In Europe, Amazon completed its investment in Deliveroo, strengthening grocery fulfillment integration. In China, Alibaba reorganised into multiple business units, giving platforms such as Taobao/Tmall and Cainiao more operational autonomy. Southeast Asia witnessed consolidation as Grab, GoTo’s Tokopedia, and TikTok Shop explored operational collaborations following regulatory changes in Indonesia. In the Middle East, Amazon UAE and Noon expanded regional logistics agreements to support faster delivery.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 2420 |

| Forecast Period | 2025 – 2029 |

| Estimated Market Value (USD) in 2025 | $7.25 Trillion |

| Forecasted Market Value (USD) by 2029 | $9.21 Trillion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

For more information about this report visit https://www.researchandmarkets.com/r/4jo6qn

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment