This post was originally published on this site.

-

Affirm Holdings reported past second-quarter fiscal 2026 results with sales of US$586.65 million and net income of US$129.59 million, alongside a raised full-year outlook.

-

Alongside the earnings beat, new and expanded partnerships with Intuit’s QuickBooks, Wayfair, Expedia, Fiserv and Bolt highlight Affirm’s push deeper into merchant, small-business and international ecosystems.

-

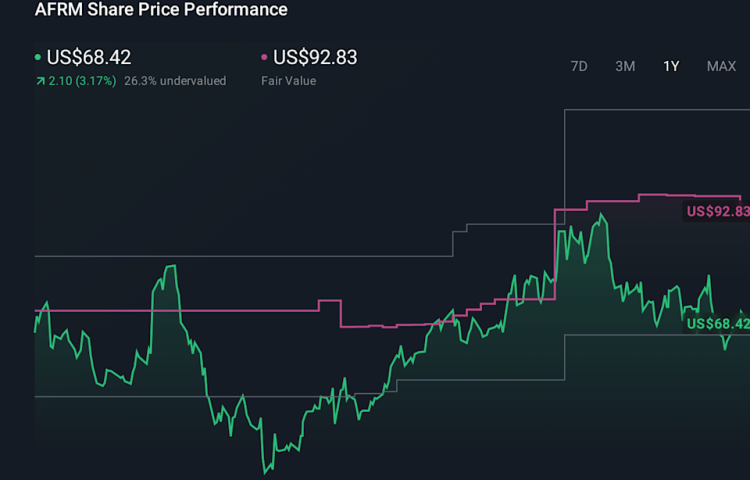

Against this backdrop, we’ll examine how the earnings beat and raised outlook shape Affirm’s investment narrative despite a recent 5% weekly share price decline.

This technology could replace computers: discover 22 stocks that are working to make quantum computing a reality.

For Affirm to make sense in your portfolio, you have to believe its “buy now, pay later” rails can extend well beyond online checkout into everyday spending, small-business invoicing and bank debit programs. The latest quarter’s earnings beat and raised outlook support that thesis in the near term, but the market’s 5% weekly pullback suggests investors are still wrestling with questions around credit performance and how much growth is already reflected in a rich earnings multiple. The new partnerships with QuickBooks, Expedia, Wayfair, Fiserv and Bolt strengthen near-term catalysts by broadening Affirm’s reach across travel, ecommerce, SMBs and traditional banking, potentially deepening transaction volume and merchant stickiness. At the same time, those wins do not remove the key risks around valuation, funding costs and any future uptick in credit losses.

However, one risk in particular could catch shareholders off guard if it accelerates. Affirm Holdings’ share price has been on the slide but might be dropping deeper into value territory. Find out whether it’s a bargain at this price.

Eighteen Simply Wall St Community fair value views span about US$25 to US$140 per share, showing very different expectations. Set that against Affirm’s premium valuation and credit risk concerns, and you can see why it pays to compare multiple viewpoints.

Explore 18 other fair value estimates on Affirm Holdings – why the stock might be worth less than half the current price!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AFRM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com