This post was originally published on this site.

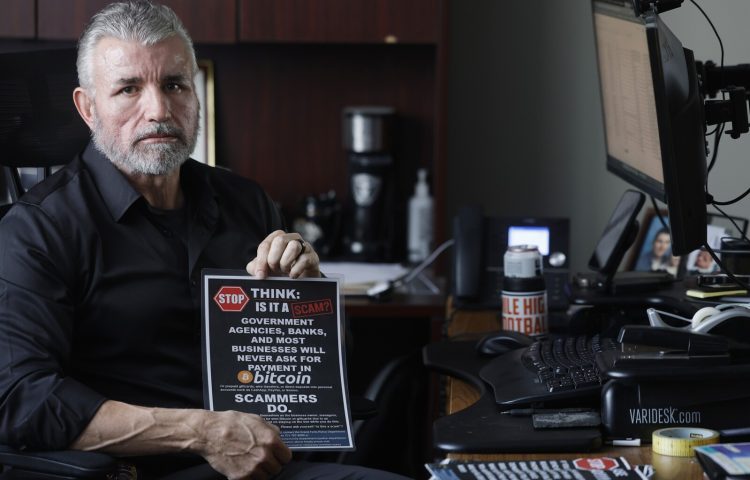

GRAND FORKS — A Grand Forks detective advises residents to be cautious when communicating with anyone online who instructs them to transfer gift cards or Bitcoin, no matter what reason they’re given.

“Anytime somebody’s asking for payment in Bitcoin or gift cards, you’re being scammed,” Det. Todd Riedinger said.

ADVERTISEMENT

He believes when dealing with people through social media, text, email or phone call, complete vigilance is necessary. He feels people assume they aren’t being scammed until after an incident has already occurred. Instead, he said, it’s best to go into the situation assuming it’s a scam until proven otherwise.

“People, in general, just need to be aware that scams are happening,” Riedinger said. “Anytime somebody’s asking you to transfer money — regardless of what type of money it is, gift cards, bitcoin or whatever — you have a high chance that you’re being scammed, and there’s a high chance you’re not going to get that money back.”

During

a Jan. 12 Grand Forks City Council meeting

, Riedinger shared his concerns as a financial crimes investigator, saying that since October 2022, Grand Forks residents have lost $466,803 to bitcoin cryptocurrency scams. Within less than a week of the council meeting, the number climbed to $474,803, though law enforcement later got a $2,000 transaction canceled.

It’s rare that money taken through these scams is returned, Riedinger said, because it’s difficult to trace the path of the money once converted to bitcoin.

Scammers instruct people to deposit cash into bitcoin ATMs located in Grand Forks businesses, giving them the information for existing accounts. Accounts are anonymous, to a degree, and once funds are inside, they can be transferred to a number of other accounts before being withdrawn — often by another victim, who is unknowingly participating in covering the suspect’s trail, according to Riedinger.

Law enforcement usually only learns about these crimes after the fact, when tens of thousands of dollars may have been lost.

“The damage is already done,” Riedinger said.

ADVERTISEMENT

In the most recent case, he noted it could have been worse. A 71-year-old victim was planning to send a total of $20,000, after being convinced his bank was stealing from him. He felt he needed to withdraw his money and convert it to bitcoin. An employee at a local business that houses a bitcoin ATM contacted law enforcement after observing the man at the ATM, and police were able to explain to him that he was lied to.

North Dakota passed legislation in 2025 that put a $2,000 daily limit on bitcoin ATMs, which Riedinger hoped would mitigate the scam issue. Still, he said, scammers have since found ways to circumvent the limit. Riedinger is advocating for a required ID scan that will alert someone the account they’re trying to deposit money into belongs to someone else. Ideally, it would ensure they can’t deposit more than $2,000 in one day.

“If that’s what we have to live with — that our victim is still going to lose $2,000, but they’re not going to be able to send $20,000 in one shot — I can live with that,” Riedinger said.

He hopes to see additional legislation go through in the 2027 session but, in the meantime, he at least wants the loophole closed in Grand Forks. Riedinger encourages people to share information and experiences with their loved ones, and says any business owner who wants to speak with him about bitcoin ATMs is welcome to reach out.

Bitcoin and other scams rely on fear tactics. Scammers tell people they’ll lose all their money if they don’t act immediately, eliciting panic. Another common scam occurs when someone receives a call that says they failed to show up for jury duty and a warrant exists for their arrest. They’re told they’ll be arrested if they don’t pay a bond.

“They really brainwash the victims into believing this, even though it doesn’t make any sense that a sheriff’s office would want bitcoin,” Riedinger said.

Almost every victim he’s spoken to after an incident says the signs were there and alarm bells were ringing in their head. The situation didn’t seem right, but the scammer made the situation feel urgent and serious, so logic went out the window.

ADVERTISEMENT

Gift card scams operate similarly, and are also used because they’re difficult to trace, since scammers sell gift card information to an innocent third party rather than using it themselves, Riedinger said. Targets for these scams are often the elderly, because they’re more likely to have thousands of dollars in their bank accounts and have faith that people are not trying to take advantage of them.

“(Scammers) prey on the people who still have hope and faith in humanity that somebody wouldn’t willingly try to bleed you dry of everything you’ve worked for,” Riedinger said. “But they will.”